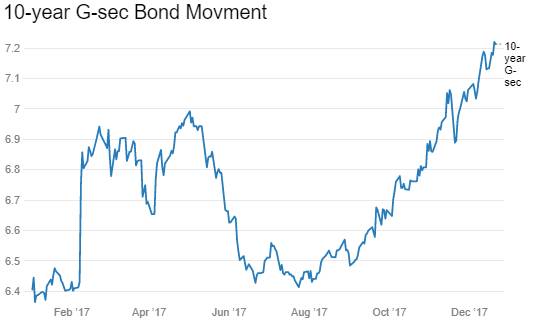

The benchmark 10 year government bond, the 6.97% 2027 bond, saw yields close at calendar year highs last week. The bond yield has moved up sharply this year on various factors and how these factors play out in 2018 will determine the direction of yields going forward. The yield at current levels of 7.27% is looking toppish though market sentiments remain weak.

10-year benchmark government bond yields rose by 87 bps in CY-2017 (Chart 1), On 2nd January 2017, 10-year G-sec yield was at 6.40%, currently, as of 22nd December 2017, it is at 7.27%. The factors that drove the yield movement over the year 2017 were 1. RBI policy, 2. Inflation, 3. Bond Oversupply, 4. Concern on Fiscal Slippages 5. Fed Rate Hikes.

RBI Policy

RBI is primarily an inflation targeting Central Bank and its hawkish stance on inflation in October 2017 drove yields the most in CY-2017. RBI cut its benchmark repo rate 1 time by 25 bps this year.

RBI changed its policy stance from accommodative to neutral, which hurt market sentiment as bond market was factoring a 25 bps rate cut as the economy can get a boost from a rate cut. Economy was struggling due to demonetization. RBI turning neutral signifies that there will be no more rate cuts going forward unless there is a dramatic change in the economic environment.

RBI maintained status quo, however, the tone of the MPC was distinctly hawkish on inflation and the statement, “but keeping in mind the output gap dynamics, the MPC decided to continue with the neutral stance and watch the incoming data carefully” suggested that the central bank debated on a shift in stance from neutral to tight. December confirmed that the rate cut cycle had come to an end, as most members of the RBI committee are worried about fresh risk of inflation. Monetary policy committee members cited worries on rising crude oil prices, the likelihood of a fiscal slippage and rising inflationary expectations of households for signalling a shift in stance.

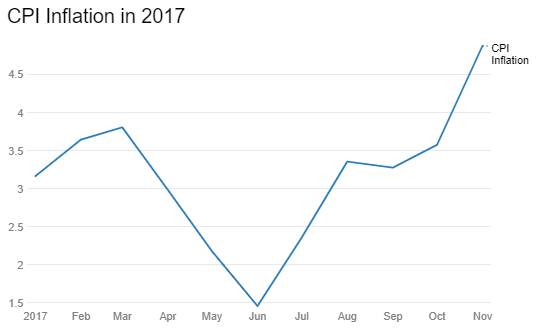

Inflation

Inflation in CY 2017 saw a zig-zag move (Chart 2), In June 2017 inflation fell to record low of 1.54% lowest since 1999. In falling inflation prompted RBI to cut its benchmark rate by 25 bps. In November 2017 CPI inflation rose to 4.88%, touching a 15-month high. Going forward, inflation is projected to be marginally higher, the recent increase in oil prices is likely to sustain. Food inflation, led by vegetables, remains highly variable and the impact of HRA on housing inflation is expected to peak in December. RBI also raised its inflation forecast to 4.3%- 4.7% in second half of this fiscal year.

Bond Oversupply

Fear of a large number of OMO sales has also pushed bond yields higher, in November when RBI cancelled OMO sales bond yields fell sharply.

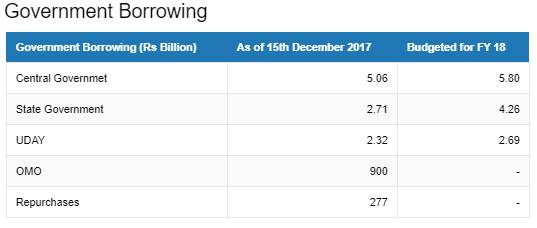

System liquidity has increased sharply after demonetization, RBI fx purchase and Government spending. In order to sterilize the liquidity, RBI increased OMO bond sales. In CY-2017, RBI sold Rs 900 billion of bonds through OMOs, The Rs 2.11 trillion bank recapitalisation plan and the Rs 6.92 trillion road construction plan entails huge supply of bonds. Supply whether direct or indirect will hit bond yields as both these plans lead to higher economic activity that could exert higher inflation expectations down the line. SDL bond supply has also increased, as of December 2017 expected SDL supply is around Rs 3112 billion, while G-sec supply for FY 17-18 will be Rs 5800 billion.

Concern about Fiscal Slippage

Prospects of higher borrowings this year with fiscal deficit at 96% of budget as of October 2017 has also pushed yields to a higher level. The budget for next year may see the government veering away from its stated fiscal deficit target of 3% of GDP. The market also expects Budget 2018-19 to focus on rural sectors given that the Gujarat election results were negative for BJP in rural areas. The budget may look at a fiscal push to rural growth leading to both higher borrowings and higher inflation on the back of consumption demand.

Direct tax collections and disinvestments have grown this fiscal year while indirect tax collections and RBI dividend have fallen short and spectrum auctions have not taken place. Bond supply has been heavy from the government, state governments and the RBI. Given expected shortfall in revenues, the market is worried about extra borrowing by the government this year.

Federal Reserve in 2017 raised its benchmark interest rate by 75 bps and Federal Reserve in its December policy meeting kept its rate outlook unchanged for 2018 & 2019, Fed forecast 3 additional rate hikes in 2018 and 2019.Fed also confirmed that it will step up the unwinding of its balance sheet, as scheduled, to USD 20 billion beginning in January 2018 from USD 10 billion. However, Fed is not seen as hawkish as it guided for gradual pace of rate hikes and slow winding down of its balance sheet.

The 10-year benchmark government bond, the 6.79% 2027 bond, saw yields rise by 13 bps week on week to close at levels of 7.27%. The on the run bond, the 6.79% 2029 bond saw yields rise by 3 bps to 7.12% levels and the 6.68% 2031 bond saw yields close up by 12 bps at 7.33%. The long bond, the 7.06% 2046 bond saw yields close up by 4 bps at levels of 7.51%.

The OIS market saw 5 year OIS yields closing 9bps higher week on week at levels of 6.73%. The one year OIS yield closed up by 9bps at 6.46%.

Corporate bonds saw 5 year AAA corporate bond yields close up by 8bps at levels of 7.67% and 10 year AAA corporate bond yields close up by 1bps at 7.86%. 5 year AAA spreads fell by 2bps at 60 bps and 10 year AAA spreads fell by 12 bps at 59 bps.