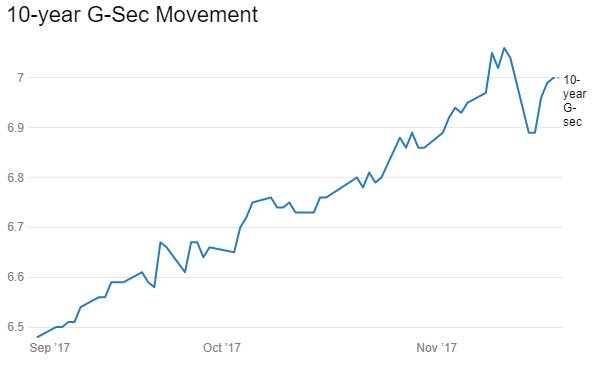

Bond traders are at a wits end on how to make money in the market. Bond yields have backed up sharply by over 40bps since RBI October policy review. In the last two weeks, 10 year benchmark bond yields have risen by 15bps, fallen by 15bps and again risen by 10bps on the back of nervousness in the market.

The next couple of months are also news negative for markets. Expected Fed rate hike in December with signals for more hikes, RBI policy where the central bank may put out any hopes of easing going forward, worries of more bond supply starting January 2018 and budget for fiscal 2018-19 in February 2018 will keep markets on the edge. Traders will be reluctant to go long while shorting has a heavy cost of 100bps given mibor is around 6% levels.

Playing the curve also does not make sense as the curve gets more volatile on uncertainty. Flatteners or steepeners may go against traders as markets turn less liquid. How does a trader make money in this market?

Playing a range on the 10 year is one option but ranges can shift dramatically on sudden news. Hedged trades with OIS entail risk of OIS yields taking a life of their own on Fed speak. OIS has no correlation with corporate bonds and any OIS=corporate bond trade is a blind trade.

In this uncertain environment, traders are best taking whatever safe carry they can get. Short tenor corporate bonds and 6 months to 1 year maturity CP’s offer spreads with safety over the underlying. Once markets have surmounted uncertainty and yields have stabilized at whatever levels, traders can then take directional bets on yields.

The 10 year benchmark government bond, the 6.79% 2027 bond, saw yields fall by 4bps week on week to close at levels of 7.00%. The bond saw volatility with yields falling by 15bps and then rising back to 7% levels post Moody’s rating upgrade and RBI OMO cancellation.

The on the run bond, the 6.79% 2029 bond saw yields close 7bps down at 7.08% levels and the 6.68% 2031 bond saw yields close down by 7 bps at 7.06%. The long bond, the 7.06% 2046 bond saw yields close up by 1bps at levels of 7.41%. Gsec yields will by volatile on the back of market nervousness.

The OIS market saw 5 year OIS yields closing 3bps lower week on week at levels of 6.51%. The one year OIS yield closed flat at 6.29%. OIS yield curve will steepen on the back of market worries.

Corporate bonds saw 5 year AAA corporate bond yields close up by 4bps at levels of 7.46% and 10 year AAA corporate bond yields close down by 1bps at 7.73%. 5 year AAA spreads rose by 7bps at 47bps and 10 year AAA spreads rose by 3bps at 61bps. Corporate bond yields will follow government bond yield direction though pace of rise will be lower leading to falling credit spreads. Liquidity will keep credit spreads down as markets search for yields.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 1116 billion as of 24th November 2017. The surplus was Rs 1574 billion as of 17th November. Liquidity will stay comfortable on government spending and RBI fx purchases though advance tax payouts in December could lower the liquidity in the short term.