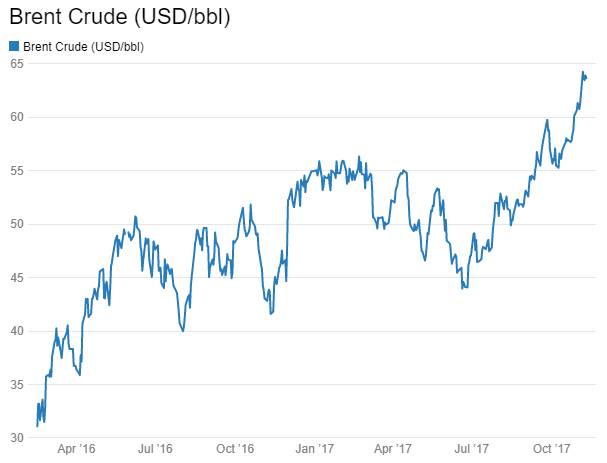

Supply creates its own demand when there are expectations of rate cuts or of inflation staying low. However given rising global oil prices, improving global economic data, record high levels of Sensex & Nifty, both rate cut and lower inflation expectations have been taken out of bond yields. The only source of comfort for the market is that 10 year government bond yield at close to 7% levels is up by almost 60 bps from lows seen in June 2017. Has the bond yield peaked out for the near term?

Given that markets are facing supply, Fed rate hikes, budget and incoming inflation data that may not be positive, 10 year government bond yields may struggle to see any positive movements in prices, even at yields close to 7% levels. Traders should play from the short side rather than the long side.

10 year benchmark government bond yields rose 9bps week on week on the back of supply worries and rising global oil prices. Oil prices closed just off 2 year highs on internal political issues in Saudi Arabia and expected improvement in demand amidst strong global economic data.

The bond market has only supply to look forward to. Government bond auctions, SDL auctions and RBI OMO’s are constant for the market. Worries of higher than budgeted borrowing for this fiscal year on the back of expected revenue shortfall on GST implementation are hurting market sentiments.

The budget for fiscal 2018-19 is just a few months away and with bank recapitalization, spending for roads and need for pump priming the economy, the government may not stick to its FRBM targets. Higher borrowing for next year too will hurt market sentiments.

Government bond yields rose last week on supply and inflation worries. The benchmark 10 year bond, the 6.79% 2027 bond saw yields rise by 9bps week on week to close at levels of 6.95%. The on the run bond, the 6.79% 2029 bond saw yields close 5bps up at 7.12% levels and the 6.68% 2031 bond saw yields close up by 6 bps at 7.06%. The long bond, the 7.06% 2046 bond saw yields close up by 5bps at levels of 7.35%. Gsec yields will trend higher on lack of positive cues for the market.

The OIS market saw 5 year OIS yields closing 9bps higher week on week at levels of 6.45%. The one year OIS yield closed up by 6bps at 6.23%. OIS yield curve will steepen on the back of market worries on supply and inflation.

Corporate bonds saw 5 and 10 year AAA corporate bond yields rise by 7bps and 6bps respectively to close at levels of 7.28% and 7.66%. 5 year credit spreads were flat at 37bps while 10 year spreads fell by 3bps to 59bps. Corporate bond yields will follow government bond yield direction though pace of rise will be lower leading to falling credit spreads. Liquidity will keep credit spreads down as markets search for yields.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 1739 billion as of 10th November 2017. The surplus was Rs 2232 billion as of 3rd November. Liquidity will stay comfortable on government spending and RBI fx purchases.