The new Fed Chair Jerome Powell, to replace Janet Yellen, is expected to continue rate hikes at a slow and steady pace. Fed in its meeting last week reaffirmed the strength of the US economy and labour markets and signaled a steady pace of rate hikes. The next rate hike will be in December 2017 and there would be a minimum of three rate hikes in 2018. US GDP grew 3% in the second quarter of 2017 against expectations of 2.5%. Job additions for October 2017 was a solid 261,000 jobs though below expectations of 310,000 job additions. Job numbers for August and September were revised upwards while unemployment rate ticked down to 4.1% from 4.2%.

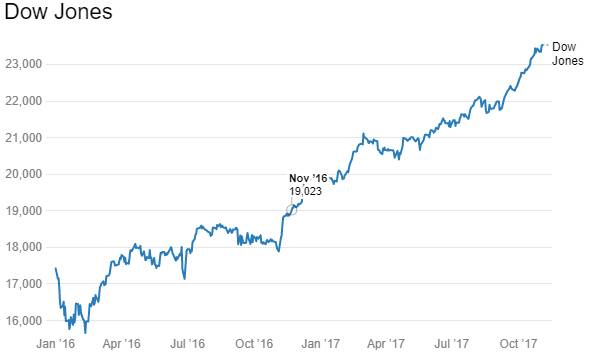

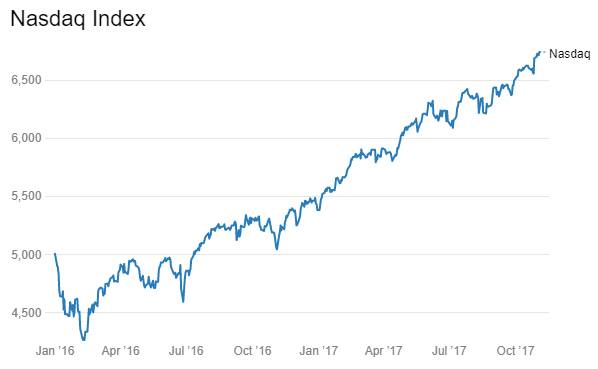

US tax cuts is expected to spur economic growth, which will lead inflation higher. Equity indices are at record highs indicating strong growth prospects.

ECB in its latest policy indicated a pruning of asset purchases from Euro 60 billion a month of Euro 30 billion a month starting January 2018. The Central Bank will keep rates at all time lows till September next year when the asset purchases end. The Eurozone economy is seeing strong manufacturing growth, rising business confidence, falling unemployment rates and rising GDP growth rates. Equity indices are at record highs indicating optimism in the economy. Bank of England raised rates for the first time since the financial crisis in 2008 on the back of improving growth prospects for the economy despite Brexit overhang.

China’s economic growth is seen as bottoming out at levels of 6.7% while Japan is seeing higher growth trends. Globally, there is optimism on economic growth with rising prices of risk assets. Monetary policy will start to factor in the growth optimism, bringing to an end the unprecedented and coordinated accommodative policies of major global central banks.

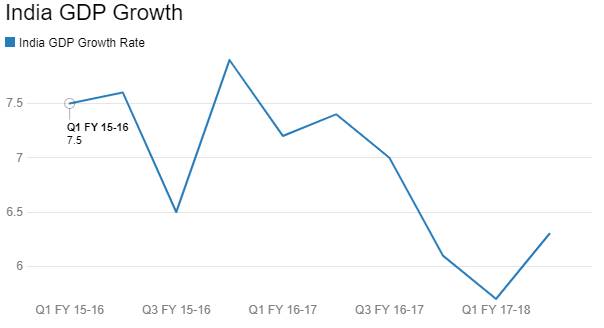

RBI last lowered the Repo rate in June 2017, to multi year low levels of 6%. The last two policies in August and October, policy rates were left unchanged despite 1st quarter GDP growth falling to levels of 5.7% against full year fy 2018 forecast of over 7%. Given the positive economic data globally, optimism exhibited by equity markets, rates hikes by Fed and BOE and the record high levels of Sensex and Nifty, RBI will maintain status quo on policy unless there is a strong threat to economic growth.

Bond markets were anticipating rate cuts in August or October policy, which they did not get. Going forward, prospects of rate cuts look almost zero percent and market has already started factoring that in bond yields. The 10 year benchmark gsec yield at levels of 6.85% is trading at eight months highs. The market is also worried on supply for next year given bank recapitalization and spending on roads.

The 10 year gsec, the 6.79% 2027 gsec will trade at higher levels in the coming months till the budget in February 2018. Borrowing for next fiscal will drive bond yields post budget.

Government bond yields rose last week on supply worries. The benchmark 10 year bond, the 6.79% 2027 bond saw yields rise by 5bps week on week to close at levels of 6.85%. The on the run bond, the 6.79% 2029 bond saw yields close 2bps up at 7,06% levels and the 6.68% 2031 bond saw yields close up by 2 bps at 7%. The long bond, the 7.06% 2046 bond saw yields close down by 1bps at levels of 7.30%. Gsec yields will trend higher on lack of positive cues for the market.

The OIS market saw 5 year OIS yields closing 2bps lower week on week at levels of 6.36%. The one year OIS yield closed up by 1bps at 6.17%. OIS yield curve will steepen on the back of markets taking out rate cut expectations.

Corporate bonds saw 5 and 10 year AAA corporate bond yields fall by 1bps and 2bps respectively to close at levels of 7.22% and 7.62%. Credit spreads fell by 2bps and 3bps to close at 37bps and 62bps. Five year spreads are tight and could move higher.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facility (MSF or Marginal Standing Facility) and MSS/CMB bond issuance was in surplus of Rs 2222 billion as of 3rd November 2017. The surplus was Rs 2019 billion as of 27th October. Liquidity will stay comfortable on government spending and RBI fx purchases.