High Yield Bond Spreads are set to fall further as the market searches for returns at a time when interest rates are seen as bottoming out. RBI in its policy meet in the beginning of October 2017 maintained status quo on rates and highlighted rising core CPI as a factor that will keep it from lowering rates further. Core CPI rose to 4.6% in September 2017 as against 4.5% in August and 4% in June.

CRISIL in its recent report said that Credit Ratio, which is the total number of debt upgrades to downgrades, rose to 1.59x from 1.22x over the last one year while the Debt Weighted Ratio, which is the total amount of debt upgrades to downgrades rose to 1.94x from 0.88x. Credit quality is improving and high liquidity, low rates and strong equity markets are helping credit quality to improve.

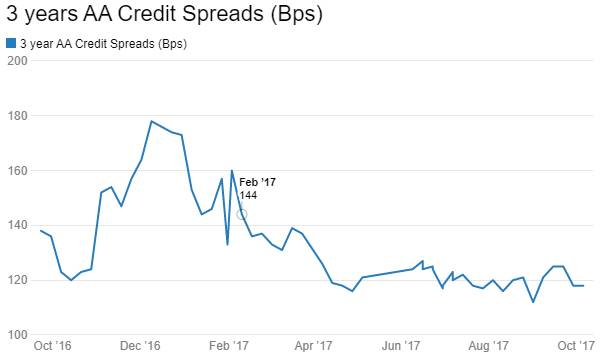

High yield bond spreads have come off sharply from levels of around 300bps -350bps to levels of 200bps – 250bps over the last one year and can come off further as prospects of rating upgrades improve. Chart 1. Liquidity is a primary driver of credit spreads. Globally, junk bond yields are at record lows on the back of central bank QEs.

Liquidity is extremely high in the system on the back of demonetization overhang and RBI fx purchases. RBI has outstanding forward purchases of USD 32 billion, which is latent liquidity of over Rs 2 trillion. Liquidity will continue to slosh around in the system for a few years unless there is a huge capital outflow due to global events.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) and MSS bond issuance was in surplus of Rs 2787 billion as of 13th October 2017. The surplus was Rs 3103 billion as of 2nd October. RBI has announced an OMO sale of Rs 100 billion on the 28th of October, taking total OMO sales to Rs 800 billion.