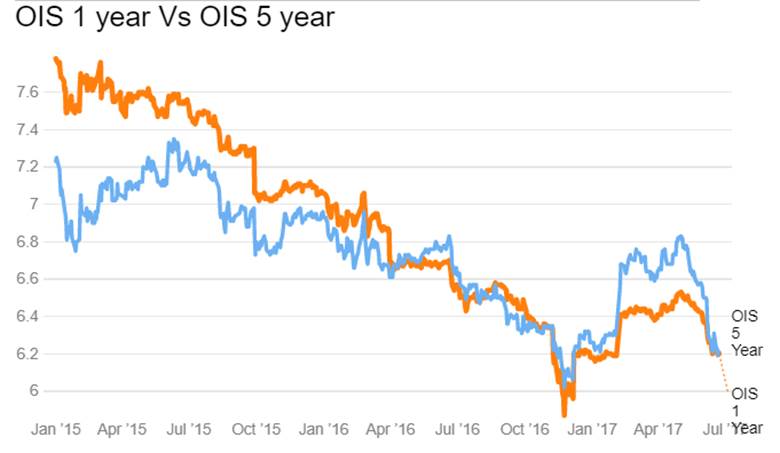

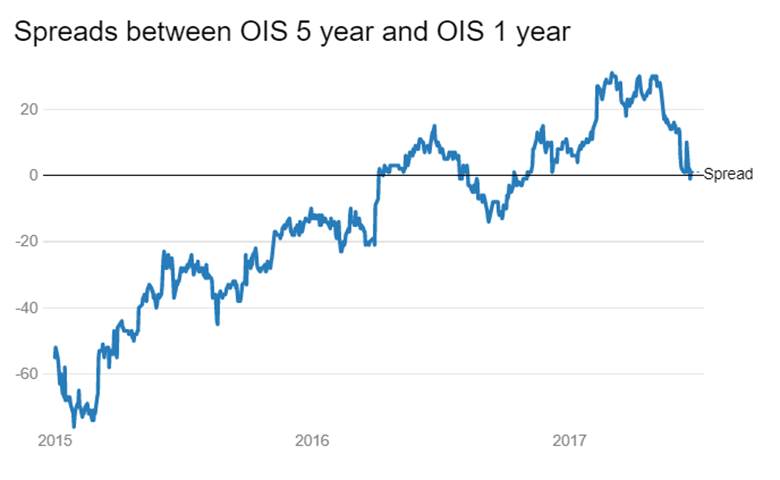

Five year OIS (Overnight Index Swap) yield fell by 10bps week on week to close at levels of 6.21%. One year OIS yield fell by 1bps to close at 6.20%. The OIS yield curve has almost completely flattened and the last time it was completely flat was in November 2016 when markets expected rate cuts after demonetization.

The flatness of the OIS curve coupled with the curve trading below repo levels of 6.25% suggest that the market is pricing in repo rate cut in August. At this point to time, market is pricing in 25bps repo rate cut and if the OIS yield curve falls further and inverts, markets then would have started pricing in a 50bps rate cut. However it remains to be seen if markets believe RBI will cut rates by 50bps.

The benchmark 10 year gsec, the 6.79% 2027 gsec, saw yields fall by 2bps to close at 6.46% levels. The 10 year gsec yield had fallen below 6.20% levels in November 2016 on expectations of rate cut post demonetization. The flattening of the OIS curve on rate cut expectations will prompt a fall in the 10 year gsec yield to below repo rate of 6.25% leading into the August RBI policy review.

The minutes of the Monetary Policy Committee (MPC) meeting this month revealed that the members were less hawkish on inflation with one member wanting a 50bps rate cut. Markets are looking at this meeting minutes as a precursor to a rate cut in August.

Government bond yields fell last week on rate cut expectations. The new benchmark 10 year bond, the 6.79% 2027 bond saw yields close down 2bps week on week at levels of 6.46%. The old 10 year benchmark bond, the 6.97% 2026 bond, saw yields close down by 1bps at 6.64% levels while the on the run bonds, the 6.79% 2029 bond and the 7.06% 2046 bond saw yields close down by 2bps and 3bps respectively at levels of 6.72% and 7.05%. Gsec yields are likely to fall further on the back of rate cut expectations.

10 year benchmark AAA bond yields closed flat at 7.38% levels with spreads up by 2bps at 77bps levels against the new 10 year benchmark gsec, the 6.79% 2027 gsec. 3 year AAA spreads were flat while 5 year AAA spreads were higher by 10bps at 62bps each. Benchmark 3 year AAA corporate bond yields closed flat at 7.18% levels. 5 year benchmark AAA bond yields closed up by 5bps at 7.28%. Credit spreads are likely to come off on search for yields amidst high liquidity and rate cut expectations.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) and MSS bond issuance was in surplus of Rs 4350 billion as of 23rd June 2017. The surplus was Rs 4321 billion in the week previous to last. Liquidity will stay high on the back of government spending and RBI purchasing fx. Fx reserves closed at record highs of USD 381.95 billion last week on RBI buying USD.