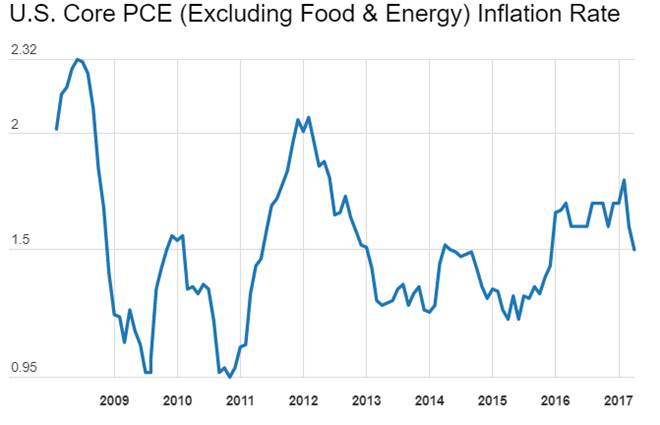

The Fed in its FOMC meet last week raised interest rates for the third time since December 2016, citing strong labour markets. Fed believes that with unemployment rate at 4.3%, levels last seen in 2001, wages will rise leading to inflation rising above the Fed’s target of 2%. Fed’s preferred inflation gauge the core PCE (Personal Consumption Expenditure) has stayed below 2% for a long period of time.

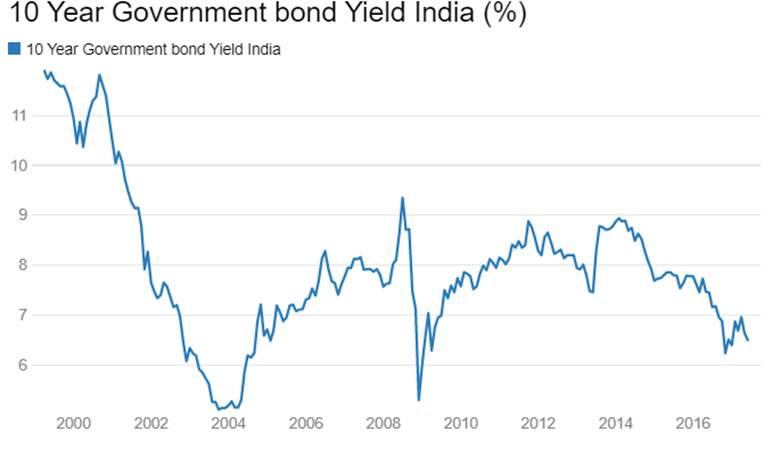

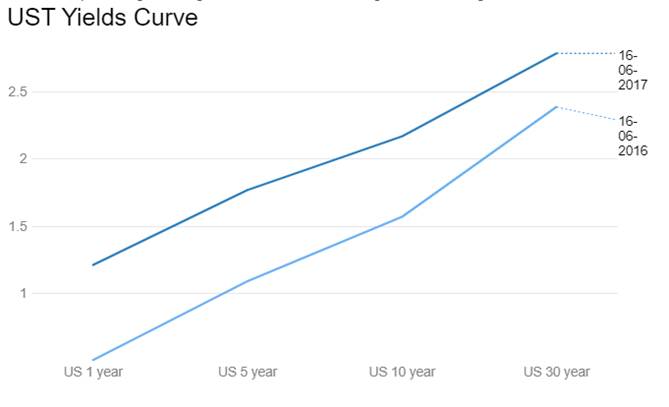

Similarly RBI maintained its neutral stance in its policy this month despite lowering inflation expectations. Bond markets are not waiting for RBI to change its policy stance from neutral to accommodative and have brought down bond yields and have flattened the yield curve. Chart 3. 10 year benchmark gsec yields are down 45bps from highs seen during the year. Gsec yields are likely to trend down further with more curve flattening on expectations of RBI rate cut in its August meet.

Bond markets are factoring in inflation undershooting RBI target of 4%. Sharp fall in food inflation coupled with farmer distress on falling prices of farm produce, GST implementation disruption (temporary) on the economy and falling global crude oil prices are all factors that can push inflation sharply down.

RBI may be falling behind the curve on inflation expectations while bond markets are pushing ahead of the curve.

Government bond yields closed mixed last week on the back markets taking a breather after a strong rally. The new benchmark 10 year bond, the 6.79% 2027 bond saw yields close down 2bps week on week at levels of 6.48%. The old 10 year benchmark bond, the 6.97% 2026 bond, saw yields close up by 2bps at 6.65% levels while the on the run bonds, the 6.79% 2029 bond and the 7.06% 2046 bond saw yields close up by 8bps and close flat respectively at levels of 6.74% and 7.08%. Gsec yields are likely to fall further on the back of falling inflation expectations.

OIS market saw one year yield fall by 5bps and five year OIS yield rise by 3bps last week. One year OIS yield closed at 6.21% while five year OIS yield closed at 6.31%. The spread can invert on rate cut expectations.

10 year benchmark AAA bond yields closed lower by 2bps at 7.38% levels with spreads flat at 79bps levels against the new 10 year benchmark gsec, the 6.79% 2027 gsec. 3 year and 5 year AAA spreads were higher by 5bps and flat respectively at 62bps and 52bps. Benchmark 3 year AAA corporate bond yields closed higher by 5bps at 7.18% levels. 5 year benchmark AAA bond yields closed flat at 7.23%. Credit spreads are likely to come off further on search for yields amidst high liquidity.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) and MSS bond issuance was in surplus of Rs 4321 billion as of 16th June 2017. The surplus was Rs 4808 billion in the week previous to last. Liquidity fell on the back of advance tax outflows.