The 6.79% 2027 gsec yield can go down to levels of around 6.55% and touch levels of 7.15% on the upper side until a fresh 10 year benchmark gsec is issued.

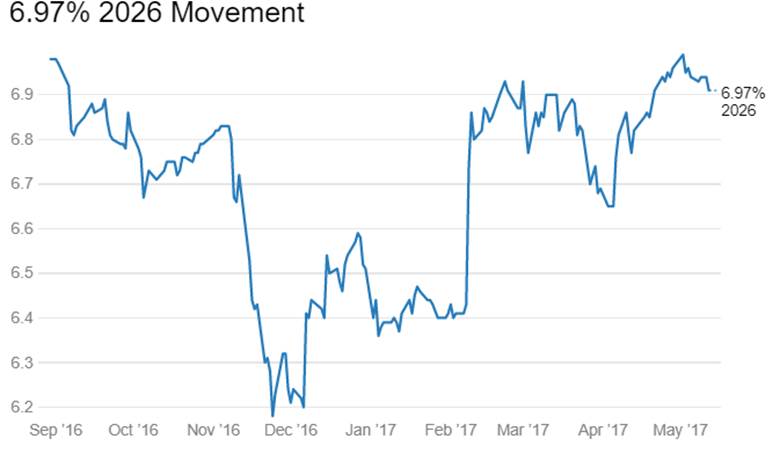

The new ten year benchmark gsec auction held last week saw the cut off come in at 6.79%. The last 10 year gsec auction held in September 2016 saw the cut off at 6.97%. What will be the yield path of the new 10 year gsec, the 6.79% 2027 gsec, for this fiscal year? The 6.97% 2026 gsec had a good run, with yields falling to lows of 6.15% and yields never closed above 6.97%. The bond is currently trading at a yield of 6.91%.

In the extreme short term, the yield on this bond can fall further from levels of 6.73% largely on the back of benign IIP and CPI data released on the 12th of April, forecast of normal monsoons by the IMD, strong liquidity conditions in the system and market’s appetite for a trading paper. IIP for March 2017 (revised series with base year 2011-12) printed at 2.7% down from 5.5% seen in March 2016. CPI inflation for April 2017 fell to record lows of 2.99%. The IMD has forecast normal monsoons this year despite EL Nino predictions. System liquidity is strong from demonetization, RBI fx purchases to prevent the INR from appreciating too fast on the back of strong capital flows and government spending.

However, the fact that the 6.79% 2027 gsec is issued at a time of global economic recovery and Fed in a rate hike mode will prevent the yield from going too far down. India’s inflation too is on an expected path (RBI forecast) of declining in the first half and rising in the second half of this fiscal year. The markets will start to factor in prospects of higher inflation on the back of economic recovery and reversal of policy stance by the ECB at the end of this calendar year, which would lead to higher yields on the 6.79% 2027 gsec.

India economic growth prospects look bright for this fiscal year with strong capital flows taking equity indices to record highs, low interest rates driving consumption as seen by strong pick in vehicle demand in April, growth in exports for 6 consecutive months and overall improvement in business confidence. Economic data in the US and Eurozone has been largely positive with US unemployment rate at 4.4%, falling to levels last seen in 2007 and Eurozone inflation rising to ECB’s target levels of 2% along with positive data on GDP and manufacturing. Fed is on a rate hike path while the ECB is still keeping interest rates at negative levels and is purchasing Euro 60 billion of bonds a month. ECB policy stance is likely to change if economic data comes in more positive than negative.

RBI is targeting inflation at 4% and will stay neutral on policy with a tendency towards hawkishness if inflation data comes in higher than expected and if monsoons are not on track. Government has budgeted for fiscal deficit of 3.2% of GDP, which is down from levels of 3.5% of GDP seen in 2016-17 and that is positive for bond markets. Bond yields will not rise sharply on a sustained basis unless there are shocks on the external front.

The 6.79% 2027 gsec yield can go down to levels of around 6.55% and touch levels of 7.15% on the upper side until a fresh 10 year benchmark gsec is issued.

Government bond yields were down last week on the back of IMD’s normal monsoon forecast. The new 10 year benchmark gsec saw yields trading at 6.78% levels in the When Issued market and yields fell sharply to 6.73% post cut off at 6.79%. The old ten year benchmark bond, the 6.97% 2026 bond saw yields fall by 3bps week on week to close at levels of 6.91%. The 7.88% 2030 bond saw yields fall by 3bps to close at 7.37%. The 8.13% 2045 bond saw yields close down by 1bps at 7.58%. Bond yields can fall in the near term on prospects of normal monsoons.

OIS market saw one year yield fall by 1bps and five year OIS yield fall by 5bps last week. One year OIS yield closed at 6.49% while five year OIS yield closed at 6.72%. OIS curve will fall tracking government bond yields.

10 year benchmark AAA bond yields closed lower by 2bps at 7.76% levels with spreads up by 1bps at 73bps levels. Benchmark 3 year AAA corporate bond yields closed lower by 8bps at 7.40% levels. Credit spreads were down by 6bps at 58 bps levels. 5 year benchmark AAA bond yields closed flat at 7.58% with spreads up by 3bps at 60ps levels. Credit spreads are likely to trend down from higher levels as markets search for yields.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) and MSS bond issuance was in surplus of Rs 4615 billion as of 12th May 2017. The surplus was Rs 4902 billion in the week previous to last. RBI is sucking out liquidity through issue of MSS securities and Cash Management Bills.