Wondering where to position for optimum returns with the lowest level of risk in the bond market? Look no further than 3 years AAA corporate bonds. Benchmark 3 years AAA corporate bonds are trading at levels of around 7.48% while 3 years AAA NBFC bonds are trading at levels of around 7.73%. Credit spreads are at 64bps and 89 basis respectively.

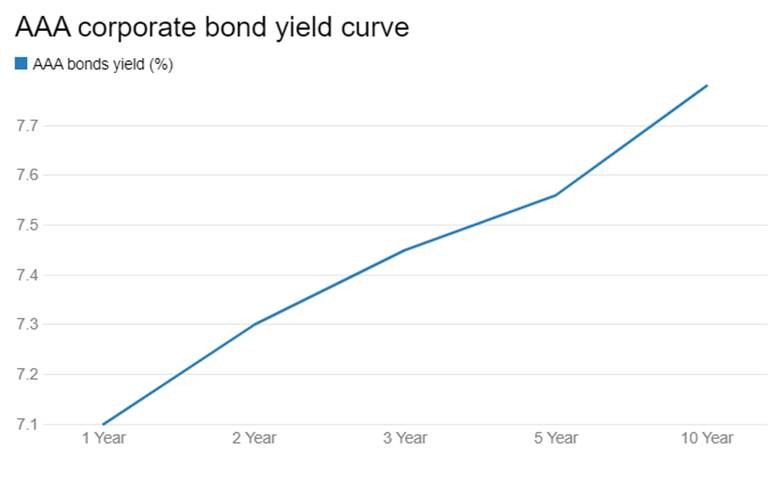

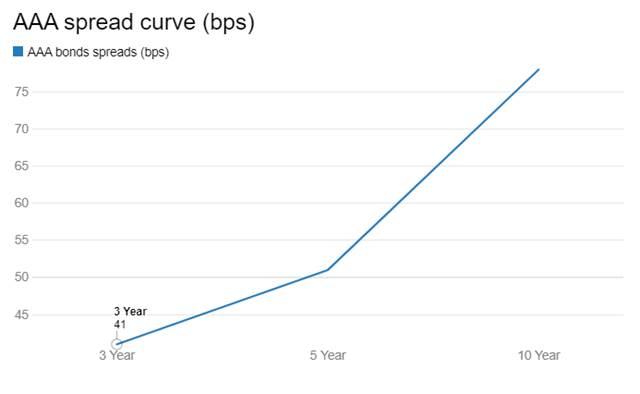

At these levels of spreads and yields, 3 years AAA corporate bonds offer the extra yield over governments bonds with extremely low credit risk. The flatness of the AAA corporate bond yield curve also makes the 3 years corporate bond attractive. Chart 1. 5 and 10 years AAA corporate bonds are trading at levels of around 7.58% and 7.78% respectively with spreads at 57bps and 72bps. Given that expectations of yields falling are not very high with RBI turning policy neutral, spreads between 3 and 10 year AAA corporate bonds at 35 bps are not likely to flatten.

3 years AAA corporate bonds at levels of 7.48% and 7.73% for NBFC bonds are at spreads of 123bps and 148bps respectively over the repo rate of 6.25%. The spreads provide a strong cushion even if the repo rate is hiked. Given the current excess liquidity prevailing in the system, money market rates are likely to stay around repo rates and 3 years corporate bonds provide a good carry for traders and investors.

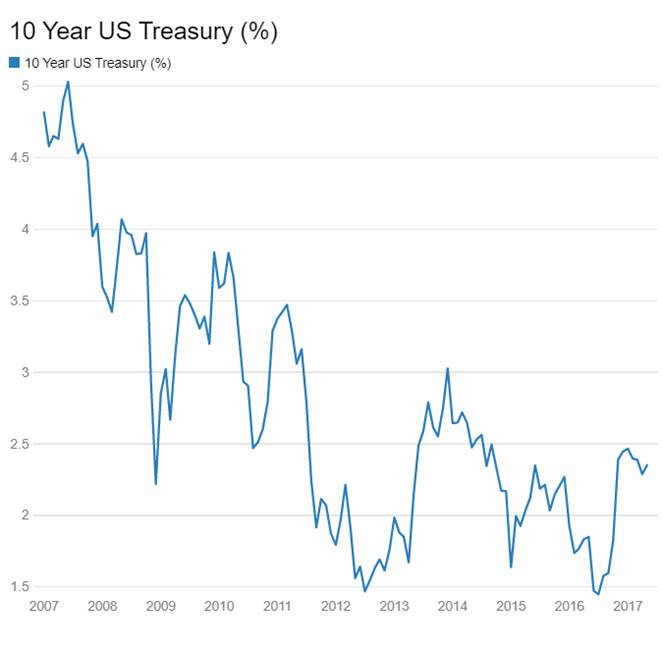

Bond markets will take comfort from the fall in oil prices, which fell on the back of worries of a supply glut. Oil prices have fallen by over 10% over the last two weeks. US unemployment rate fell to its lowest level of 4.4% since 2007 with the US economy adding more than expected 211,000 jobs in April 2017. Wage gains were muted, which allows the Fed to gradually hike rates. Fed held rates in its policy meet last week. A June hike is on cards given good job numbers and 10 year US treasury yields closed higher by 6bps at 2.35% on a week on week basis.

RBI is most likely to hold policy rates steady in its June meeting given fall in oil prices and gradual rate hikes by the Fed.

Government bond yields were mixed last week on market’s worry over excess liquidity. The ten year benchmark bond, the 6.97% 2026 bond saw yields fall by 2bps week on week to close at levels of 6.94%. The old ten year benchmark bond, the 7.59% 2026 bond saw yields fall by 1bps to close at 7.02% levels while the 7.88% 2030 bond saw yields rise by 2bps to close at 7.40%. The 8.13% 2045 bond saw yields close flat at 7.59%. 10 year bond yields will trade in a tight range around current levels on market’s uncertainty on liquidity and inflation.

OIS market saw one year yield fall by 2bps and five year OIS yield fall by 5bps last week. One year OIS yield closed at 6.50% while five year OIS yield closed at 6.77%. OIS curve will stay ranged given excess liquidity in the system.

10 year benchmark AAA bond yields closed higher by 2bps at 7.78% levels with spreads up by 4bps at 72bps levels. Benchmark 3 year AAA corporate bond yields closed higher by 8bps at 7.48% levels. Credit spreads were up by 13bps at 64 bps levels. 5 year benchmark AAA bond yields closed higher by 5bps to close at 7.58% with spreads up by 7bps at 57ps levels. Credit spreads are likely to trend down from higher levels as markets search for yields.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) and MSS bond issuance was in surplus of Rs 4902 billion as of 5th May 2017. The surplus was Rs 4267 billion in the week previous to last. Liquidity is rising on RBI fx intervention and government spending.