State Government Borrowings saw concerns raised by the Monetary Policy Committee (MPC) in their 8th February meeting. The high supply of SDL’s is causing concerns in the bond market as it eats into the appetite for government bonds. Bond traders require a good mix of short term and long term investors to make markets in G-secs but if long term investors prefer SDL’s to gsec’s due to higher spreads available in SDL’s, then traders may not be able to trade the volumes required for a vibrant G-sec market.

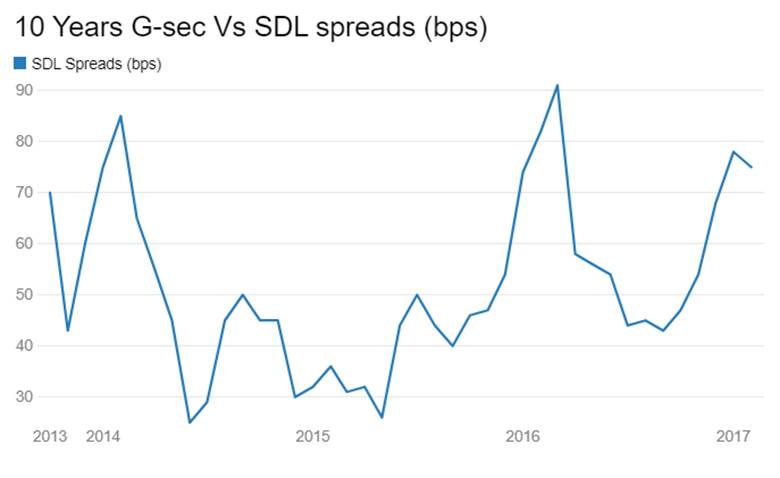

States have borrowed a gross of Rs 3.19 trillion and net of Rs 2.5 trillion as of February 2017, the amounts were Rs 2.5 trillion and Rs 2.26 trillion respectively in February 2016. SDL auction of Rs 250 billion is scheduled for the 28th of February. SDL spreads over 10 year benchmark gsec have risen from levels of 45bps to 80bps on the back of supply. Adding to the SDL supply is the issue of UDAY Scheme bonds that offers higher yields than SDL’s.

Market’s are willing to give lower spreads to corporate bonds than SDL’s, despite the superior risk status of SDL’s. 3, 5 and 10 year AAA corporate bonds are trading at spreads of 55bps, 59bps and 80bps respectively with spreads being lower for issuers that are in scarce supply.

Given that RBI has turned neutral on policy, the bond market will tend to widen spreads on SDL’s to levels where it is attractive enough for investors despite supply. However at the same time, underlying gsec yields will also harden on the heavy supply of central and state government securities that will hit the market in the next fiscal year.

The ten year benchmark bond, the 6.97% 2026 bond saw yields rise by 6bps week on week to close at levels of 6.91%. The old ten year benchmark bond, the 7.59% 2026 bond saw yields rise by 7bps to close at 7.07% levels while the 7.88% 2030 bond saw yields rise by 7bps to close at 7.48%. The 8.13% 2045 bond saw yields rise by 2bps to close at 7.56%. Bond yields will trade in a tight range in the coming weeks.

OIS market saw one year OIS yield close up by 2bps and five year OIS yield close up by 6bps week on week. One year OIS yield closed at 6.43% while five year OIS yield closed at 6.71%. OIS yield curve will steepen as markets worry about Fed rate hikes.

Credit spreads closed sharply higher last week as corporate bond yields rose sharply on the back of rising SDL spreads. 3 year benchmark AAA corporate bond yields closed higher by 20bps week on week at 7.28% levels. Credit spreads rose by 16 bps to close at 55bps levels. 5 year benchmark AAA bond yields rose by 17bps to close at 7.53% with spreads up 12bps at 59bps levels. 10 year benchmark AAA bond yields closed higher by 25bps at 7.83% levels with spreads up by 19bps at 80bps. Credit spreads will stay higher until Fed meeting in Mid March.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) and MSS bond issuance was in surplus of Rs 5753 billion as of 24th February 2017. The surplus was Rs 5648 billion in the week previous to last. MSS bonds outstanding were Rs 1500 billion. Rise in currency in circulation on RBI easing limits on cash withdrawals will bring down system liquidity.