The surprise change in RBI policy stance from accommodative to neutral has hurt sentiments on the 6.97% 2026 bond, which saw yields rising by 40bps week on week to close at levels of 6.80%. Bond markets were largely divided between rate cut of 25bps and no rate cut in RBI’s policy meet on the 8th of February but were definitely not expecting change in stance to neutral.

Over and above the change in neutral stance, the RBI stance on liquidity too has led to markets worrying about OMO sales next fiscal year. RBI is targeting system liquidity at neutral levels and given that liquidity is in high surplus on demonetization, any excess liquidity left over after RBI removes all limits of withdrawal in March, could be sterilized through OMO sales or issue of longer dated MSS bonds. RBI has been auctioning Cash Management Bills (CMB), which have a maximum maturity of 91 days to sterilize liquidity.

The neutral stance has now shifted focus to the US. US equity indices closed at record highs last week as President Trump has stated that a highly favorable tax regime for corporates will be put up in the next two to three weeks. Deep cuts in corporate tax would have a negative effect on US budget deficit, which could lead to higher supply of treasuries in 2017. The Fed too would take note of the inflationary effects of tax cuts and could start rate hikes for 2017 in their March meeting, giving them room to hike rates more number of time if required. US 10 year treasury yields could come under pressure if Fed signals rising inflation expectations and that would feed into the yields on the 6.97% 2026 gsec.

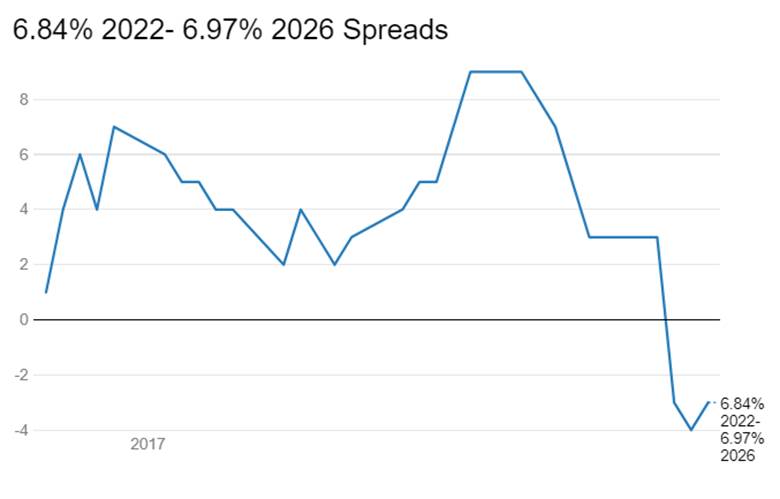

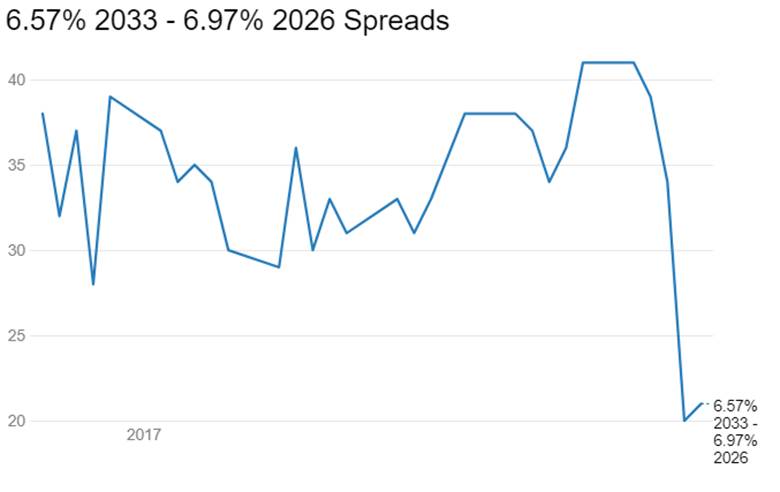

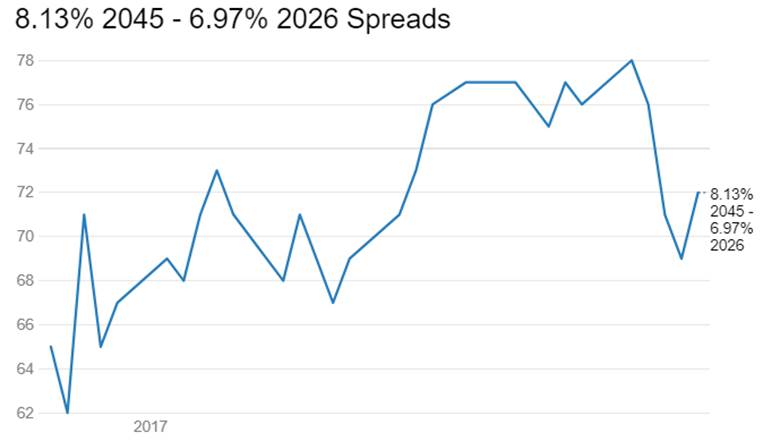

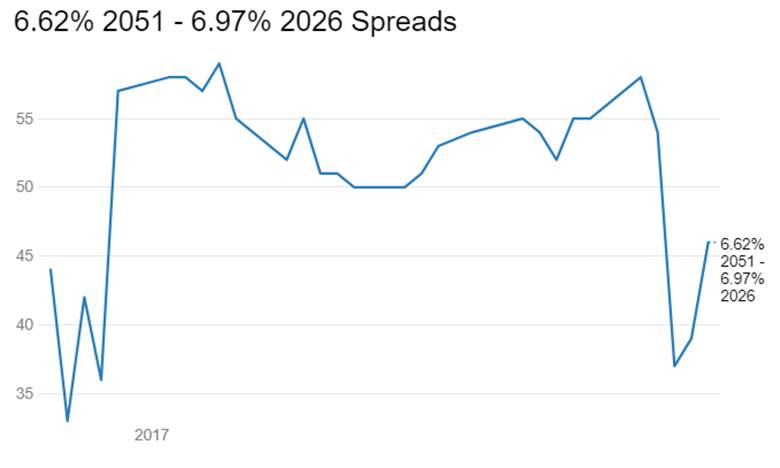

The bond market at this point of time has nothing to look forward to, despite good system liquidity and the fact that the repo rate will stay stable at 6.25% for a time to come. Yield curve spreads have risen across the curve, with benchmark 15 and 30 year gsecs spreads in relation to the 10 year gsec rising on negative market sentiments, as seen in the charts below. At some point of time, markets will buy into the spreads but that will not happen till end March, after Fed meet and release of first half 2017-18 government borrowing calendar.

The ten year benchmark bond, the 6.97% 2026 bond saw yields rise by 40bps week on week to close at levels of 6.80%. The old ten year benchmark bond, the 7.59% 2026 bond saw yields rise by 43bps to close at 6.97% levels while the 7.88% 2030 bond saw yields rise by 48bps to close at 7.41%. The 8.13% 2045 bond saw yields rise by 36bps to close at 7.53%. Bond yields will trade with an upward bias in the coming weeks.

OIS market saw one year OIS yields close down up by 22bps and five year OIS yields close up by 35bps week on week. One year OIS yield closed at 6.41% while five year OIS yield closed at 6.68%. OIS yield curve will steepen as markets worry about Fed rate hikes.

Credit spreads closed sharply down last week as yields turned sticky at higher levels. 3 year benchmark AAA corporate bond yields closed up by 22bps week on week at 7.08% levels. Credit spreads fell by 19 bps to close at 37bps levels. 5 year benchmark AAA bond yields rose by 13bps to close at 7.23% with spreads down 21bps at 35bps levels. 10 year benchmark AAA bond yields rose by 28bps to close at 7.58% levels with spreads down by 13bps at 66bps. 3 and 5 year credit spreads will rise from current levels as markets normalize spreads post the RBI shock.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) and MSS bond issuance was in surplus of Rs 6359 billion as of 10th February 2017. The surplus was Rs 7139 billion in the week previous to last. MSS bonds outstanding were Rs 2000 billion. Rise in currency in circulation on RBI easing limits on cash withdrawals lowered system liquidity. Liquidity will continue to trend down as more cash goes out of the system.