Banks are flooded with deposits post demonetization of Rs 500 and Rs 1000 notes. The public is depositing their old notes but have limits on withdrawal leading to bank deposits swelling. Most of the deposits are in savings account where interest rates are at around 4% for most banks.

Banks have seen deposits of around Rs 3.5 trillion as of 18th November. RBI has sucked out the excess liquidity with banks through term reverse repos at 6.24%. RBI has auctioned 7 days to 91 days term reverse repos and has seen banks placing Rs 3 trillion in the term reverse repos.

Banks will be seeing fresh inflows of funds on a daily basis, though the pace of inflows will slow. Banks now have a problem of plenty but the fact is that the deposits can be withdrawn once the withdrawal limits are removed. The economy requires a certain amount of cash and levels of cash need to be replenished with the public for normal transactions. Banks would see a large amount of deposits going out of the system in January 2017 after the last date for depositing old notes, which is 30th of December, ends.

Banks would be left with residual deposits of the public that is not used for everyday transactions. Banks now have temporary liquidity and permanent liquidity, the amounts of which will be known only after 30th of December.

Banks will park funds with the RBI, which is taking their money at levels of 6.24%, despite the fact that reverse repo rate is at 5.75%. RBI is willing to pay banks higher than the fixed rate reverse repo as it wants to keep the policy rate, which is the weighted average call money rate at 6.25% levels. Unless RBI cuts rates, banks will be content to park funds with the RBI at 6.24%.

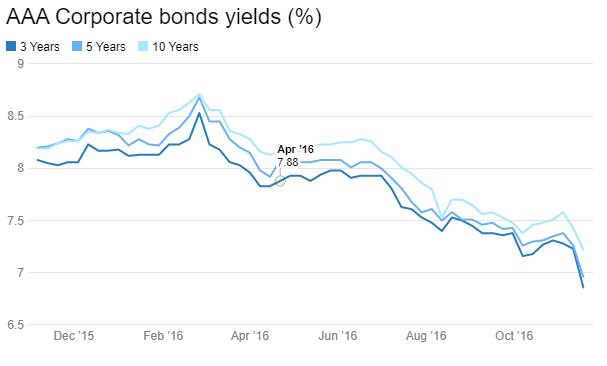

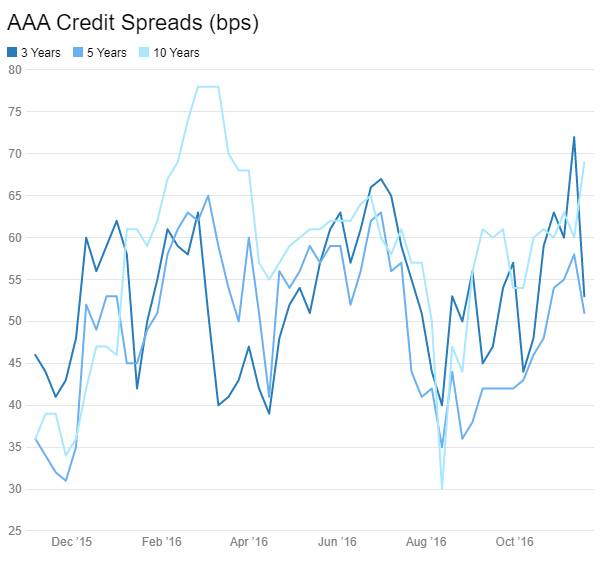

Banks will also invest in mutual funds that can give higher returns than RBI. Investments will be in ultra short funds that invest in CP ,CD’s and corporate bonds or short term income funds that invest in corporate bonds maturing in two to five years. Two, three and five year AAA rated PSU bonds such as REC and PFC are trading at levels of around 6.85% to 6.95%, at credit spreads of around 50bps to 55bps. Two, three and five year AAA rated NBFC bonds are trading at levels of 7.45% to 7.55% at spreads of 110bps to 120bps. Given that these bonds are shorter in maturity and carry reasonably attractive yields at a time when liquidity is extremely cheap and easy, they do look attractive and can come off as demand rises for these bonds.

Banks investments in government bonds including SDL is Rs 28.95 trillion and this works out to around 28% of deposits post the inflow. Hence banks really do not require to buy additional government bonds to maintain SLR levels of 20.5% of deposits (NDTL or Net Demand and Time Liabilities).

Banks would then look to trade in government bonds with their excess liquidity as expectations are that RBI would ease rates further on the back of negative effects of demonetization on inflation and growth. Government bonds are risk free and do not require capital charge and banks will trade heavily until yields fall enough to deter them from trading.

The ten year benchmark bond, the 6.97% 2026 bond saw yields fall by 29bps week on week to close at levels of 6.43%. The old ten year benchmark bond, the 7.59% 2026 bond saw yields fall by 28bps to close at 6.55% levels while the On the Run bonds, the 7.88% 2030 bond and the 8.13% 2045 bond saw yields fall by 24bps and 21bps respectively to close at levels of 6.76% and 6.93%. Gsec yields will fall further on expectations of rate cuts.

OIS market saw one year OIS yields close down by 8bps and five year OIS yields close down by 4bps week on week. One year OIS yield closed at 6.11% while five year OIS yield closed at 6.23%. OIS yield curve will steepen in the coming weeks as markets factor in easy liquidity and rate cuts.

Credit spreads closed mixed last week. Three-year benchmark AAA corporate bond yields fell by 37bps week on week to close at 6.86% levels. Credit spreads fell by 19 bps to close at 53bps levels. Five-year benchmark AAA bond yields fell by 30bps to close at 6.96% with spreads falling by 7bps at 51bps levels. Ten-year benchmark AAA bond yields fell by 21bps to close at 7.22% levels with spreads up by 9bps at 69bps. Credit spreads are likely to go down on expectations of rate cut and surge in system liquidity,

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) was in surplus of Rs 3180 billion as of 18th November. The deficit was Rs 380 billion in the week previous to last. Government surplus was Rs 356 billion last week, down by 80 billion week on week. Liquidity will continue to surge as banks deposits increase on demonetization.