Given the domestic and global factors, the yield on the 6.97% 2026 bond is likely to stay ranged with 6.60% levels at the floor and 6.85% at the ceiling. Break out of 6.85% is likely if there is deep global risk aversion while inflation coming in lower than 5% levels for the next few months could see the yield drop below 6.60% levels.

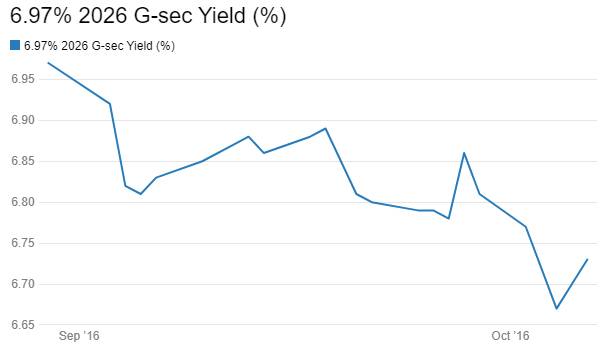

The benchmark ten year gsec, the 6.97% 2026 gsec, has seen yields drop by 24bps since the time it was issued in the beginning of September 2016. The bond yield dropped 10bps post RBI rate cut on the 4th of October 2016, from levels of 6.78% to 6.68% and is currently trading at levels of 6.73%. Chart 1. Bond yields are trading at 7 year lows.

What is the outlook for the 6.97% 2026 bond yield going forward? Can yields drop further or have yields touched the bottom? To answer this question, we should analyse the factors that affect the yield on the 6.97% 2027 bond.

The MPC (Monetary Policy Committee), when it unanimously voted to cut the Repo Rate by 25bps on the 4th of October, stated that the rate cut was in line with RBI’s objectives of targeting CPI inflation of 5% by end March 2017 and 4% +/- 2% long term target. RBI governor Dr.Urjit Patel also commented that RBI is comfortable with a real rate of interest at 1.25% as against Dr. Rajan’s comfort level of closer to 2%.

RBI has maintained its liquidity stance of bringing system liquidity down from structurally deficit levels to neutral levels. Liquidity has eased significantly over the last six months with system liquidity at surplus levels of around Rs 1000 billion, largely on the back of government spending and RBI OMO bond purchases of Rs 1000 billion since April 2016.

Given RBI’s stance on inflation, real interest rates and liquidity, the central bank is unlikely to cut rates in its upcoming policy meets and any rate decision will be taken after the union budget in February 2017. The central bank will be actively managing liquidity over the next few months.

Outlook for liquidity is extremely comfortable. Government spending is high and with higher capital flows expected on the back of India’s relatively better macros as compared to its peers, BOP (Balance of Payment) position will be highly favourable for RBI to shore up foreign exchange reserves. CAD is expected at just USD 0.3 billion for the second quarter of fiscal 2016-17, similar to levels seen in the first quarter.

The shortfall in spectrum auction revenues by around Rs 300 billion is unlikely to impact fiscal deficit or government borrowing negatively as tax revenues and capital receipts through stake sales in a buoyant capital market can negate the shortfall. The bounty of around Rs 300 billion through black money disclosure amnesty scheme will also help the government to contain its fiscal deficit.

On the global front, the Fed is likely to hike rates this year while ECB and BOJ keep rates at negative levels and liquidity high. Global liquidity will stay cheap and that will help capital flows. However, volatility on Brexit and US Presidential Elections outcome could rise and increase risk aversion globally.

Government bond yields closed down last week on the back of RBI rate cut. The 6.97% 2026 bond saw yields close down by 9bps week on week to close at levels of 6.73%. The old benchmark ten year bond, the 7.59% 2026 bond saw yields close down by 12bps week on week to close at 6.85% levels while the 7.88% 2030 bond saw yields falling by 5bps to close at 7% levels. The 8.13% 2045 bond saw yields falling by 4bps to close at 7.14% levels. Bond yields are likely to stay ranged in the coming weeks.

OIS market saw one year OIS yields close down by 7bps and five year OIS yields close flat week on week. One year OIS yield closed at 6.40% while five year OIS yield closed at 6.37%. OIS yield curve will steepen in the coming weeks.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) was in surplus of Rs 449 billion as of 7th October. The surplus was Rs 465 billion in the week previous to last. Government surplus was zero last week as compared to Rs 294 billion in the week previous to last. Liquidity will be impacted by festive season demand for funds and maturity of RBI forward contracts.