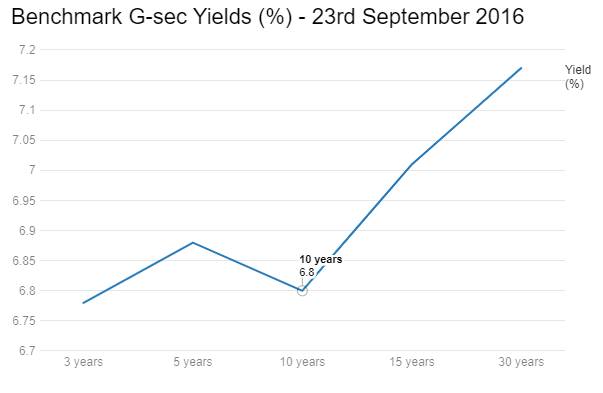

The gsec yield curve has dropped sharply and flattened out over the last six months. Chart 1. The three, five, ten, fifteen and thirty year benchmark bonds are trading at yields of 6.78%, 6.88%, 6.80%, 7.01% and 7.17% respectively. The spread between ten year fifteen year and thirty year bonds are at levels of 21bps and 37bps respectively. Markets are clearly positioned for a repo rate cut given that the ten year bond is trading at just 30bps spread over repo rate of 6.50%. The spread was 100bps six months ago.

Where is the value in the gsec yield curve at current levels of yields? The whole yield curve shifting down on a 25bps rate cut by the RBI looks unlikely as the market is already positioned for the rate cut. If the RBI signals more rate cuts post a 25bps rate cut, then the yield curve can shift down.

Given a flat yield curve, will spreads compress further? Spreads may not compress in benchmark bonds but off the run bond spreads would compress. Markets will search for bonds where yields are higher than the benchmark bonds and also have absolute levels of yields over 7.10% levels. Such bonds offer both a pick up in yields and also offer a good carry over the repo rate.

Government bond yields closed down last week on the back of Fed holding rates and BOJ adopting yield curve targeting with ten year JGB yield to be kept around 0% levels. The new benchmark ten year bond, the 6.97% 2026 bond saw yields close down by 6bps week on week to close at levels of 6.80%. The old benchmark ten year bond, the 7.59% 2026 bond saw yields falling by 8bps week on week to close at 6.97% levels while the 7.88% 2030 bond saw yields falling by 7bps to close at 7.08% levels. The 8.13% 2045 bond saw yields falling by 6bps to close at 7.17% levels. Bond yields will tend to fall further as markets position for rate cut by the RBI on 4th October.

Credit spreads rose last week. Three year benchmark AAA credit spreads rose by 7bps to close at 54bps level while five year spreads closed flat at 42bps levels and ten year spreads rose by 1bps to close at levels of 61bps. Credit spreads will stay ranged till RBI policy on 4th October.

OIS market saw one year OIS yields close down by 2bps and five year OIS yields close down by 5bps week on week. One year OIS yield closed at 6.45% while five year OIS yield closed at 6.33%. OIS yields will fall going into RBI policy.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) was in deficit of Rs 67 billion as of 23rd September. The deficit was Rs 225 billion in the week previous to last. Government surplus was Rs 262 billion last week as compared to Rs 27 billion in the week previous to last. Liquidity will stay in deficit till end of this month given half year end demand for funds by the system but will ease in October on government spending.