Economic data released last week suggested that RBI could cut policy rates in its 4th October 2016 policy review. IIP growth came in negative for the month of July 2016; CPI inflation fell to 5.05% in August from 6.07% seen in July. Trade numbers for August showed negative exports and imports growth. The government going ahead with the implementation of GST will ease fiscal deficit concerns for the RBI.

The impediment to RBI rate cut is the Fed. Fed is meeting this week to decide on policy and there is mixed signals emanating from Fed officials and economic data. Fed officials have been increasingly speaking for a rate hike though economic data from jobs to retail sales have disappointed.

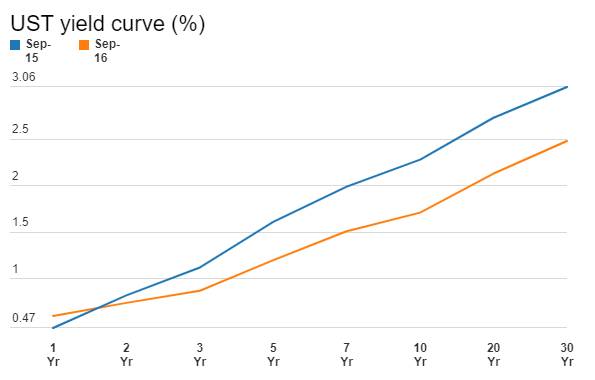

US ten year treasury yields have climbed by around 30bps from lows seen over the last few months. Short end yields have risen by 30bps to 50bps from lows while Libor yields have risen by around 50bps to 75bps. US treasury yields are factoring in more rate hikes from the Fed and even though ten year treasury yields have risen from lows, the yield curve has still flattened out considerably over the last one year.

Financial markets may not react negatively to Fed rate hikes unless the Fed sounds caution on inflation. Fed Chair Janet Yellen has been benign on inflation with forecasts of 2% CPI inflation over the next couple of years.

Markets taking Fed rate hikes in their stride will be positive for rate cut expectations by the RBI.

Government bond yields closed up last week on the back of Fed rate hike worries. The new benchmark ten year bond, the 6.97% 2026 bond saw yields close up by 3bps week on week to close at levels of 6.86%. The old benchmark ten year bond, the 7.59% 2026 bond saw yields falling by 1bps week on week to close at 7.05% levels while the 7.88% 2030 bond saw yields rising by 1bps to close at 7.15% levels. The 8.13% 2045 bond saw yields rising by 3bps to close at 8.23% levels. Bond yields will tend to fall further post FOMC meet if there is no rate hike or if markets take rate hike in their stride.

Credit spreads were mixed last week. Three year benchmark AAA credit spreads rose by 2bps to close at 47bps level while five year spreads closed flat at 42bps levels and ten year spreads fell by 1bps to close at levels of 60bps. Credit spreads will stay ranged till FOMC rate decision this week.

OIS market saw one year OIS yields close down by 4bps and five year OIS yields close flat week on week. One year OIS yield closed at 6.47% while five year OIS yield closed at 6.38%. OIS yields will fall post FOMC meet if positive for markets.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) was in deficit of Rs 187 billion as of 16th September. The surplus was Rs 1040 billion in the week previous to last. Government surplus was Rs 27 billion last week as compared to zero in the week previous to last. Liquidity tightened on the back of advance tax outflows and RBI forward sales contracts maturing and will stay tight until advance tax comes back into the system through government spending.