Bond markets embraced Dr. Rajan’s last policy review as Governor of RBI and compressed all available spreads in the market. RBI left policy rates unchanged but indicated that it would inject primary liquidity into the system to bring system liquidity from being structurally in deficit to neutral territory. RBI believes that deficit is to the tune of Rs 1200 billion and would look to buy bonds through OMO’s and also add liquidity through fx intervention. RBI injected Rs 100 billion of liquidity through OMO bond purchase auction on the 11th of August, following the policy review, and is likely to conduct more OMO auctions in the coming weeks to add liquidity into the system.

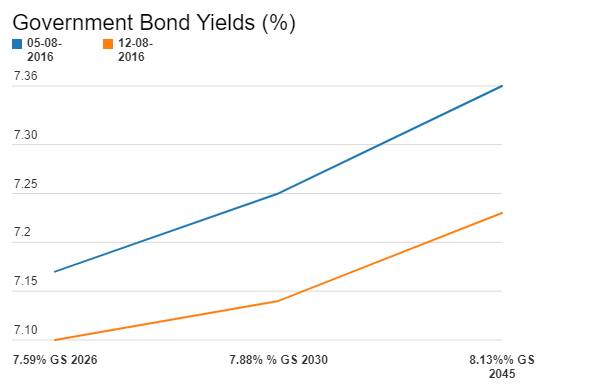

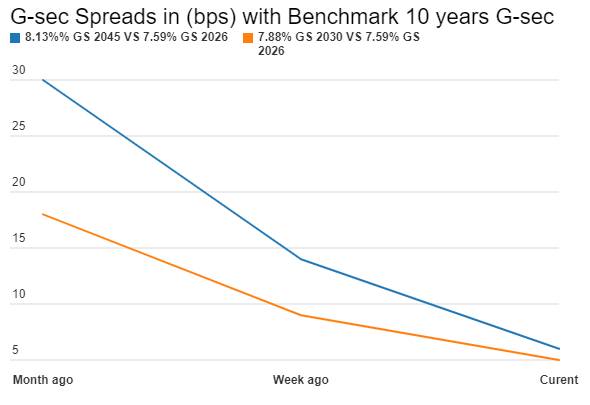

Bond markets started to search for yields given that the Repo Rate will be stable at 6.5% and liquidity will ease considerably in the system on RBI bond buying. The gsec yield curve flattened with the spreads of 15 years and 30 years gsecs coming off sharply in relation to the 10 year gsec.

The benchmark ten year bond, the 7.59% 2026 bond saw yields falling by 7bps week on week to close at 7.09% levels while the 7.88% 2030 bond saw yields falling by 11bps to close at 7.14% levels. Spread of the 7.88% 2030 bond to the 7.59% 2026 bond closed at just 5bps from 9bps seen a week ago and from 18bps seen last month. The 8.13% 2045 bond saw yields come off by 13bps to close at 8.23% levels with spreads over the 7.59% 2026 bond coming off by 6bps to close at 14bps levels. Spread was at 30bps last month.

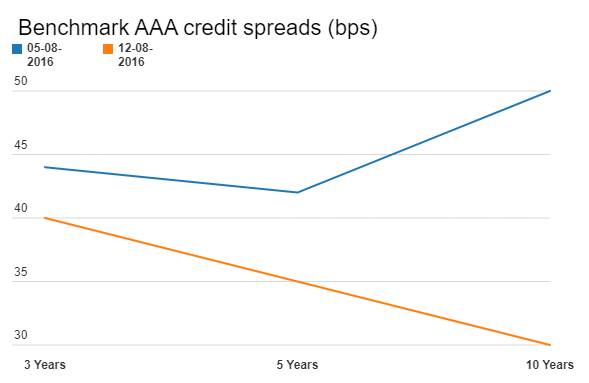

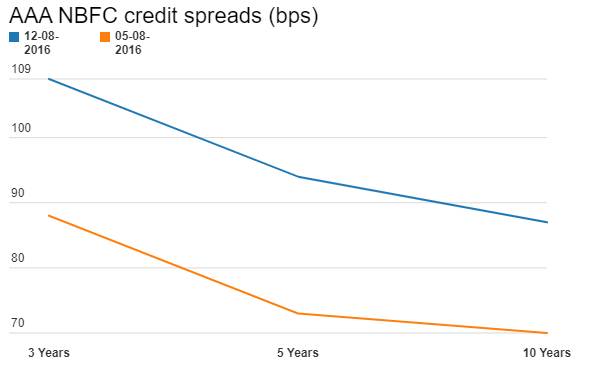

Credit spreads too fell sharply as markets chased yields. Three, five and ten year benchmark AAA credit spreads fell by 4bps, 7bps and 20bps respectively last week to close at levels of 40bps, 35bps and 30bps. NBFC bonds spreads fell even sharper last week with benchmark three, five and ten year AAA NBFC bond spreads falling by 21bps, 21bps and 17bps respectively to close at levels of 88bps, 73bps and 70 bps.

The sharp compression in spreads could prompt some profit taking in the market given that CPI inflation for the month of July 2016 printed at 6.07% against 5.77% seen in June. Food inflation was the highest on record for this series at 8.35% against 7.79%. The Monetary Policy Committee (MPC), which has to stick to inflation targets of 4% +/- 2%, will now set RBI policy rates and until inflation comes off on lower food prices due to good monsoons, policy rates are unlikely to be changed.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) was in surplus of Rs 70 billion as of 12th of August. The surplus was Rs 536 billion in the week previous to last. Government surplus was Rs 82 billion last week. Liquidity will stay easy as RBI has paid dividend of Rs 658.76 billion to the government, which will come back into the system as government repays bond maturity of around Rs 380 billion this week.

OIS market saw one year OIS yields close up by 4bps and five year OIS yields flat week on week. One year OIS yield closed at 6.54% while five year OIS yield closed at 6.51%. OIS yields will stay around 6.50% levels, as near term rate cut expectations are muted post inflation numbers.