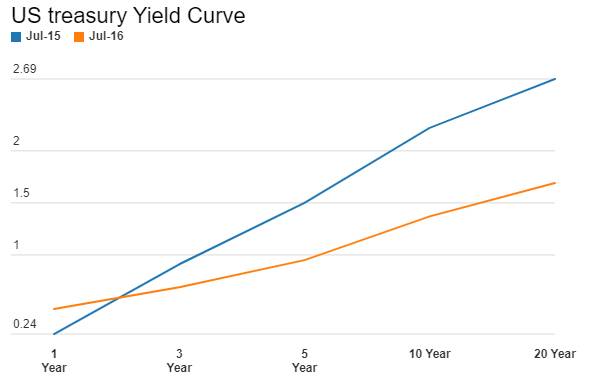

The US treasury yield curve has flattened over the last one year even as the gsec yield curve has steepened. Chart 1. US treasury three month, six month, twelve month and two year yields have risen by 26bps, 29bps, 23bps and 2bps respectively over the last one year even as five year, ten year and thirty year treasury yields have dropped by 64bps, 96bps and 102bps respectively. The US treasury yield curve is the flattest since 2007 and the reason for the flatness is the fact that the Fed is in the process of hiking rates, which is pulling up yields at the short end of the curve. The longer ends of the curve are factoring in a prolonged period of moderate economic growth and weak inflation expectations.

The fall in US treasury yields have been sharp post Brexit, with five, ten and thirty year treasury yields falling by 27bps, 33bps and 39bps over the last one month. Brexit has led to markets factoring in a slower than expected pace of Fed rate hikes though the jobs report for June 2016 lowered some of the expectations. The US economy added 287,000 jobs in June against expectations of 175,000 jobs and this will give comfort to the Fed on its rate hike path.

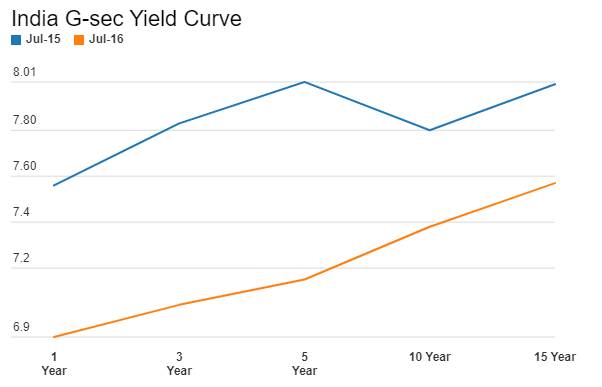

The gsec yield curve has steepened over the last one year. One, three and five year gsecs have seen yields fall by 80bps to 90bps over the last one year while ten, fifteen and thirty year gsec yields have fallen by 35bps to 45bps. The yield curve steepening is due to the RBI lowering the Repo rate by 100bps and bringing down liquidity deficit in the system.

A flattening yield curve in the US indicates more rate hikes while a steepening yield curve in India indicates more rate cuts.

The government bond market saw bond yields falling last week on rate cut expectations. The 8.27% 2020 bond yield fell 9bps to close at 7.15% levels while the 7.59% 2026 bond yield closed down 3bps at 7.39% levels. The 7.88% 2030 bond yield closed down 5bps at 7.58% levels while the 8.13% 2045 bond closed down 3bps at 7.68% levels. Government bond yields will fall further on rate cut expectations.

OIS market saw one year OIS yields close down by 4bps and five year OIS yields close down by 6bps week on week. One year OIS yield closed at 6.51% while five year OIS yield closed at 6.56%. OIS yield curve will fall on rate cut expectations.

Benchmark AAA corporate bond yields closed down last week. Three year bond yields closed down by 11bps at 7.81% levels with spreads down by 2bps at 65bps levels. Five year bond yields closed down by 9bps at 7.91% with spreads down by 7bps at 56bps levels while ten year bond yields closed down by 5bps at 8.11% with spreads down by 2bps at 58bps levels. Corporate bond yields will fall on rate cut expectations.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) was in deficit of Rs 92 billion as of 8th July. The deficit was Rs 160 billion in the week previous to last. Government surplus was zero last week, down by Rs 146 billion week on week. Liquidity eased on government spending and will ease further as government implements 7th Pay Commission Recommendations.