State Development Loans (SDL’s) have been largely viewed as risk free by markets on the back of RBI managing their borrowing and both the central bank and the government providing overdraft facilities to meet financial obligations. Gilt funds are allowed to invest in SDL’s even though technically states do not have risk free status as they cannot print money to repay debt.

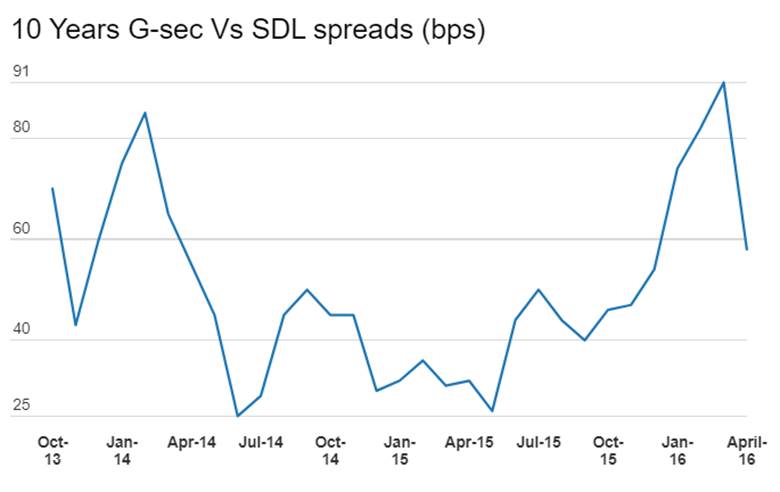

SDL spreads, under normal market conditions have hovered around 50bps over the ten year government bond. Chart 1. This spread is largely due to the lower liquidity of SDL’s as compared to government bonds.

Individual states too are becoming increasingly irresponsible on the fiscal front. Tamilnadu, once a financially well managed state, now has one of the largest holes due to SEB losses and has actually chosen not to participate in the UDAY scheme. The state elections scheduled this month has seen political parties throw freebies for the electorate, which could leave a gap of around Rs 500 billion in the states finances.

The amount spent on freebies, if spent on infrastructure could lead to more investments in the state but with freebies, productivity decreases even as infrastructure deteriorates and taxes rise leading to investments moving out of the state to other better managed states.

State finances deteriorating will lead to higher dependence on borrowing to finance the fiscal deficit and that will lead to higher supply of SDL’s. States borrowed a record Rs 3000 billion in fiscal 2015-16 and are scheduled to borrow over Rs 3000 billion in this fiscal year. The market may not want to absorb such a large supply of SDL’s and may turn selective leading to spreads of SDL’s of fiscally irresponsible state widening.

Government bond markets saw mixed yield movements last week. The benchmark ten year bond, the 7.59% 2026 bond saw yields closing down by 1bps at 7.43% levels. The 8.27% 2020 bond saw yields falling 2bps at 7.36% levels. The 7.88% 2030 bond saw yields rising by 2bps to close at 7.76% levels while the 8.13% 2045 bond saw yields closing up 2bps at 7.85% levels. Government bond yields are likely to trend down on RBI announcing OMO purchase auction for Rs 100 billion this week.

OIS market saw one year OIS yields stay flat and five year OIS yields close down by 1bps week on week. One year OIS yield closed at 6.67% while five year OIS yield closed at 6.69%. OIS yield curve will steepen on easing liquidity conditions.

Benchmark AAA corporate bond spreads closed up last week largely due to movement in government bond yields. Three year bond yields closed flat at 7.93% levels with spreads up by 2bps at 54bps levels. Five year bond yields closed flat at 8.06% with spreads up by 2bps at 56bps levels while ten year bond yields also closed flat at 8.17% with spreads up 1bps at 60bps levels. Corporate bond yield and spread curve will fall as market searches for yields amidst accommodative monetary policy.

System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) was in deficit of Rs 716 billion as of 6th May. The deficit was Rs 917 billion in the week previous to last. Government surplus was zero last week, down by Rs 211 billion week on week. Liquidity will ease as government spends and RBI pumps in liquidity through fx purchases and OMOs.