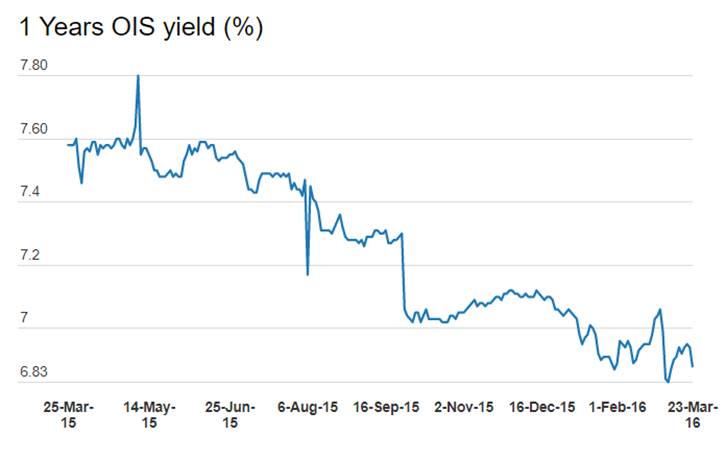

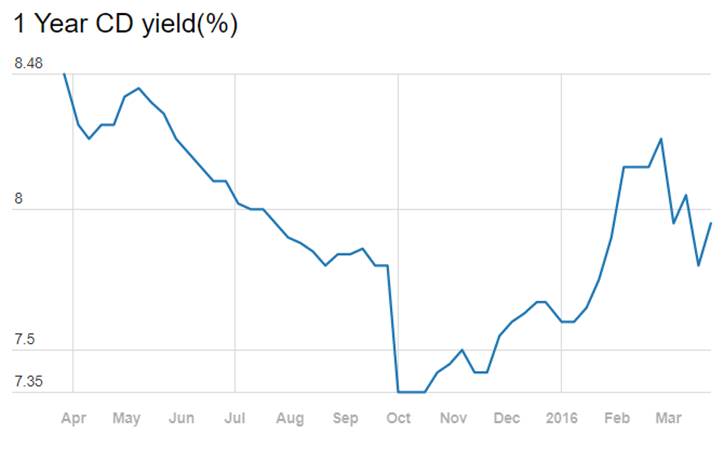

The spread between the one year OIS (Overnight Index Swap) yield and the one year Bank CD (Certificate of Deposit) yield is extremely attractive and bond markets will look to lower this spread considerably over the next two weeks. One year OIS yield is trading at levels of 6.88% and one year CD yield is trading at levels of 7.95% at a spread of 107bps to the one year OIS yield. The spread was 50bps three months back with one year OIS yield at 7.10% and one year CD yield at 7.60%.

One year OIS yield has come off by 22bps over the last three months while one year CD yield has risen by 35bps. The fall in OIS yield reflects RBI rate cut expectations while rise in CD yields reflect tightening fiscal year end liquidity. Going into April where RBI is widely expected to cut the Repo Rate by a minimum of 25bps and liquidity is expected to ease as banks release fiscal year end cash hoards, demand for CD’s will rise considerably leading to sharp fall in CD yields. The spread between one year OIS yield and one year CD yield is likely to fall by at least 50bps in the coming weeks.

Government bond markets saw yields closing down last week. The benchmark ten year bond, the 7.59% 2026 bond saw yields closing down by 1bps at 7.51% levels. The 8.27% 2020 bond saw yields falling by 4bps to close at 7.56% levels. The 7.88% 2030 bond saw yields falling by 1bps to close at 7.86% levels while the 8.13% 2045 bond saw yields falling by 8bps to close at 7.93% levels. Government bond yields are likely to trend down on April RBI rate cut hopes.

OIS market saw one year and five year OIS yields close flat week on week at 6.88% and 6.68% respectively. OIS yields are likely to fall on expectations of liquidity easing out and RBI rate cut.

Benchmark AAA corporate bond yields fell last week on easing liquidity and rate cut expectations. Three year bond yields fell 3bps to close at 8.03% levels with spreads up by 2bps at 43bps levels. Five year bond yields were down 8bps at 8.20% with spreads down by 4bps at 50bps levels while ten year bond yields were down 3bps at 8.33% with spreads down 2bps at 68bps levels. Corporate bond yield and spread curve will fall as market searches for yields amidst accommodative monetary policy.

Liquidity conditions are tight with System liquidity as measured by bids for Repo, Reverse Repo, Term Repo and Term Reverse Repo in the LAF (Liquidity Adjustment Facility) auctions of the RBI and drawdown from Standing Facilities (MSF or Marginal Standing Facility and Export Credit Refinance) in deficit of Rs 2384 billion as of 25th March. The deficit was Rs 2132 billion in the week previous to last. Government surplus was at levels of Rs 1712 billion last week, lower by Rs 220 billion week on week. Liquidity will stay tight this week on fiscal year end considerations but will ease out considerably in April as banks release cash hoards and government spends on salaries.