INR ended the week lower against the USD amid persistent USD buying by the central bank, along with concerns about India’s weakening growth, crude oil price rise and strain on government’s finances, all of which have led to a view of weakness in the INR. INR depreciated by 0.29% against the USD last week and depreciated by 0.62% against the euro.

The persistent USD buying interventions by RBI since late September has sent out signals to market players that the Central Bank is not comfortable with the INR appreciation beyond Rs 71.00. However, since last week, the RBI has reportedly resorted to interventions in the derivatives market to neutralize the impact of its interventions on liquidity in the banking system, which can be seen by rising premiums which have shot up to 4.32% levels from 3.80% levels seen in November end.

However, INR gained on Friday paring some of its loss accumulated during the week amid rising risk appetite buoyed by optimism over an interim US-China trade deal early next year, which has boosted investor’s risk appetite. China said on Thursday that Beijing and Washington were in close contact on the signing of the “Phase 1” trade deal, which came after U.S. President Donald Trump’s indication for a ceremony for the signing.

Oil prices rose on Friday, hitting three-month highs after weekly inventory report indicated a bigger-than-expected decline in stockpiles for oil. American Petroleum Institute reported that U.S. crude supplies fell by 7.9 million barrels for the week ended Dec. 20.

USD ended the week lower against major world currencies as optimism around prospects for a Phase 1 trade deal led to improvement is risk appetite and reduced demand for safe-haven currencies such as Yen. However, with global currency markets in a holiday mood, overall trading activity was mostly subdued. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.29% on a week on week basis and is at a level of 97.32.

British Pound ended the week marginally higher against USD last week despite falling sharply on Monday amid the uncertainty over the new trade relationship between the UK and the EU post-Brexit.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 5 bps to 1.89% last week after aggressive bidding in the last bond auction conducted on Thursday. The Treasury Department auctioned USD 32 billion in seven-year notes, marking the last auction for coupon-bearing Treasury’s this week.

Eurozone bond yield largely fell last week. European Central Bank Governing Council member Klaas Knot said last week that interest rates in the eurozone could remain historically low for years, but the ECB’s ultra-loose monetary policy risks becoming counterproductive.

German 10-year bond yields fell by 2 bps last week, France 10-year bond yields fell by 2 bps and is at 0.04%. Italy’s 10-year benchmark yields fell by 1 bps.

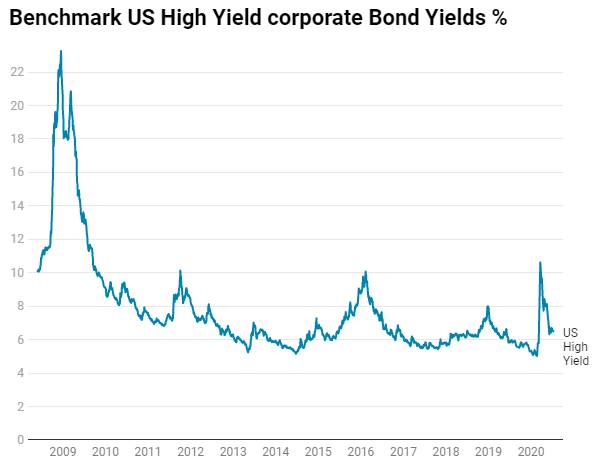

US benchmark Junk bond yields fell by 1 bps and is at 5.29%, Euro benchmark Junk bond yields fell by 2 bps to 2.65%.