INR ended the week lower against USD amid rising crude oil prices and strengthening of the USD after the risk of UK exiting the European Union without a trade deal resurfaced. However, sustained foreign fund inflows continue to support the INR. INR depreciated by 0.43% against the USD last week and appreciated by 0.33% against the euro.

Oil prices held steady near three-month highs on Friday on the back of easing U.S.-China trade tensions that have weighed on demand as well as the global economic growth outlook. However, the progress in a long-running trade dispute between the United States and China, the world’s two biggest oil consumers, has boosted expectations for higher energy demand next year.

USD ended the week higher against major world currencies last week. The gain was largely attributed to the sharp fall in British Pound after reports surfaced that UK Prime Minister Boris Johnson is planning a new Brexit deadline, shrugging off the effect of impeachment of U.S. President Donald Trump. Trump is the third president to be impeached in U.S. history but is likely to survive a trial in the GOP-led Senate, which is expected to vote in January. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.44% on a week on week basis and is at a level of 97.60.

The Pound came under additional pressure during the week after BoE held rates and reiterated a ‘neutral’ stance on outlook. The market participants were expecting a rate cut after the release of weak economic data and Prime Minister Boris Johnson’s revival of the specter of a no-deal Brexit scenario, both of which increase the pressure for monetary support.

The Bank of Japan left its ultra-easy monetary policy unchanged on Thursday despite signs of a slowdown in the country’s economy since a consumption tax hike in October. After a two-day meeting, the BOJ Policy Board decided to keep the short-term interest rate at minus 0.1% and guide long-term rates to around zero percent. It will also continue its massive asset purchase program. The decision came after the central bank’s quarterly Tankan survey released showed that sentiment among large manufacturers worsened for a fourth straight quarter to a near seven-year low.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 11 bps to 1.94% last week as stocks headed for a sixth straight day of gains in the wake of last week’s U.S. – China trade deal. Investors largely looked past impeachment proceedings against President Donald Trump in Congress, with market participants noting his removal from office was unlikely.

The U.S. House also approved a USD 1.4 trillion spending package on Tuesday to avoid a partial government shutdown. Congress passed the bill on Friday to avoid the closure of the federal government.

Meanwhile, the Federal Reserve is supporting the equity market rally by providing extra liquidity for banks through short term repo operations and purchases of T-bills. The U.S. central bank’s efforts to restore calm to financial markets in the aftermath of a sudden spike in short-term borrowing costs in mid-September has proven to be successful, said New York Fed President John Williams on Wednesday.

Federal Reserve, Chicago Fed President Charles Evans said he didn’t think the U.S. central bank needed to lower interest rates further, in his first remarks since the December meeting.

Eurozone bond yield rose last week after Sweden’s central bank, the Riksbank, raised its benchmark repo rate by 25 bps to zero, defying a slowdown in the economy and global uncertainty. Rates are still negative at the European Central Bank and the Japanese, Danish, Swiss and Hungarian central banks.

German 10-year bond yields rose by 6 bps last week, France 10-year bond yields rose by 7 bps and is at 0.06%. Italy 10-year benchmark yields rose by 17 bps.

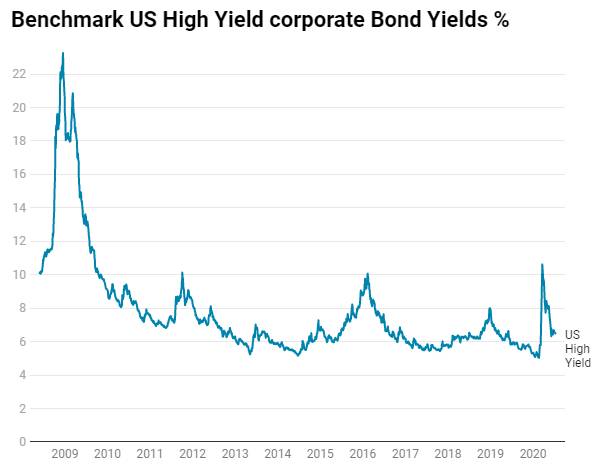

US benchmark Junk bond yields fell by 18 bps and is at 5.30%, Euro benchmark Junk bond yields fell by 12 bps to 2.67%.