INR ended the week higher against the USD last week amid improvement in the market risk sentiment despite the release of weak domestic macro-economic data. INR gained during the week largely on the back of the expectation of a possible resolution of trade conflicts between the US and China. However, the gain was capped after RBI intervened in the forex market to prevent a steep rise in the INR.

Risk sentiment improved largely after President Donald Trump agreed a “limited phase one deal” that will at least temporarily end the trade war between the U.S. and China. On the domestic data front, CPI inflation for November was at 40 months high of 5.54% largely on the back of a rise in food prices. Core CPI inflation was at 3.4% to 3.6% signaling a lack of pricing power given weak consumer demand. Further, the release of weak IIP growth for October at a negative 3.4% signaled a weak economy.

The central bank has been preventing a steep rise in the INR for the past three months. Significant purchases of the USD since late September, on occasions, when the rupee rose above Rs 71.00 gave away strong signals that central bank is not comfortable with INR appreciation.

USD ended the week lower against major world currencies as market sentiment improved after US-China agreed on phase 1 trade deal and amid landslide victory of Prime Minister Boris Johnson in recently concluded U.K. election, raising hopes that Brexit is likely to be done in early 2020. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.54% on a week on week basis and is at a level of 97.17.

USD came under sharp pressure on Thursday after the Federal Reserve forecast that it would keep interest rates on hold through 2020. Fed Chairman Jerome Powell in a press conference said that the economic outlook for the U.S. was favorable as the central bank announced its decision to hold steady on rates, but said a significant, persistent rise in inflation would be needed to hike rates.

In an attempt to secure a Phase 1 trade deal, U.S. will cancel the Sunday implementation of a new 15% tariff on all of China’s remaining annual exports to the U.S. and reportedly, cut existing tariffs on Chinese goods by as much as 50%. And in exchange, China will agree to buy USD 50 billion of agricultural products from the U.S.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 2 bps last week after the U.S. and China struck phase one trade deal that would put off the implementation of tariffs in December, but both President Donald Trump and Chinese officials did not offer specific details on the level of agricultural purchases and other aspects of the agreement. U.S. Trade Representative Robert Lighthizer said that the signing would take place in Washington in the first week of January.

German 10-year bond yields fell by 1 bps last week, France 10-year bond yields fell by 3 bps and is at 0.01%. Italy’s 10-year benchmark yields fell by 19 bps.

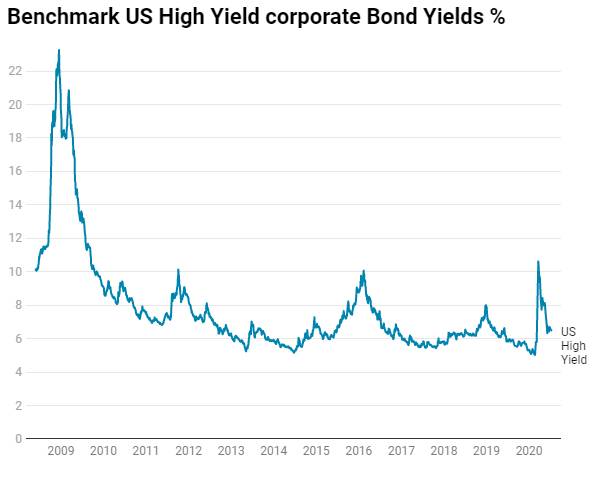

US benchmark Junk bond yields fell by 20 bps and is at 5.48%, Euro benchmark Junk bond yields fell by 10 bps to 2.79%.