INR ended the week higher against the USD last week amid continued foreign fund inflows into corporates who are looking to raise funds from offshore investors. INR also gained, as media reports suggesting a possible resolution of trade conflicts between the US and China. INR on Thursday received additional support after the RBI promised to continue with the accommodative stance in its monetary policy.

USD ended the week lower against major world currencies amid heightening uncertainty over the U.S. – China trade deal as mixed trade signals from U.S. President Donald Trump kept market participants nervous. However, USD was supported on Friday, as stronger-than-expected U.S. jobs gains last month reaffirmed beliefs that the economy remained on solid footing. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.58% on a week on week basis and is at a level of 97.70.

On Wednesday US President Donald Trump said that discussions between China and the US are going very well. Negotiators may be closer to an agreement on tariff relief that could help stave off the next round of US tariffs on Chinese goods that is due to take effect Dec. 15. These tariff relief measures would be part of a phase one deal. Trump’s comments came just a day after saying he has no deadline for a deal and would not be opposed to waiting until after the elections in November 2020.

U.S. economy created 266,000 jobs last month, against the expectation of 186,000. The unemployment rate unexpectedly dropped to 3.5% and wage growth slipped to 0.2% in November, lower than expectations of 0.3%.

British Pound appreciated by 1.66% against USD last week amid expectations that Prime Minister Boris Johnson would win a majority at next week’s election, paving the way for Britain to leave the European Union on Jan. 31.

Euro appreciated by 0.38% against USD last week despite data showing that German factory orders unexpectedly declined in October, indicating that the manufacturing sector in the bloc’s largest economy is struggling to pull out of a more than year-long slump.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 7 bps last week despite falling by 13 bps on Tuesday after President Donald Trump said a U.S.-China trade deal might not come until after the 2020 presidential election, sparking a rush into haven assets. However, the yield rose back in the latter part of the week after the release of upbeat jobs report that enticed market participants into riskier assets and brushed aside fears of a looming U.S. recession.

German 10-year bond yields rose by 8 bps last week, France 10-year bond yields rose by 9 bps and is at 0.03%. Italy 10-year benchmark yields rose by 10 bps.

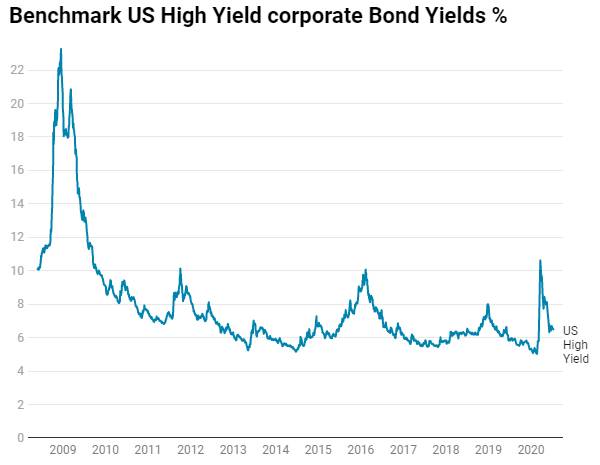

US benchmark Junk bond yields rose by 2 bps and is at 5.68%, Euro benchmark Junk bond yields fell by 2 bps to 2.89%.