INR ended the week marginally lower against the USD as market participants remained cautious ahead of the release of gross domestic product data, which was released after market hours on Friday. The data released shows that India’s GDP grew at a modest 4.5% in the September quarter. This marks the sixth straight fall in quarterly GDP growth and the first time in almost seven years that it has fallen below the psychologically important 5% mark.

The weak GDP growth will lead to rising fiscal deficit on the back of weak revenues and the government’s need to fiscally stimulate the economy. Weak macros coupled with weak trade numbers on fall in global demand and on uncertainty on US-China trade deal will take their toll on the INR.

USD last week was flat amid release of mixed set of economic data, Fed chair Powell’s Speech and uncertainty over a trade deal. USD Index (DXY), which tracks the movement of the USD against six major currencies, remained flat on a week on week basis and is at a level of 98.27.

Federal Reserve Chairman Jerome Powell in his speech hinted that the central bank is likely to hold rates steady. Powell further added that the Fed is “strongly committed” to its 2% inflation goal. However, he noted that inflation has run well below that level for 2019 despite three interest rate cuts over the past four months.

Data showed this week that the U.S. economy grew at a 2.1% annualized rate, compared to 1.9% in the first reading. The data was in contrast to other indicators showing a slowdown in global activity. In a separate report, durable goods gained 0.6% after falling 1.4% in the prior month. U.S. consumer confidence fell for a fourth straight month in November despite expectations of a small rebound.

U.S.-China trade progress remained in focus after U.S. President Donald Trump approved two bills that back Hong Kong’s anti-government protestors. While China has vowed to retaliate, it has not taken any action so far and it is unclear if that will have any bearing on trade talks.

British Pound appreciated by 0.71% against USD last week after British Prime Minister Boris Johnson promised to bring a Brexit deal to parliament before Christmas. His Conservative Party leads in opinion polls ahead of the Dec. 12 election.

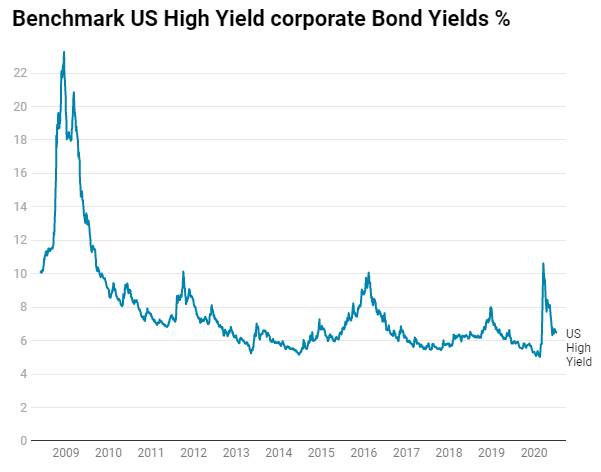

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields remained flat last week as market participants turned cautious over trade developments between the world’s two largest economies.

German 10-year bond yields remained flat last week while France 10-year bond yields were 1 bps lower at -0.06%. Italy 10-year benchmark yields rose by 6 bps.

US benchmark Junk bond yields fell by 17 bps and is at 5.66%, Euro benchmark Junk bond yields fell by 21 bps to 2.91%.