INR gained marginally against the USD last week after the government said it will sell majority stake in BPCL, SCI and CCI. Sustained foreign fund inflows and lower crude oil prices provided additional support to the INR. INR appreciated by 0.11% against the USD last week and depreciated by 0.10% against the euro.

USD ended the week higher against major world currencies last week after comments from U.S. President Donald Trump on China increased hopes that the two sides would sign a trade deal soon. Additionally, the release of upbeat U.S. economic data also helped USD to gain largely in the latter part of the week. USD Index (DXY), which tracks the movement of the USD against six major currencies, up by 0.23% on a week on week basis and is at a level of 98.27.

Trump said a deal with China was “potentially very close,” and also indicated that he might not sign a bill passed this week by Congress that supports Hong Kong in an attempt to appease Beijing. Xi said China would strive to sign a phase one deal after tensions rose on the Hong Kong Bill. Trump had said earlier that China is not doing enough to close a deal.

USD started the week on a lower note on Monday amid uncertainty over trade deal after media reported that Chinese officials are pessimistic that a trade deal will be signed. The bleak outlook was due to U.S. President Donald Trump’s reluctance to roll back tariffs. China has been pushing for the two sides to remove tariffs, as they work on a phase one trade deal. Trump has said that he has not agreed to end tariffs, causing uncertainty on whether or not there will be a deal.

The tensions between the two sides rose even further after the U.S. Senate passed two Hong Kong-related bills that support protesters in the city. China’s foreign ministry spokesman called the decision a blatant interference in China’s internal affairs and said the U.S. faced “negative consequences” if it persisted.

USD came under additional pressure on Thursday after the Fed minutes released showed that Fed officials agreed that the stance of policy “likely would remain” where it is “as long as incoming information about the economy did not result in a material reassessment of the economic outlook.

Euro depreciated by 0.24% against USD last week after Eurozone PMIs confirmed that the region grew at a slower pace due to a continued contraction in manufacturing and slower expansion in services. German PMIs were mixed with the data showing improvements in the manufacturing sector and deterioration in services. ECB President Christine Lagarde described the global economy as marked by uncertainty and called for Europe to develop a new policy mix that includes fiscal stimulus.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields were down by 6 bps last week on uncertainty over the US-China trade deal. However, yields rose in the latter part of the week after purchasing managers’ surveys showed a steady upturn in activity in the manufacturing sector, a sign that factories may be overcoming the trade-driven slowdown.

German 10-year bond yields were down last week by 3 bps and France 10-year bond yields were 2 bps lower at -0.05%. Italy 10-year benchmark yields fell by 4 bps.

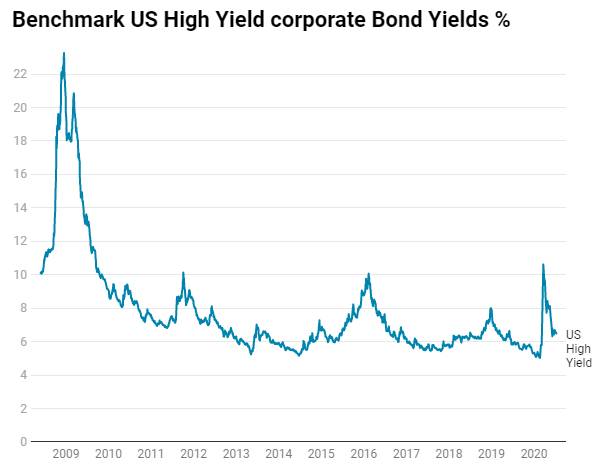

US benchmark Junk bond yields rose by 8 bps and is at 5.83%, Euro benchmark Junk bond yields rose by 4 bps to 3.12%.