INR, last week, fell sharply against the USD, as CPI inflation for October came in at 4.62%, which is a 16 months high. INR was also impacted on reports of weak economic conditions. INR depreciated by 0.70% against the USD last week and depreciated by 0.75% against the euro. INR touched a weekly low of Rs 72.21 before closing at Rs 71.79 on Friday.

The bailout packages to sectors including banks, NBFCs, PSUs, Real Estate and the big bang corporate tax rate cut have placed the INR under pressure. Fiscal deficit is likely to exceed budgeted targets, and this is hurting the INR.The Indian economy is showing signs of softness, both rural and urban demand indicators suggest lost momentum, with prospects for household spending likely to remain muted in the near term.

USD ended the week lower against major world currencies, as the markets awaiting more clarity on US and China phase one trade deal.USD Index (DXY), which tracks the movement of the USD against six major currencies, down by 0.32% on a week on week basis and is at a level of 98.04.

As per U.S. commerce department, October retail sales were up 0.3% on a monthly basis and 3.1% on a yearly basis. Data shows that consumers are holding back on purchases of big-ticket household items and clothing.

US industrial production dipped 0.8% month on month in October and 1.1% year on year.

US ISM non-manufacturing index grew to 54.7 in October against 52.6 in September. The US international trade deficit in goods and services reduced to USD 52.5 billion in September from USD 55.0 billion in August, as imports decreased more than exports. September exports were USD 206.0 billion, USD 1.8 billion lower than August exports. Imports were USD 258.4 billion, USD 4.4 billion lower than August imports.

British Pound and Euro traded higher against the USD last week, as German economy grew 0.1% in Q3, avoiding recession. UK election developments also weighed on GBP movements. Australian dollar tanked 0.63% against the USD on week unemployment data, rate stayed high at 5.3% and headline employment shrank.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields were down by 9 bps last week on weak global economy data and slower progress of US-China trade deal.

German 10-year bond yields were down last week by 8 bps and France 10-year bond yields were 5 bps lower at -0.03%. Italy 10-year benchmark yields rose by 13 bps.

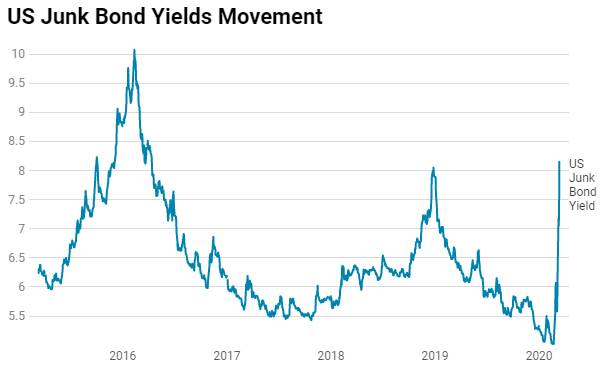

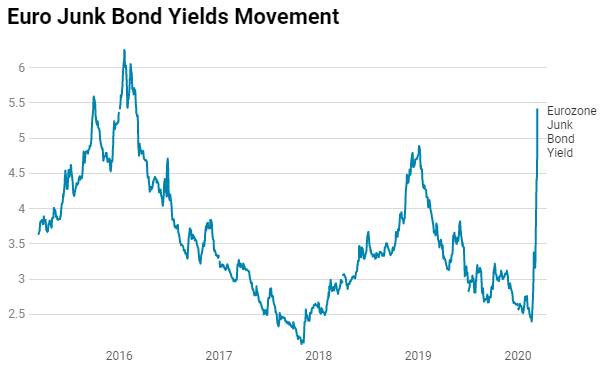

US benchmark Junk bond yields rose by 4 bps and is at 5.78%, Euro benchmark Junk bond yields rose by 5 bps to 3.06%.