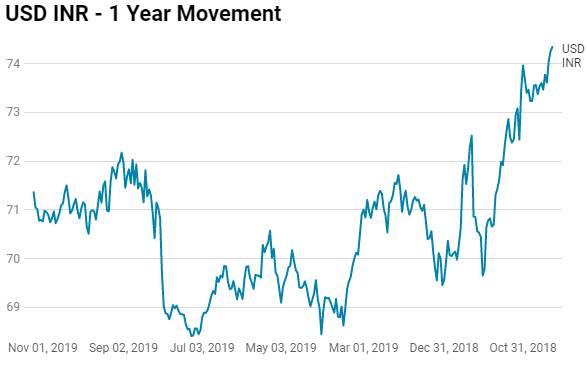

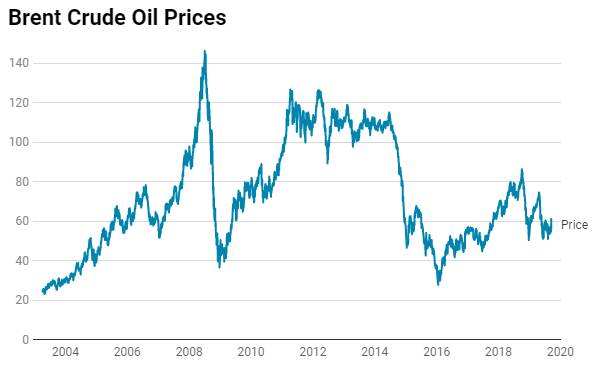

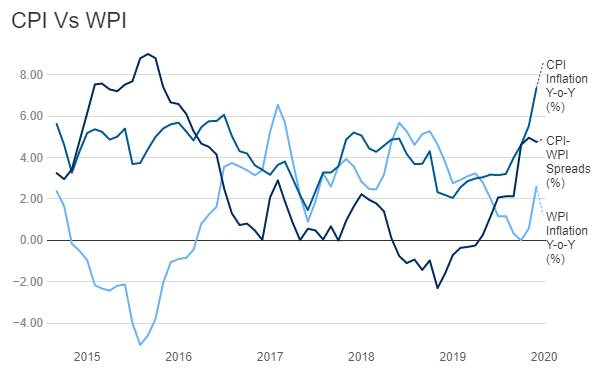

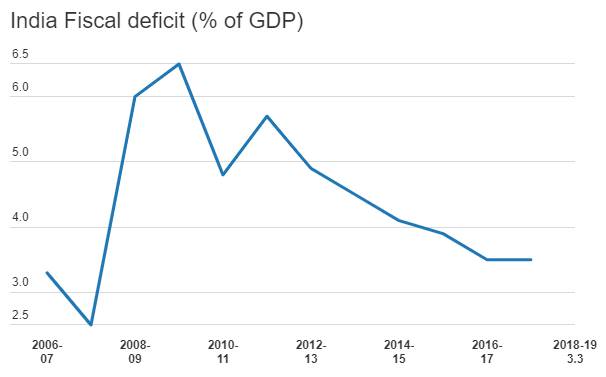

The bailout packages to sectors including banks, NBFCs, PSUs, Real Estate and the big bang corporate tax rate cut have placed the INR under pressure. The sharply slowing economy and weak business outlook have prompted the government to undertake a series of measures to revive the economy but the outcome is uncertain and government finances have turned weak. Fiscal deficit is likely to exceed budgeted targets and this is hurting the INR.

INR is likely to depreciate against the USD if the economy is not showing any momentum.

INR, on Friday, fell sharply against the USD after Moody’s Investors Services lowered the nation’s rating outlook to negative citing growth concerns. The reduction comes at a time when investors have been skeptical about the government meeting its budget targets amid a slowdown in tax revenues and September’s surprise USD 20 billion tax giveaway for companies. INR depreciated by 0.67% against the USD last week while appreciated by 0.46% against the euro.

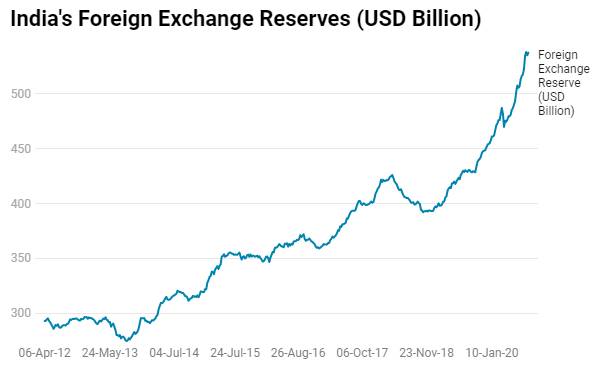

INR appreciated by 1.70% against the USD in the last one year and is currently trading at levels of Rs 71.28 against the USD. INR has depreciated by 2.13% against the USD so far in 2019 and has marginally depreciated by 0.30% in the last 1 month.

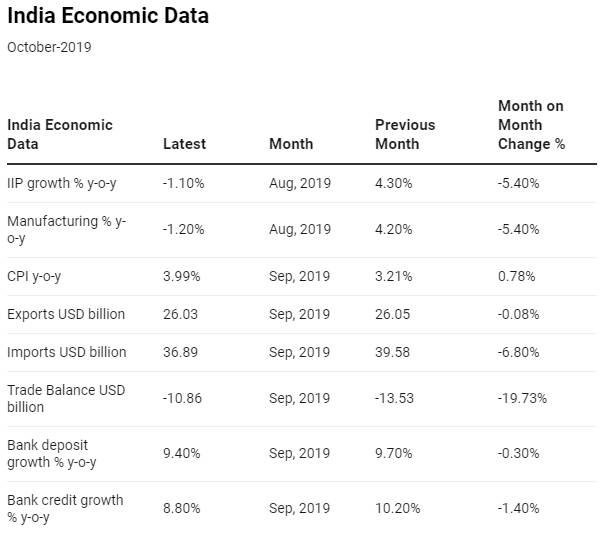

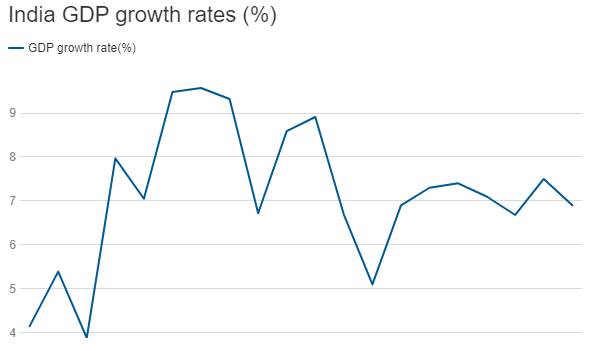

The Indian economy is showing signs of softness, both rural and urban demand indicators suggest lost momentum, with prospects for household spending likely to remain muted in the near term. Lower business confidence due to elevated global uncertainties is filtering through to investment activity. Weaker global demand conditions are also weighing on Indian exporters and the manufacturing sector.

The country’s real GDP growth slowed notably in the second quarter of 2019 with output expanding by 5.0% on a yearly basis against 5.8% in the January–March period and 7.4% in 2018. However, the Indian government is implementing measures to underpin the flagging economy, yet the room for fiscal stimulus is limited on the back of India’s weak public finances. In order to boost private sector investment over the coming years, the government announced a substantial corporate tax reform in September, which sees the corporate tax rate cut from 30% to 22%, effective from April 1, 2019.

The benchmark repo rate has been reduced in five consecutive monetary policy meetings by a total of 135 basis points since the beginning of the easing cycle in February 2019. The most recent rate cut took place in early October when the policy rate was reduced by 25 bps to 5.15%, the lowest level since 2010. The RBI maintains its “accommodative” monetary policy stance. Furthermore, it has signaled that the stance would remain unchanged “as long as it is necessary to revive growth” and that additional policy space exists to address weak economic activity.

USD ended the week higher against major world currencies as the US and China are expected to sign phase one of the trade deal and may roll back some tariffs. However on Friday, Trump made it clear that nothing has been decided – he said that while China wants the U.S. to roll back tariffs, he hasn’t agreed to them. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 1.15% on a week on week basis and is at a level of 98.35.

U.S. job growth slowed but not as much as anticipated with the economy adding 128,000 jobs against 89,000 expected, the unemployment rate ticked up to 3.6% from 3.5% while average hourly earnings growth rose to 0.2% instead of the 0.3% forecast.

US ISM non-manufacturing index grew to 54.7 in October against 52.6 in September. The US international trade deficit in goods and services reduced to USD 52.5 billion in September from USD 55.0 billion in August as imports decreased more than exports. September exports were USD 206.0 billion, USD 1.8 billion lower than August exports. Imports were USD 258.4 billion, USD 4.4 billion lower than August imports.

British Pound and Euro traded sharply lower against USD last week as Bank Of England kept rates unchanged with 7-2 votes and lowered next 2 year GDP and inflation forecasts. Euro came under pressure last week despite German trade and current account numbers, showing significant improvement. German industrial output fell 0.6% against the previous month. Q3 GDP numbers are scheduled for release this week and the data is widely expected to confirm that the German economy fell into recession in the third quarter.