INR ended the week higher against the USD, largely helped by broad USD weakness on Friday. INR traded lower in the early part of the week after media reports indicated that China was doubtful about a long-term trade agreement with the US, dampening the appetite for riskier assets. INR appreciated by 0.11% against the USD last week and depreciated by 0.28% against the euro.

Foreign portfolio investors have been investing into Indian equities on the back of hopes that the Centre may announce reforms to boost the economy and consumer demand. Moreover, a 9-basis-point fall in US Treasury yields this week on a rate cut by the Federal Reserve made high-yielding gilts an attractive investment spot.

USD ended the week lower against major world currencies amid fresh trade uncertainties, U.S. nonfarm payrolls report and Fed policy decision. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.61% on a week on week basis and is at a level of 97.24.

U.S. job growth slowed but not as much as anticipated, adding 128,000 jobs against expectations of 89,000, the unemployment rate ticked up to 3.6% from 3.5% while average hourly earnings growth accelerated to 0.2% instead of the 0.3% forecast.

USD fell on Thursday after the third Federal Reserve rate cut this year but failed to give clarity on further easing. The lack of a clear indication from the Fed that it is done with easing, for now, was less hawkish than expected, sending the USD lower. The Fed cut interest rates to a target range of between 1.50% and 1.75% and dropped the previous phrase that it “will act as appropriate” to sustain the economic expansion.

USD came under additional pressure on Friday after reports suggested that Chinese officials have doubts about reaching a comprehensive long-term solution to the U.S.-Sino trade war. However, the US & China later said that they made progress in talks aimed at defusing a nearly 16-month-long trade war that has harmed the global economy, and U.S. officials said a deal could be signed this month.

British Pound and Euro traded higher against USD last week after European Union Council President Donald Tusk confirmed on Monday that the EU has agreed to extend the deadline for Brexit until Jan. 31, 2020, in line with the request from the U.K. government earlier this month. Further, Prime Minister Boris Johnson won parliamentary approval on Wednesday to hold a general election in December that might break the Brexit deadlock.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 9 bps last week after a report that Chinese government officials were unsure if a longer-term comprehensive trade deal with the U.S. can be reached, only one day after Federal Reserve chairman Jerome Powell suggested no further immediate interest rate cuts may be needed given geopolitical risks had eased.

In Europe, bond yields largely fell last week as Christine Lagarde began her presidency of the European Central Bank and as the European Central Bank resumed its bond-buying program. The ECB said in September that it would buy 20 billion euros worth of bonds a month.

German 10-year bond yields fell last week by 2 bps and France 10-year bond yields remained flat at negative 0.07%. Italy 10-year benchmark yield rose by 5 bps.

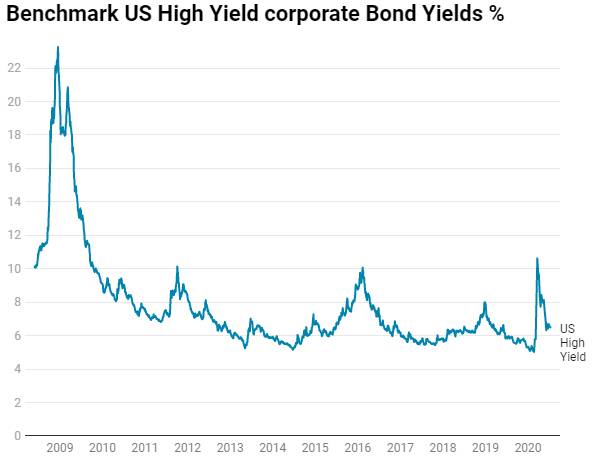

US benchmark Junk bond yields rose by 16 bps and is at 5.73%, Euro benchmark Junk bond yields rose by 8 bps to 3.12%.