INR ended the week lower against the USD amid concerns over the progress of China-US trade talks, IMF downgraded India growth forecast and there was increased demand for the USD from importers. However, INR gained in the latter part of the week largely on the back of optimism over the Brexit deal and amid softening crude oil prices. INR depreciated by 0.19% against the USD last week while depreciated by 0.96% against the euro.

The IMF cut estimates for India growth in 2019 from 7.0% to 6.1%, and from 7.2% to 7.0% for 2020, in its recent World Economic Outlook report. Despite the cut in the growth forecast, the IMF is still quite optimistic in its 2020 forecasts for Indian growth, suggesting it sees a rapid recovery.

USD ended the week lower, as the Euro and British Pound gained amid optimism that a Brexit deal will help mitigate risks of a recession in the bloc. USD came under pressure after retail sales fell for the first time in seven months in September, increasing the chances of the Federal Reserve cutting interest rates later this month. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 1.04% on a week on week basis and is at a level of 97.28.

Trade tensions also weighed, as uncertainty remained despite a temporary truce between the U.S. and China. The International Monetary Fund warned on Tuesday that the U.S.-China trade war would cut 2019 global growth to its slowest pace since the financial crisis. The organization said that more details on Trump’s Phase 1 trade deal were needed.

U.K. Prime Minister Boris Johnson made a deal with the EU on Thursday, which hinges on Northern Ireland applying a limited set of EU rules on some goods, with the U.K. only charging EU tariffs on goods passing through to EU markets.

The deal was not passed by the British Parliament. Northern Ireland’s Democratic Unionist Party said it is opposed to the proposed agreement, making it uncertain if the deal will be approved.

USD started the week on a higher note on Monday as market sentiment improved after breakthrough in the U.S.-China trade dispute and on Brexit. Risk appetite had improved on Friday after the U.S. and China announced a “roadmap to a phase 1 agreement” which included the suspension of a tariff increase planned for this week and a commitment from China to buy more U.S. agricultural produce. However, China wants to hold more negotiations this month before agreeing to sign the deal.

USD fell on Friday as market participants turned cautious after data showed the impact of the trade war has taken its toll on China. China’s gross domestic product grew 6% annually in the third quarter, which was the slowest rate in 30 years.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 1 bps last week amid expectation that the Fed is likely to cut interest rates in its upcoming meeting. New York Fed President John Williams said late Thursday that the central bank was closely monitoring its measures to soothe pressures in funding markets. The U.S. central bank has regularly intervened to provide liquidity and announced USD 60 billion of bill purchases at least through the second half of 2020.

Additionally, Fed Vice Chairman Richard Clarida said the economy was still facing risks, and that inflation was muted. But he did not comment on the outlook for interest rates at the upcoming Oct. 29-30 meeting.

In Europe, bond yields were largely mixed last week after U.K. Prime Minister Boris Johnson announced that the U.K. and European negotiators had managed to strike a tentative Brexit deal, with European Commission President Jean-Claude Juncker saying it was a “fair and balanced agreement”. However, on Saturday, the British parliament voted against the agreement on the United Kingdom’s departure from the European Union.

German 10-year bond yields rose last week by 6 bps and France 10-year bond yield rose by 8 bps. Italy 10-year benchmark yield fell by 2 bps.

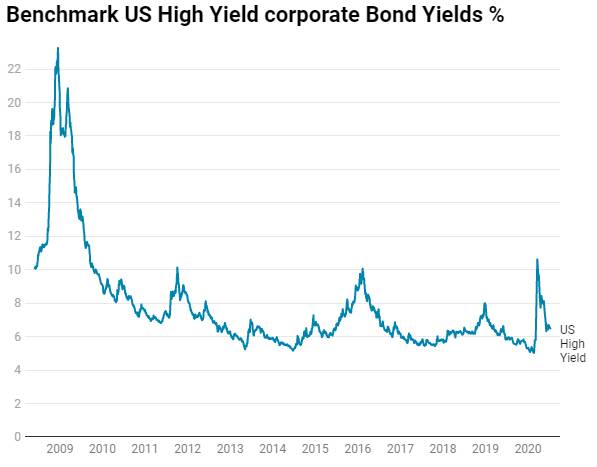

US benchmark Junk bond yields fell by 18 bps and is at 5.64%, Euro benchmark Junk bond yields fell by 17 bps to 2.99%.