INR ended the week lower against the USD after exhibiting volatility during the week amid uncertainty over US-China trade deal, rising crude oil prices, foreign fund outflows and on fears that the RBI may prevent a sharp rise in the INR through its USD buying interventions. INR depreciated by 0.18% against the USD last week while depreciated by 0.83% against the euro.

INR recovered marginally on Friday, as risk appetite improved largely on the expectation that the US and China will be able to sign a partial deal easing worries over an escalation in the protracted trade war. Late on Thursday, US President Donald Trump said “had a very, very good negotiation” with the Chinese delegation, led by Vice Premier Liu He, in Washington.

USD ended the week lower against major world currencies, as the sentiment in the markets shifted from gloom to hope on Friday after President Trump announced a “Phase 1 Deal” with China. However, according to Trump, it may take up to 5 weeks to get the deal written. The next 5 weeks is critical because this is the fourth time that the US has offered relief to China and trade relations soured quickly after. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.51% on a week on week basis and is at a level of 98.30.

USD started the week on a higher note on Monday, as market participants waited for an outcome from U.S.-China trade talks in Washington. However, on Monday media reports suggested that there is a minimal chance of a breakthrough in the trade talks between the U.S. and China, which was to resume on Thursday.

USD started its downward trajectory on Wednesday after Powell on Tuesday said that the Fed will soon start expanding its balance sheet again. He also stressed that this was not the resumption of “quantitative easing”, but rather a technical exercise in ensuring that the financial system has enough liquidity to function. Separately, Powell noted that he hadn’t ruled out another interest rate cut this year but stressed that the Fed would be data-led.

Further, the weakness was added to the USD after consumer prices rose less than expected in September, increasing the chances of the Federal Reserve cutting rates before the end of the year.

British Pound appreciated sharply against the USD after last week’s comments by Irish Prime Minister Leo Varadkar, who said he believes a Brexit deal is likely to be reached. On Thursday, the prime ministers of the U.K. and Ireland released a joint statement saying that they saw a potential pathway to a Brexit deal.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose sharply by 21 bps last week amid signs that the U.S. was nearing a limited trade deal that could prevent a further escalation of the tariff spat between the two world’s largest economies.

In Europe, bond yields were largely up after minutes from the European Central Bank’s September meeting highlighted rifts within its policy-making committee, casting doubt on further easing and sparking a selloff in European government paper. German 10-year bond yields rose last week by 15 bps while France 10-year bond yield rose by 12 bps. Italy 10-year benchmark yield rose by 20 bps.

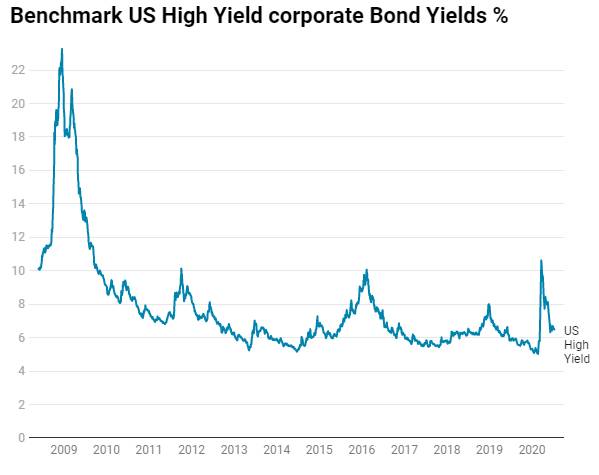

US benchmark Junk bond yields fell by 2 bps and is at 5.82%, Euro benchmark Junk bond yields rose by 12 bps to 3.16%.