INR ended higher against USD last week amid easing crude oil prices and foreign fund inflows. Further, a cut in corporate tax rates announced prior to last week has stirred optimism for Indian assets, as market participants are of the view that recent measures by the government will lead to foreign fund inflows in coming months, which has turned sentiment in favor of the INR. However, the gain in USD last week prevented steep gains in the INR. INR appreciated by 0.54% against the USD last week and appreciated by 1.49% against the euro.

Additionally, global risk sentiment for emerging market assets was lifted by comments from US President Donald Trump on Wednesday that China wants to reach a trade agreement “badly” and it could happen “sooner than you think.” Moreover, Trump and Japanese Prime Minister Shinzo Abe signed the “first stage” of an initial pact at the United Nations General Assembly on Wednesday, which entails cut in tariffs on each other’s goods. This also lifted the risk sentiment.

USD remained highly volatile last week but ended higher against major world currencies, as market participants remained cautious over recent developments related to an impeachment inquiry on U.S. President Donald Trump and amid optimism over trade agreement between U.S.-China. Further, the release of soft consumer confidence data last week added pressure to the USD. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.60% on a week on week basis and is at a level of 99.11.

USD started the week on a flat amid trade concerns, after a Chinese delegation ended its U.S. trip early. Both sides said the talks were constructive, but neither gave any details about what was discussed. However, on Tuesday U.S. Treasury Secretary Steven Mnuchin confirmed U.S.-China trade talks will resume next month.

USD came under slight pressure following the launch of an impeachment inquiry on President Donald Trump. The U.S. House of Representatives will launch a formal impeachment inquiry over whether Trump sought help from Ukraine to smear former Vice President Joe Biden, a front-runner for the 2020 Democratic presidential nomination. Trump has denied the claims.

However, USD exhibited sharp gain on Wednesday after the release of a transcript between U.S. President Donald Trump and Ukrainian President Volodymyr Zelensky failed to intensify an impeachment inquiry from Congress. The transcripts revealed that Trump did ask Zelensky to investigate corruption charges that were dropped against Biden’s son, but no direct mention of foreign aid was made.

USD continued to gain on Thursday amid renewed U.S.-China trade hopes. U.S.-China trade hopes reignited after U.S. President Donald Trump suggested an agreement with China might come sooner than anyone thinks, although he didn’t offer many specifics.

Further, the consumer spending on goods and services rose 0.1% in August, while durable goods orders inched up 0.2% compared to a rise of 2% in July. The numbers suggest that the economy is cooling after a strong acceleration in the second quarter, putting the focus on next week’s monthly jobs report.

Euro depreciated against USD last week amid fresh uncertainty over European Central Bank policy after the resignation late Wednesday of Sabine Lautenschlaeger in an apparent act of protest against President Mario Draghi’s insistence on reviving quantitative easing. British Pound was also under pressure on reports cited by European Union’s Brexit negotiator, who said Britain had yet to provide “legal and operational” proposals for an agreement on exiting the bloc.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 4 bps last week, as political jitters from Washington boosted demand for safe haven assets like U.S. government paper. Market Participant will keep a close watch on resurfacing political concerns after U.S. House Democrats endorsed an impeachment inquiry into President Donald Trump. However, the proceedings may not make much headway in a Republican-dominated Senate. U.S.-Iran tensions and the possibility of a no-deal Brexit have also kept market participants on edge.

In Europe, bond yields were largely down, as concerns about a weak economy and political uncertainty in Britain and the United States continued to support debt markets.

German and French 10-year bond yields fell last week by 5 bps and 6 bps respectively while Italy 10-year benchmark yield fell by 10 bps.

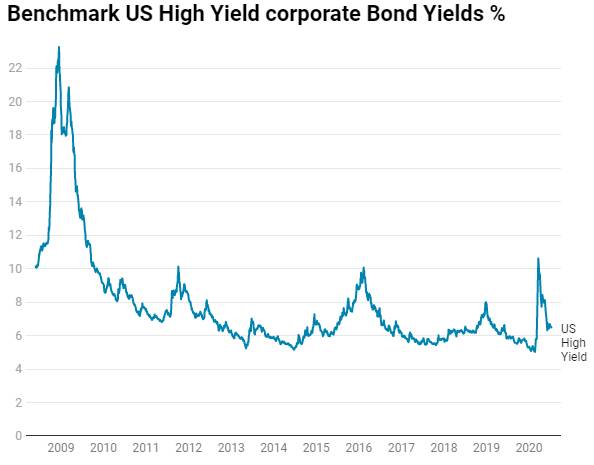

US benchmark Junk bond yields rose by 8 bps and is at 5.59%, Euro benchmark Junk bond yields rose by 13 bps to 2.88%.a