INR remained largely volatile last week amid weakness in the global market sentiment but ended the week flat. INR came under heavy selling pressure in the early part of the week largely due to the sharp rise in crude oil prices after drone attack on Saudi Arabia’s largest oil processing plant. Brent crude oil prices surged by 13% to USD 68.06 per barrel on Monday.

However, the slew of measures taken by the Finance Minister last week to stimulate the demand in the economy, helped the INR gain sharply on Friday, paring its early week losses. INR depreciated marginally by 0.02% against the USD last week while appreciated by 0.52% against the euro.

The government announced an effective corporate tax rate cut from 30% to 25.2% to boost flagging economic sentiments that were reeling under lack of investment and consumer demand, showing up in falling corporate revenues. (Read our analysis on Big Bang Tax Rate Cut and Its Short- & Long-Term Effect on Markets).

USD ended the week higher against major world currencies despite exhibiting high volatility throughout the week. Fed rate cut, geopolitical tension, BoJ monetary policy were among the major drivers for the global currency market last week. Demand for safe-haven assets was high as Japanese Yen appreciated sharply against the USD amid heightened geopolitical tensions in the Middle East after weekend attacks on Saudi oil plants, which disrupted global oil supplies.

U.S. Federal Reserve lowered its main interest rate for a second time this year and Chairman Jerome Powell said that “moderate” policy moves should be sufficient to sustain the U.S. expansion. However, the Fed continued to remain accommodative and its future policy action will be data-dependent. The Fed cut its benchmark rate by a quarter percentage point to a range of 1.75% to 2% citing that “Weakness in global growth and trade policy have weighed on the economy.”

USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.26% on a week on week basis and is at a level of 98.51. Japanese Yen appreciated by 0.49% against the USD and by 1% against the Euro.

USD started the week on a lower note, as global sentiments weakened after an attack on oil fields in Saudi Arabia, which disrupted 5% of the world’s daily crude oil production, raising fears of a global economic slowdown and increasing tensions between the U.S. and Iran. The U.S. government blamed Iran for the attacks, which the Islamic state denied.

On Tuesday, Japan and the U.S. had reached an initial trade accord over tariffs. However, it is unclear whether the U.S. will maintain tariffs on Japanese auto imports as part of the agreement.

British Pound appreciated sharply to new yearly highs against the euro and USD on Friday amid optimism that the U.K. and EU will avoid a disorderly Brexit on Oct. 31, although the basis of such hopes remained open to question. However, on a weekly basis, British Pound depreciated by 0.18% against USD.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 18 bps last week after the Federal Reserve cut interest rates by 25 basis points, its second such move in 2019. The Fed failed to signal further rate cuts for 2019, disappointing some investors who had been hoping for hints at looser monetary policy.

Economic reports that proved better than expected data also may have kept rates somewhat in check. Existing-home sales rose 1.3% in August from the previous month to a seasonally adjusted annual rate of 5.49 million, marking the strongest pace of sales since March of last year. The Philadelphia Federal Reserve’s manufacturing index fell to 12.0 in September after registering a reading of 16.8 in August.

In Europe, bond yields were largely down tracking U.S. yields and amid optimism from European Commission President Jean-Claude Juncker, who said a Brexit deal is possible and that the much-contested Irish border backstop could be replaced by an alternative.

German and French 10-year bond yields fell last week by 8 bps and 5 bps respectively. while Italy 10-year benchmark yield rose by 6 bps.

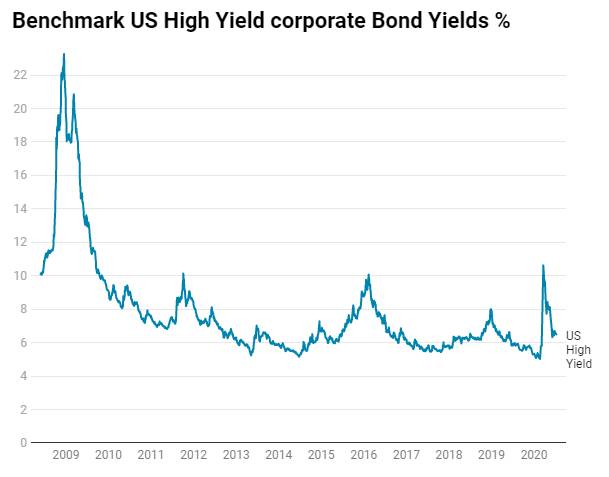

US benchmark Junk bond yields fell by 5 bps and is at 5.51%, Euro benchmark Junk bond yields rose by 8 bps to 2.75%.