INR ended the week higher against the USD last week and posted gains for seven consecutive trading sessions amid improvement in global risk appetite and due to the release of upbeat domestic industrial data. INR appreciated by 1.12% against the USD last week and by 0.43% against the euro.

The appetite for riskier emerging market assets improved after US President Donald Trump signaled that he would consider an interim trade deal with China. President Donald Trump in a tweet on Wednesday wrote that ‘At the request of the Vice Premier of China, Liu He, and due to the fact that the People’s Republic of China will be celebrating their 70th anniversary on October 1st, we have agreed as a gesture of good will, to move the increased Tariffs on USD 250 billion worth of goods (25% to 30%) from October 1st to October 15th.

ECB rate cut and bond purchase program too drove appetite for EM currencies. Read our note on ECB policy for details.

On Friday, China decided to exempt 16 US goods from tariffs, although it was only a very small part worth USD 1.6 billion out of a total of around USD 110 billion.

There was also a relief on the Brexit front following a report by The Times that the Democratic Unionist Party of Ireland, allies of the Conservative Party, were willing to soften their stance on the contentious Irish backstop. This allayed fear of the UK exiting the European Union without a deal.

On the domestic front, upbeat domestic industrial data released on Thursday additionally improved the sentiment for the INR. The data showed industrial growth, based on the Index of Industrial Production, jumped to 4.3% in July from 1.2% the previous month against the expectation of a rise of 2.3%.

A slide in global oil prices has also boosted the INR. Oil prices tumbled more than 3% last week after media reported that US President Donald Trump is weighing easing sanctions on Iran, which could boost global crude supply at a time of lingering worries about global energy demand.

Chinese yuan last week was also supported after Beijing scrapped foreign quota and allowed unfettered access to the stock markets. China’s State Administration of Foreign Exchange said in a statement on Wednesday that it would remove quota restrictions on the dollar-dominated qualified foreign institutional investor scheme and RQFII, a programme introduced in 2011 that gives investors access to offshore renminbi to buy mainland-traded stocks.

Beijing said the move would “make it much more convenient for overseas investors to participate in China’s domestic financial markets, making China’s bond and stock markets broadly accepted by international markets.”

USD ended the week lower against majors last week amid expectations for the Fed’s second rate cut this year in next week’s FOMC meet. The sharp gain in Euro and British Pound last week along with easing concern over US- China trade war have kept USD under pressure. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.14% on a week on week basis and is at a level of 98.26.

Both the euro and the British pound made sharp gains last week, British pound appreciated by 1.77% and is trading at GBP 1.2501 against the USD, as the political and judicial problems of Prime Minister Boris Johnson embolden hopes that the country will avoid a disorderly exit from the European Union at the end of next year. The euro, meanwhile, has risen despite the European Central Bank announcing its biggest package of rate cut and economic stimulus in three years. The decision by the ECB initially pushed the euro lower, but that was short-lived.

The ECB cut interest rates by 10 basis point to -0.5% and announced open-ended QE of euro 20 billion per month starting 1st November. The central bank downgraded its inflation and growth forecast AND also introduced a reserve system that would exempt part of bank holdings from negative rates. President Mario Draghi has also warned governments that they needed to act quickly to revive flagging eurozone growth.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose sharply by 34 bps last week posting its biggest weekly jump since November 2016. The sell off in U.S. bonds can largely be attributed to profit-taking from market participants after a huge rally seen in recent months. Positive economic developments have also contributed to the selling in bond market.

August’s U.S. retail sales increase of 0.4%, and 4.1% for the year and a better-than-expected reading in U.S. core consumer price inflation pushed yields higher. Last week, the employment report showed wages had risen by 0.4% last month, higher than the expectation of 0.3% rise.

In Europe, bond yields were also largely up as concerns crept into the market that the European Central Bank is reaching the limits of what its policy can achieve, a day after the bank pledged indefinite stimulus to boost a weak economy. Market had initially cheered the ECB’s rate cuts, open-ended asset purchases and steps to protect banks from the negative side-effects of sub-zero interest rates. But concerns then grew over the emphasis in the ECB chief Mario Draghi’s press conference on the need for fiscal stimulus to take over in boosting economic growth and inflation.

German and French 10-year bond yields rose last week by 19 bps and 17 bps respectively while Italy 10-year benchmark yield fell by 1 bps.

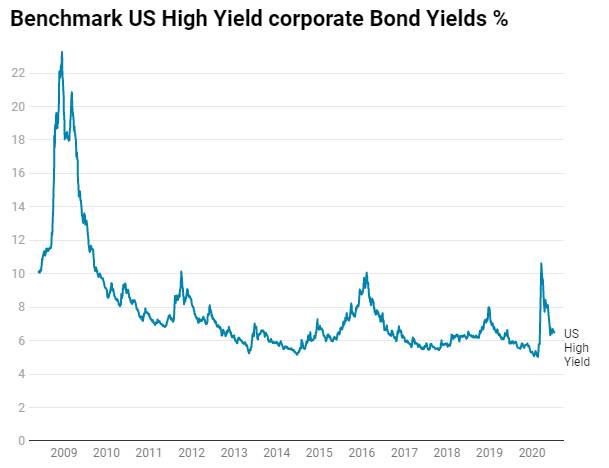

US benchmark Junk bond yields fell by 1 bps and is at 5.56%, Euro benchmark Junk bond yields fell by 5 bps to 2.67%.