INR ended lower against the USD last week, as the appetite for riskier assets worsened amid escalation in trade standoff between the US and China over the weekend. INR was also under additional pressure after a slump in India’s GDP growth for the quarter ended June 2019 weakened the sentiment and affirmed the case of slowdown in global economic growth spilling over to emerging markets. INR depreciated by 0.25% against the USD last week and depreciated by 0.07% against the euro.

Data released last week showed that India’s GDP growth slumped to a 25-quarter low of 5.0% in April-June 2019 on account of a sharp slowdown in the manufacturing and agriculture sectors. GDP had grown 5.8% in January-March 2019 quarter and 8.0% in April-June last year. The fall was sharper than market expectations of 5.6% growth.

Manufacturing Purchasing Managers’ Index fell to a 15-month low of 51.4 in August from 52.5 a month ago. Data released on Sunday also showed that GST tax collections in August, although up 5.8% on year, remained subdued at Rs 982.02 billion.

USD ended the week lower after the economy added fewer jobs than expected in August. Additionally, the escalation in U.S. – China trade war and the release of weak economic data also weighed on USD. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.53% on a week on week basis and is at a level of 98.39.

U.S. monthly jobs report showed that payroll employment added 130,000 jobs in August, less than expected, and the U.S. unemployment rate held at 3.7% while average hourly earnings rose 0.4%, beating expectations.

Fed Chairman Powell, speaking in Switzerland on Friday, said that the economy is healthy and not in danger of falling into a recession. His remarks followed the usual tweets from President Trump calling for deep rate cuts when the Fed’s FOMC meets on Sept. 17-18.

USD started the week on a flat note on Monday as concerns over the escalation in the U.S. – China trade war kept market participants wary. U.S. slapped 15% tariffs on a variety of Chinese goods on Sunday while China in retaliation increased duties of between 5% and 10% on a variety of major US goods exported to China.

USD came under additional pressure on Wednesday after New York Federal Reserve President John Williams said the economy looks “weaker than previously thought” and the central bank needs to stay flexible.

Slowing global growth has contributed to weak manufacturing data and the economy could be less resilient than was previously thought, Williams said in prepared remarks at a conference in New York City. His comments cemented expectations that the central bank will cut rates in its meeting later in the month.

However, some respite came for USD on Thursday after China’s commerce ministry said its trade team will consult with their U.S. counterparts in mid-September in preparation for negotiations in early October, and both sides agreed to take actions to create favourable conditions.

Euro and British Pound appreciated sharply against the USD last week. British Pound gained after British lawmakers voted to take control of Wednesday’s parliamentary agenda in a bid to pass legislation to prevent a no-deal Brexit. If the attempt is successful, it would force Prime Minister Boris Johnson to seek more time from the European Union and prevent crashing out of the bloc with no deal.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 6 bps last week despite falling on Friday after the nonfarm-payrolls report showed the U.S. economy added less jobs than expected last month. Market expectations are for the U.S. central bank to cut rates by a quarter of a percentage point at the conclusion of its two-day policy meeting on Sept. 18.

In Europe, bond yields were largely up after slightly hawkish comments from European Central Bank officials lowered expectations for aggressive easing at next week’s policy meeting, steepening bond yield curves. Further, reduced political risk, from the approval of a coalition government in Italy to the UK parliament’s battle to avert a no-deal Brexit, have helped to improve the market sentiment, reducing demand for safe-haven government bonds.

German and French 10-year bond yields rose last week by 6 bps each. While Italy 10-year benchmark yield fell by 10 bps.

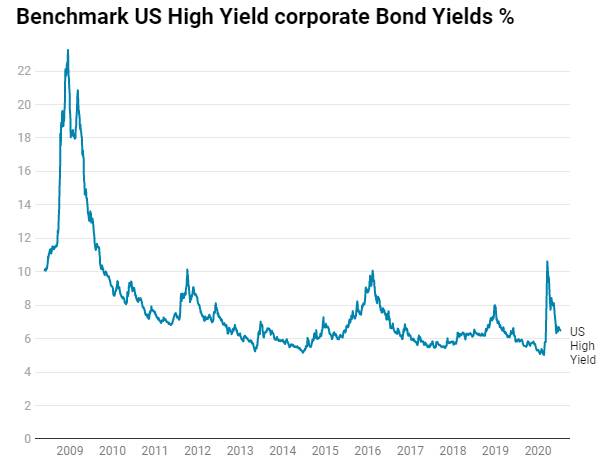

US benchmark Junk bond yields fell by 1 bps and is at 5.57%, Euro benchmark Junk bond yields rose by 1 bps to 2.72%.