INR fell to Rs 72-mark against the USD for the first time in 2019, following s selloff in domestic equities and amid weakness in Chinese Yuan, which fell to a fresh 11-year low level. INR depreciated by 0.71% against the USD last week and depreciated by 0.52% against the euro.

Global risk aversion combined with lack of any concrete measures by the centre to boost India’s economic growth, has reduced the allure of Indian equities among foreign investors in the last two months. So far in August, FPIs net sold shares worth USD 1.19 billion. However, on Friday. the FM has announced slew of measures to boost the ailing economy.

Finance minister, in a much-needed relief to the foreign portfolio investors, (FPI) has withdrew the enhanced tax surcharge on foreign investors. The government has also announced that no angel tax would be imposed on start-ups and their investors if registered with the DPIIT.

USD ended the week lower against major world currencies as the expectations for further Federal Reserve rate cuts waned, after Federal Reserve Chairman Jerome Powell in his speech on Friday said that the central bank would keep an eye on the economy and act as needed, but failed to give any new guidance on interest rates. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.30% on a week on week basis and is at a level of 97.85.

USD started the week on a higher note, as U.S. Treasury yields bounced back from recent lows amid hopes that major economies will seek to prop up slowing growth with fresh stimulus. Falling yields caused the 2-10-year Treasury curve to invert for the first time since 2007, a phenomenon widely regarded as a recession signal that puts the Federal Reserve interest rate deliberations into focus.

However, the USD remained unchanged during the mid-part of the week after the release of Federal Reserve’s July 30-31 meeting minutes. The minutes showed that officials saw the central bank’s rate cut last month as a measure taken amid the trade war with China and low inflation.

The Fed is under pressure from both investors and U.S. President Donald Trump to keep cutting rates. Earlier this week, Trump said that the central bank should cut rates by as much as 100 basis points, while on Wednesday he claimed the Fed was the only downside to the state of the economy.

Euro and British Pound appreciated sharply against the USD last week after German Chancellor Angela Merkel said it was possible a solution to the Irish backstop could be found before the U.K. leaves the European Union on Oct. 31. The pound fell earlier this week after U.K. Prime Minister Boris Johnson demanded that the backstop be removed from the divorce deal. The backstop agreement is an insurance policy to keep the Irish border open after Britain leaves the EU.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 4 bps last week, as Federal Reserve officials pushed back against rate cut bets. However, the U.S. treasury yields fell on Friday after China announced more tariffs on imports of U.S. goods.

Federal Reserve chair Powell in a planned speech said the U.S. central bank would act as appropriate, and that he was aware of the downside risks to the U.S. economy including slower global economic growth and trade policy tensions. However, he did ’not give any new guidance on interest rate.

Philadelphia Fed President Patrick Harker and Kansas City Fed President Esther George both said they did not support further interest rate cuts. On the other hand, Dallas Fed President Robert Kaplan said slowing international growth and a weakening manufacturing sector might necessitate action from the U.S. central bank but that he would prefer to keep rates on hold in September.

In Europe, bond yields were mixed with German and French 10-year bond yields rising last week by 4 bps and 6 bps respectively, while Italy 10-year benchmark yield fell by 10 bps after Italy’s Prime Minister Giuseppe Conte said he is resigning ahead of a no-confidence vote.

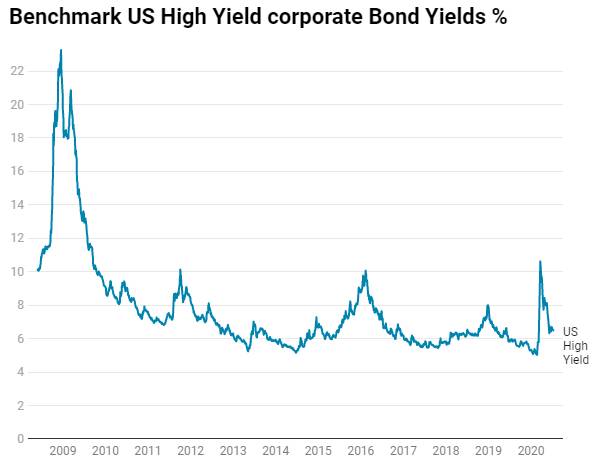

US benchmark Junk bond yields fell by 20 bps and is at 5.73%, Euro benchmark Junk bond yields fell by 29 bps to 2.84%.