INR ended the week lower against the USD amid weak risk appetite. Continuing concern over China-US trade war, protests in Hong Kong and a crash in Argentina’s peso currency drove investors to safe harbours like bonds, gold, and the yen. The Argentinean currency fell 30% on Monday, as the incumbent President Maurico Macri lost the primary elections. Concern of a contagion from a sharp fall in the Argentinean peso weighed on the INR.

Banks sold the USD for the Reserve Bank of India during last week. However, the Central Bank could not prevent a sharp fall in the INR, as importers rushed to purchase the USD given that they do not see the tide turning for the INR in the near term. INR depreciated by 0.51% against the USD last week and appreciated by 0.62% against the euro.

Last week, USD recovered against all of the major currencies with the exception of the British Pound, which coasted on stronger UK data. USD rally was driven primarily by better-than-expected U.S. data. Retail sales doubled expectations while year-over-year CPI growth edged closer to the central bank’s 2% target. These reports validate Fed Chairman Jerome Powell’s recent comments about the economy’s resilience and his positive assessment of the labour market.

USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.67% on a week on week basis and is at a level of 98.14.

USD started the week on a higher note, as investor sentiment was shaken by a currency crisis in Argentina, unrest in Hong Kong and growing indications that trade tensions are hitting global growth. U.S. President Donald Trump said he was not ready to make a deal with China and even called the scheduled trade talks in September into question.

USD was additionally supported in the later part of the week after tariffs on Chinese goods were delayed to December 15th, while certain products were removed due to “health, safety, national security and other factors”.

British Pound appreciated by 0.78% against the USD and other major rivals after being supported by strong July retail sales figures that has encouraged speculation of a third-quarter economic recovery in the UK. Retail sales rose by 0.2% in July against the expectation for a 0.3% decline. The sales were up 0.7% in the three months to the end of July and by 3.9% when last month’s figures are compared with the same period one year ago.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell sharply by 17 bps last week, as geopolitical worries, fears about global growth and concerns over trade helped draw money into safe haven assets like government bonds. The U.S. yield curve was inverted for the second straight trading session on Thursday, indicating that traders remain pessimistic about the growth outlook. Other factors driving flows into Treasury’s included protests in Hong Kong, the continuing U.S.-China trade dispute and fears that Argentina’s business-friendly president Maurico Macri will lose the general election in October.

In Europe, bond yields were down sharply after comments from European Central Bank helped spur purchases of European government bonds. Olli Rehn, who sits on the ECB’s rate-setting committee, said the central bank could unroll further stimulus measures in September, suggesting they would be more “impactful” than investors expect.

German and French 10-year bond yields fell last week by 12 bps and 15 bps respectively.

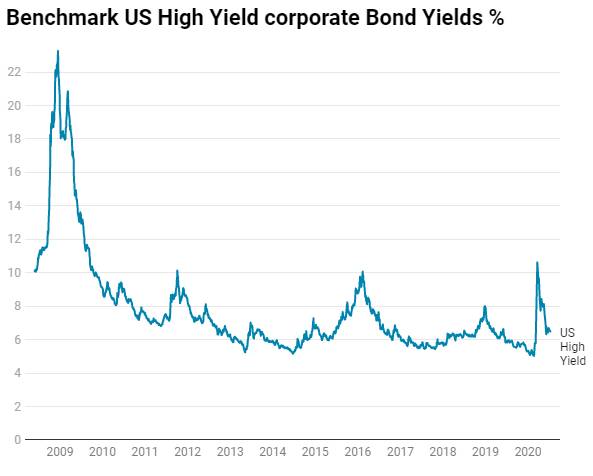

US benchmark Junk bond yields were steady at 5.93%, Euro benchmark Junk bond yields rose by 3 bps to 3.13%.