Currency markets will see high volatility amid the noise surrounding the markets. INR will move to tunes of government taking a relook at FPI tax, ongoing domestic demand slowdown, US-China trade and currency war tensions and fall in crude oil prices.

INR ended the week sharply lower against USD, as the sentiment for the risk assets weakened after the US-China trade war intensified. The RBI lowering interest rates by 35bps in its last concluded MPC meet and the geopolitical tension in the Kashmir region added pressure on INR. However, the pressure on INR eased on Friday on the expectation that the government will take measures to stimulate the economy. Meanwhile, slide in crude oil prices, which fell to near seven months low of USD 56 per barrel for Brent futures, supported the INR.

INR depreciated by 1.68% against the USD last week and depreciated by 2.56% against the euro.

On Monday, China’s central bank allowed the Yuan to fall below the sensitive level of 7 against the USD and halting the purchase of U.S. farm products. The yuan’s drop has triggered a sell-off in global financial markets as market sentiment weakened after the outlook for a deal between the U.S. and China suffered a heavy blow. The drop came after President Donald Trump’s threat of new tariffs on Chinese goods on Friday and has sparked fears that the US-China trade war is turning into a full-blown currency war, which could damage global growth. Further, the US has formally termed China as a “Currency Manipulator” after the Yuan fell below 7 against the USD.

On Tuesday last week, the INR came under heavy selling pressure after the Indian government officially scrapped the special status for the Jammu and Kashmir state by revoking Article 370, heightening political uncertainty in the region.

Further, the RBI on Wednesday reduced the policy repo rate by 35 bps to 5.40%. RBI decided to maintain the accommodative stance and prioritise economic growth

USD ended the week lower as demand for safe haven rose during the week amid rising tensions between US and China, while escalating protests in Hong Kong also dampened market sentiment. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.6% on a week on week basis and is at a level of 97.49.

On Tuesday, USD steadied after China took steps to limit weakness in the yuan and reassured market participants that it wouldn’t weaponize its currency in its trade spat with the U.S.

U.S. president Donald Trump on Wednesday reiterated his accusations that the Federal Reserve is not cutting rates fast enough. Trump tweeted that the Fed needs to “cut rates bigger and faster,” and that “our problem” was not China, but the U.S. central bank.

Euro appreciated by 0.87% against the USD last week despite the eruption of the latest political crisis in Italy, where Matteo Salvini, the head of the right-wing populist Lega party, called for new elections in a move to cement his power.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell sharply by 13 bps last week amid fresh concerns about an economic slowdown, escalation in trade dispute between the U.S. – China and a muted inflation print that fuelled investor appetite for U.S. Treasuries.

U.S. government on Friday reported that the producer prices increased at a sluggish pace in July. The Labour Department said its producer price index rose 0.2% last month after inching just 0.1% higher in June. The core PCE price index increased 1.6% on a year-on-year basis in June and has undershot its target this year. The Fed has a 2% inflation target but favours the core personal consumption expenditures (PCE) price index as an inflation gauge.

In Europe, bond yields largely steadied in the region except Italy. Italy benchmark bond yields have risen sharply by 28 bps amid rising political uncertainty after deputy prime minister, Matteo Salvini, sought snap elections following a period of public fighting between Salvini’s League party and the anti-establishment 5-Star Movement.

German and French 10-year bond yields fell last week by 8 bps and 4 bps respectively.

South Africa 10-year benchmark bond yields rose by 3 bps after the National Treasury said it will increase the amount of debt sold at weekly bond auctions to help fund a bailout of the state-owned electricity company and counter a tax revenue shortfall.

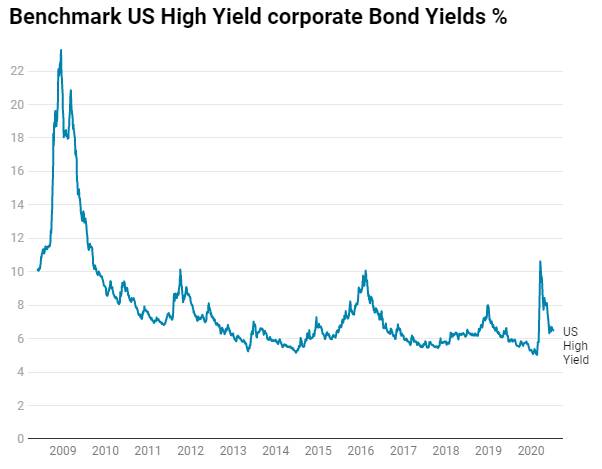

US benchmark Junk bond yields rose by 7 bps to 5.93%, Euro benchmark Junk bond yields rose by 13 bps to 3.10%.