INR ended the week lower against the USD last week as soaring crude oil prices and a fresh flare up in US-China trade tensions weighed on emerging market currencies. Additionally, the surge in USD after comments made by Federal Reserve chief Jerome Powell, which were more hawkish than expected, also weighed on INR. INR depreciated by 1% against the USD last week and depreciated by 0.73% against the euro.

USD last week traded higher against major world currencies, as Federal Reserve lowered interest rate by 25 bps in its last week FOMC meet but indicated that it was not the start of a new easing cycle. However, USD came under pressure in the later part of the week amid escalation in the U.S.-China trade war weakening market sentiment and driving safe-haven currencies higher. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.07% on a week on week basis and is at a level of 98.07.

The Federal Reserve cut interest rates for the first time since 2008 as inflation continued to track below target and signs of slowing global growth persisted. Fed Chairman Jerome Powell dashed hopes that aggressive cuts may follow, saying that the cut does not represent the start of a lengthy easing cycle. The Federal Reserve cut its benchmark rate by 25 basis points to a range of 2.0% to 2.25% from 2.25% to 2.5%.

Further in a statement at the end of the policy meeting, the Fed said it will “continue to monitor” how incoming information will affect the economy, adding that it “will act as appropriate to sustain” a record-long U.S. economic expansion.

The demand for safe-haven Japanese yen rose against the USD in the later part off the week after U.S. President Donald Trump escalated trade worries after he said that the U.S. would add tariffs on more Chinese goods. President Donald Trump threatened another 10% of tariffs on USD 300 billion worth of Chinese goods, which would put tariffs on all U.S. imports from China. Beijing warned on Friday it would retaliate.

British Pound depreciated sharply against USD last week. Pound started the week on a lower note as newly elected Prime Minister Boris Johnson told the Irish Prime Minister Leo Varadkar that he wants to take the U.K. out of the European Union by Oct. 31 regardless of whether or not there is a deal.

Johnson reiterated that he will not negotiate with the EU unless they take out the Irish backstop, an insurance policy to prevent a hard border between Northern Ireland and the Republic of Ireland. EU officials have said they will not renegotiate the deal that was made with former Prime Minister Theresa May.

The Bank of England kept rates steady in its last MPC meeting. The central bank voted unanimously to keep the rate at 0.75%, as expected, but downgraded its projections for growth for the next two years.

The BoE did not warn against a no-deal scenario, but did say that “companies expect output, employment and investment to be much lower in a no-deal Brexit.”

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell sharply by 22 bps last week as global bond markets rallied on the escalation of U.S. trade tensions following President Donald Trump’s vow to impose additional tariffs on China. President Donald Trump announced on Twitter on Thursday that he would slap 10% import tariffs on USD 300 billion of Chinese imports that had yet to be subjected to levies, starting from Sept. 1. China foreign ministry spokeswoman Hua Chunying said Trump’s pledge was tantamount to a “serious violation” and said Beijing would take “necessary countermeasures” if Trump followed through with his pledge.

In Europe, last week all maturities for German government bonds were trading at negative yields. German and French 10-year bond yields fell last week by 12 bps and 10 bps respectively. The Italian 10-year yield fell by 4 bps to 1.53%.

Emerging economies 10-year benchmark bond yields were largely mix last week.

South Africa 10-year benchmark bond yields rose by 13 bps after the National Treasury said it will increase the amount of debt sold at weekly bond auctions to help fund a bailout of the state-owned electricity company and counter a tax revenue shortfall.

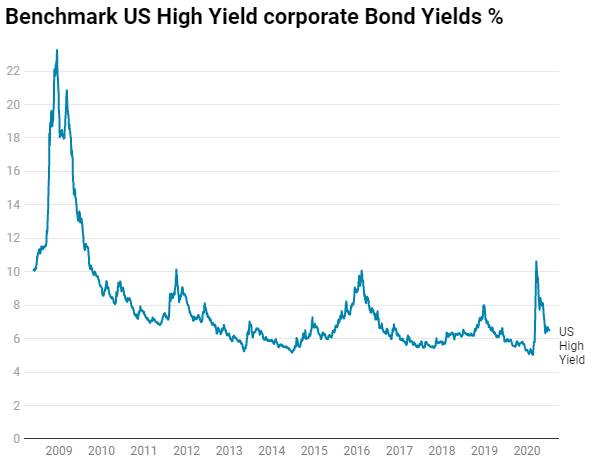

US benchmark Junk bond yields rose by 4 bps to 5.86%, Euro benchmark Junk bond yields rose by 15 bps to 2.97%.