INR ended the week lower against the USD last week largely due to sustained foreign fund outflows and firm crude oil prices. Further, the weakness in the domestic equity markets and a strengthening USD also weighed on the INR. INR depreciated by 0.14% against the USD last week and appreciated by 0.80% against the euro.

Additionally, the report that the Prime Minister’s Office was in favour of the issuance of rupee-denominated bonds overseas, instead of foreign exchange-denominated bonds, as proposed in the Union Budget has crept in confusion among the market participants which prompted foreign banks to purchase USD, likely for foreign portfolio investors who pulled out funds from Indian assets.

USD ended the week higher despite the expectation that the Fed will cut interest rates in its next FOMC meet scheduled this week. Euro and British Pound came under sharp pressure amid growing fears over the prospect of a no-deal Brexit while euro was under pressure after ECB signalled package of easing measures in September. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.88% on a week on week basis and is at a level of 98.01.

USD started the week on a higher note despite expectations for a 50-basis point Fed cut soaring last week after a dovish speech by New York Fed President John Williams. However, market participants tempered expectations after a Fed spokesman clarified that the remarks did not refer to potential policy action at the upcoming Fed meeting. Additionally, a week prior, James Bullard, another member of the U.S. central bank also said that he favours lowering interest rates by a quarter point.

On Thursday, USD came under pressure after durable goods orders in May were revised lower, the euro was higher after comments from European Central Bank President Mario Draghi pointed to more stimulus measures. However, the euro held gains after European Central Bank (ECB) kept policy unchanged, disappointing some market participants who had bet on a possible easing. ECB President Mario Draghi also sounded more upbeat on the euro-zone economy than some investors expected, curbing speculation the bank was about to enter a prolonged easing cycle.

On Friday, the second-quarter U.S. gross domestic product (GDP) increased at an annual rate of 2.1% from 3.1% in the first quarter, compared to estimates for 1.8% growth. Consumer spending rose 4.3%, while exports dropped 5.2% and imports inched up just 0.1%, indicating trade tensions between the U.S. and China are weighing on expansion.

British Pound depreciated by 1.02% against the USD last week after Boris Johnson, known for his hardline stance on Brexit, was named Prime Minister and leader of the Conservative Party. Johnson defeated Jeremy Hunt by a margin of 2 to 1. Johnson reiterated in a speech to party members his goal of leaving the EU by October 31, uniting a split party on Brexit, and leading the Tories in winning the next general election.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 3 bps last week after European Central Bank President Mario Draghi downplayed the risk of recession in the eurozone. The yield on the benchmark 10-year U.S. Treasury note settled at 2.077%, compared with 2.052% last week.

On Thursday the ECB said in a statement that it was holding interest rates unchanged but strongly signalled that it would adopt new stimulus measures, including interest-rate cuts, at its next meeting in September.

Eurozone bond yields reversed some of the rises seen after Thursday’s European Central Bank meeting expecting ECB President Mario Draghi to prepare the ground for another round of monetary easing.

German and French 10-year bond fell last week. Germany’s benchmark 10-year government bond yield fell by 5 bps last week. The Italian 10-year yield fell by 6 bps to 1.57%.

Emerging economies 10-year benchmark bond yields were largely mixed last week.

South Africa 10-year benchmark bond yields rose by 22 bps as the risk grew of a credit downgrade to junk status by year-end. Fitch added to the negative news, trimming its outlook to negative from stable while retaining its BB+ rating, saying bailouts to state firms along with weak economic growth would push up the budget deficit and add strain on state spending. China 10-year benchmark bond remained flat, Australia 10-year benchmark bond yields fell by 11 bps

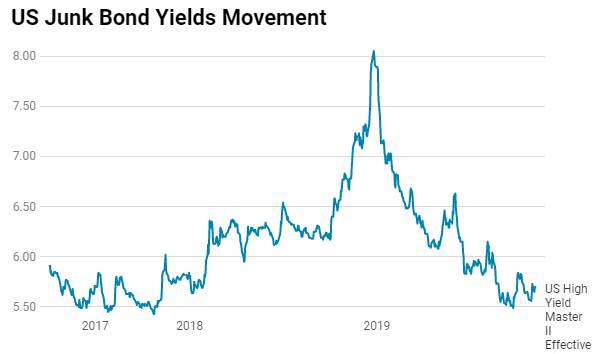

US benchmark Junk bond yields fell by 13 bps to 5.84%, Euro benchmark Junk bond yields fell by 24 bps to 2.81%.