INR ended the week lower against the USD last week despite the expectations of monetary policy easing by the RBI and US Federal Reserve in the coming weeks. INR depreciated by 0.18% against the USD last week and depreciated by 0.03% against the euro.

INR started the week on a higher note amid broad weakness in USD and despite hopes for aggressive monetary policy easing by the Reserve Bank of India in the coming months. Additionally, the release of benign CPI inflation data on Friday bolstered the case for a rate cut by the RBI. However, during the week, INR came under heavy selling pressure after the release of weak trade data and rising crude oil prices.

Data released shows that India’s exports entered negative zone after a gap of eight months, recording a decline of 9.71% to USD 25.01 billion in June. Imports also declined 9% to USD 40.29 billion in June mainly due to falling prices of petroleum products, leaving a trade deficit of USD 15.28 billion.

INR pared some of its losses on Friday but fell to post weekly losses. The gain came largely on the back of the expectations for aggressive rate cuts by Fed starting this month.

USD ended the week higher against major world currencies despite heightened expectations of aggressive rate cuts by the Federal Reserve. The gain was largely supported by the release of strong retail sales data and was additionally supported by the weakness in British Pound and Euro. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.35% on a week on week basis and is at a level of 97.15.

British Pound was trading at a six-month low level during the early part of the week, as market participants were nervous about the prospect of eurosceptic Boris Johnson winning the Conservative party leadership and becoming the next British prime minister as early as the end of this month.

Poor economic data and signals from the Bank of England that it could cut interest rates instead of raising them as previously expected have also hit the pound. The euro has been weighed by the long struggling pound, which in turn is likely to suffer from Brexit-related woes until the Conservative party leader is decided next week.

USD started the week on a higher note after manufacturing activity in New York posted its biggest increase in more than two years along with the release of stronger-than-expected retail sales data, which showed that the economy was healthy andtempered expectations of aggressive policy easing by the Federal Reserve .

However, during the mid-part of the week USD came under pressure after IMF said in a report that the USD exchange rates is 6% to 12% overvalued, while the euro is undervalued for Germany, but overvalued by 4% for France, based on economic fundamentals. Meanwhile the report also warned that Brexit and the U.S.-China trade war are a threat to the global economy.

Further, the comment made by New York Federal Reserve President John Williams added pressure to the USD. He said that that the Fed will “act quickly” to support the economy as “it’s better to take preventative measures than to wait for disaster to unfold.”

The New York Fed clarified later that Williams’ speech was not indicative of the central bank’s future moves, but investors still took his remarks as a dovish signal from the central bank.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 7 bps last week amid expectations of a rate cut by the Fed later this month. New York Fed President John Williams on Thursday spurred hopes for a half-point rate cut, suggesting central banks should act aggressively to counter emerging signs of economic distress when interest rates are near zero. However, New York Fed spokesperson later played down Williams’ remarks saying his comments only pertained to academic research and did not hold immediate policy implications. Additionally, St. Louis Fed President James Bullard said on Friday that a 50-basis point cut would be excessive.

Euro bond yields tumbled last week on Fed rate cut talk and renewed global risks. Comments from U.S. President Donald Trump that the United States still has a long way to go to conclude a trade deal with China and growing concern about a no-deal Brexit, added to a sense of renewed uncertainty in world markets.

German and French 10-year bond fell last week. Germany’s benchmark 10-year government bond yield fell by 7 bps last week. The Italian 10-year yield fell by 12 bps to 1.63%.

Emerging economies 10-year benchmark bond yields were largely lower last week.

South Africa 10-year benchmark bond yields fell by 7 bps after the central bank cut its main lending rate by 25 basis points on Thursday in a widely expected move to counter floundering economic growth. China 10-year benchmark bond yields fell 2 bps, Australia 10-year benchmark bond yields fell by 10 bps

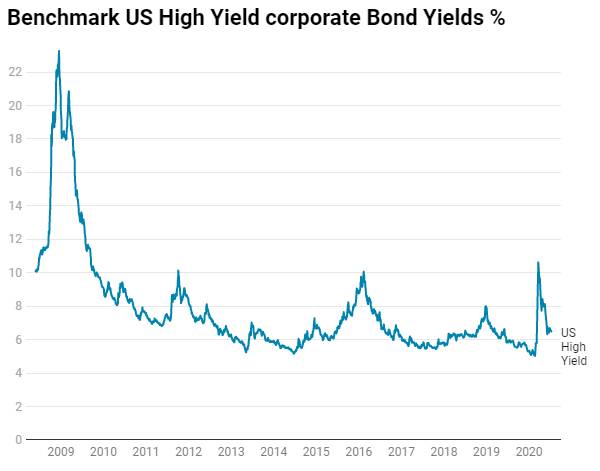

US benchmark Junk bond yields rose by 2 bps to 5.97%, Euro benchmark Junk bond yields rose by 8 bps to 3.05%.