INR ended the week higher against the USD on Friday after government in a surprise move announced a lower fiscal deficit and unveiled plans to sell debt overseas. The finance minister Nirmala Sitharaman said that the fiscal deficit for this year is estimated at 3.3% of gross domestic product down from 3.4% set in February’s interim plan. FM also said that the government has kept unchanged its target to borrow Rs 7.10 trillion this fiscal year. INR was also supported during the week after crude oil slumped amid concerns about slowing global growth. INR appreciated by 0.89% against the USD last week and appreciated by 1.96% against the euro.

USD traded sharply higher against all of the major currencies on the back of Friday’s nonfarm payrolls report, which marginally dampening expectations that the Federal Reserve will cut rates aggressively to stave off a slowdown. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 1.20% on a week on week basis and is at a level of 97.29.

U.S. Nonfarm payrolls rose by 224,000 in June, well above expectations for 160,000 and a sharp rebound from a downwardly revised 72,000 in May. However, the other data from the labour market report largely remain in favour of rate cuts, the unemployment rate increased and most importantly wage growth held steady at 0.2% instead of rising to 0.3% as per the expectation.

USD started the week on a higher note as a trade truce between the U.S. and China dampened demand for safe haven currencies, such as the yen and the Swiss franc. Over the weekend, Trump agreed to hold off on new tariffs and ease some restrictions on Chinese tech giant Huawei, while China agreed to purchase unspecified farm products from America. Both sides agreed to restart trade negotiations, which have been on hold for the last few months.

However, the gain on Monday was kept in check by weak manufacturing data. ISM manufacturing data fell to its lowest level since September 2016, even as it beat expectations.

U.S. President Donald Trump on Wednesday said that he is planning to nominate Christopher Waller, the executive vice president at the Federal Reserve Bank of St. Louis, and Judy Shelton, an economic adviser to the president during his 2016 campaign, to the Federal Reserve’s board.

Euro depreciated sharply against USD last week. Euro came under pressure, as reports suggest that IMF Manager Director Christine Lagarde was nominated as the next European Central Bank president, she is perceived as a policy dove.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 3 bps, as risk sentiment eased during the start of the week after Washington and Beijing agreed to restart trade talks, but U.S. trade advisor Peter Navarro said a potential trade deal “will take time”. However, the biggest daily jump in seven months came after the release of June payrolls data. The June jobs report showed the U.S. labor market is still holding up despite global growth headwinds, leading to a partial reversal of bets that the Federal Reserve would cut rates several times this year.

Euro bond yields fell last week after comments from European Central Bank (ECB) official and Dutch central bank chief Klaas Knot buoyed expectations for monetary policy easing, with the aim of boosting inflation in the euro zone. Yields were then pushed down further by bets that potential ECB chief Christine Lagarde will maintain a dovish stance to buoy the euro zone economy.

German and French 10-year bond yields hit record lows this week, both falling into sub-zero territory. Germany’s benchmark 10-year government bond yield fell below the European Central Bank’s deposit rate for the first time on Thursday, the latest sign that markets are braced for interest rate cuts soon. The Italian 10-year yield fell 36 bps to 1.74%.

Emerging economies 10-year benchmark bond yields were largely lower last week.

Brazil 10-year benchmark bond yields fell by 9 bps, Brazil central bank held its benchmark interest rate at a record-low 6.50%, as expected, holding back from signalling looser policy because of doubts on economic reforms.

Russia 10-year benchmark bond yields fell by 3 bps, the Russian central bank plans to lower the key interest rate in small steps, taking into account the risk the government’s spending plans may strengthen the rouble, governor Elvira Nabiullina said. The central bank embarked on a monetary easing cycle last month, lowering the cost of lending amid sluggish economic growth and abating inflationary risks

South Africa 10-year benchmark bond yields rose by 8 bps, China 10-year benchmark bond yields fell by 9 bps, Australia 10-year benchmark bond yields fell by 1 bps

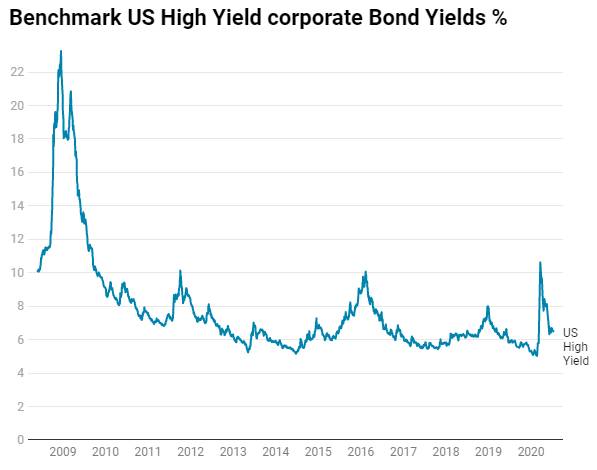

US benchmark Junk bond yields fell by 9 bps to 5.83%, Euro benchmark Junk bond yields fell by 29 bps to 2.83%.