INR ended the week higher against USD on Friday and traded above Rs 69 level against USD for the first time since April 11, as the market keenly awaited further cues from the high-stakes G20 summit. INR gains last week was largely driven by easing crude oil prices, foreign fund inflows and weakening of the USD in the overseas market. INR appreciated by 0.80% against the USD last week and appreciated by 0.21% against the euro.

Meanwhile, RBI data showed that India’s foreign exchange reserves touched a life-time high of USD 426.42 billion as it surged by USD 4.215 billion in the week to June 21. The rise in reserves was on account of increase in USD purchases by the RBI given an appreciating INR.

USD ended the week lower against major world currencies on trade talk optimism ahead of G20 and amid Dovish Fed. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.09% on a week on week basis and is at a level of 96.13.

USD started the week on a lower note on Monday after the U.S. Federal Reserve, a week earlier, signaled that it was prepared to cut interest rates later this year to counter a global economic slowdown. However, the market focussed on whether Washington and Beijing can resolve their trade dispute at a G20 summit in Japan. Further, the release of disappointing Fed manufacturing activity index for June and rising tensions between Iran and the U.S weighed on the USD.

USD edged higher on Wednesday after market participants tempered expectations for aggressive rate cuts by the Federal Reserve. Fed Chairman Jerome Powell on Wednesday said that the central bank is “insulated from short-term political pressures,” pushing back against U.S. President Donald Trump’s demands for a significant rate cut.

Additionally, the expectations for a half percentage point cut at the Fed’s July meeting receded after St. Louis Fed President James Bullard said that such a move “would be overdone”.

USD further rose on Thursday after U.S. President Donald Trump warned on Wednesday that additional tariffs could be imposed on Chinese goods if he is not happy with the progress made in trade talks this weekend. His comments came after Treasury Secretary Steven Mnuchin said he thinks “there is a path” for Trump and Chinese leader Xi Jinping to make a trade deal.

On Friday, USD was slightly lower after the release of inflation data and ahead of bilateral talks between the U.S. and Chinese presidents Donald Trump and Xi Jinping, which will give a degree of clarity over whether the trade dispute between the two will be ratcheted up or down over the rest of the year.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 5 bps, as market participants awaited the G-20 Summit in Japan, in which U.S. and China trade tensions are poised to take centre stage. The yields were already under pressure after the U.S. Federal Reserve signaled interest rate cuts beginning as early as July. However, the yields traded at 2.05% level on Wednesday before falling again to 2% after remarks from Treasury Secretary Steven Mnuchin raised optimism that some progress on a U.S.-China trade deal was being made.

Euro bond yields fell last week after Mario Draghi ramped up his signals that he is prepared to cut interest rates or buy more eurozone debt if growth fails to pick up. In comments that have drawn the ire of US president Donald Trump, Mr Draghi hit the euro when he reiterated that the central bank had “considerable headroom” to seek to stimulate the economy further in the face of threats including tensions over global trade.

Further, the data released showed annual inflation in Germany remained well below the European Central Bank’s target in June. Germany’s inflation rate was unchanged in June as an acceleration in prices for food and services was offset by a slowdown in energy costs.

German government bonds hit a new record, with 10-year yields falling by 4 bps last week to trade at level of -0.32%. The rally was broad-based. French 10-year bond yields turned negative for the first time, falling 10 bps. The Italian 10-year yield fell 6 bps to 2.10%.

Emerging economies 10-year benchmark bond yields were mixed last week.

Brazil 10-year benchmark bond yields fell by 20 bps, Brazil central bank held its benchmark interest rate at a record-low 6.50%, as expected, holding back from signalling looser policy because of doubts on economic reforms.

Russia 10-year benchmark bond yields fell by 9 bps after Russia Central Bank cut its key interest rate to 7.5% from 7.75% a week prior, the first cut since the start of the year, and said it might lower rates again. The bank said in a statement that annual inflation is continuing to slow and economic growth in the first half of 2019 has been lower than it expected, leading it to lower its inflation forecast for the year to 4.2-4.7% from 4.7-5.2 %.

South Africa 10-year benchmark bond yields fell by 4 bps, China 10-year benchmark bond yields rose by 3 bps, Australia 10-year benchmark bond yields rose by 8 bps

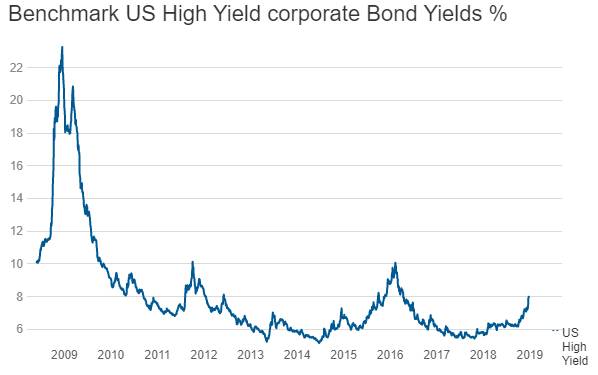

US benchmark Junk bond yields rose by 9 bps to 5.92%, Euro benchmark Junk bond yields rose by 5 bps to 3.12%.