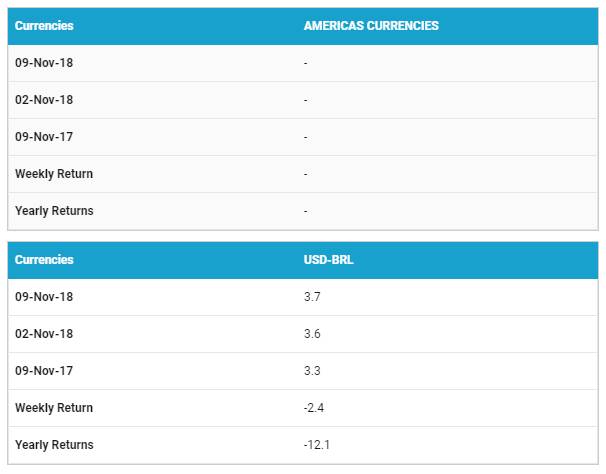

The Indian rupee ended higher last week on fall in risk aversion post US mid term elections, with equities rising and bond yields rising, as markets cut safe haven assets positions. INR ended stronger after falling sharply during early part of the week ahead of US mid-term election, US formally imposing sanctions on Iran and ahead of FOMC policy statement. However, INR recovered after US granted exemptions to eight countries including India, allowing them temporarily to continue buying Iranian oil. Further, INR was also helped by fall in global crude prices, which slipped below the USD 70 per barrel mark on Friday before a weekend meeting of major oil producing nations in Abu Dhabi. Indian Rupee appreciated by 1.34% against the USD last week and appreciated by 1.30% against the euro.

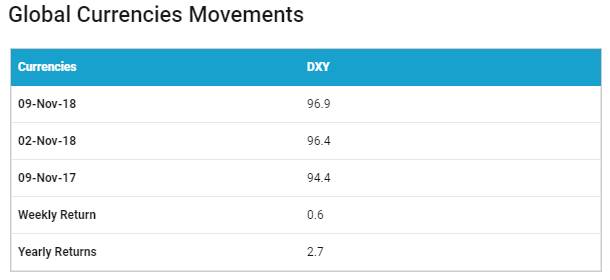

USD ended last week higher despite the US mid-term election outcome, which left congress divided with a Democratic House and a Republican Senate. However, USD recovered after the Federal Reserve left interest rates on hold in its recently concluded FOMC meeting and guided for a rate hike next month. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.57% on a week on week basis and is at a level of 96.91.

USD started the week on a lower note shrugging off upbeat U.S. services activity data, as market sentiment remained tepid ahead of U.S. mid-term elections and FOMC meeting, additionally the USD was also pressured by the gain in pound amid optimism that a deal between the UK and the European Union will be reached soon. Britain’s financial services minster John Glen said on Monday that he is confident that the final deal will give the UK financial center access to EU markets.

USD fell sharply on Wednesday after Democrats won control of the House of Representatives while Republicans tightened their hold on the Senate in the U.S. midterm elections. A divided Congress, with a Democratic House and a Republican Senate raises the prospect of gridlock in Washington, which will significantly curtail President Donald Trump’s legislative agenda.

However, USD recovered during later part of the week as market participants digested U.S. election result and shifted focus on FOMC meeting. The Federal Reserve left interest rates on hold on Thursday but delivered an upbeat assessment of the economy and labour market, reaffirming expectations for a December rate hike.

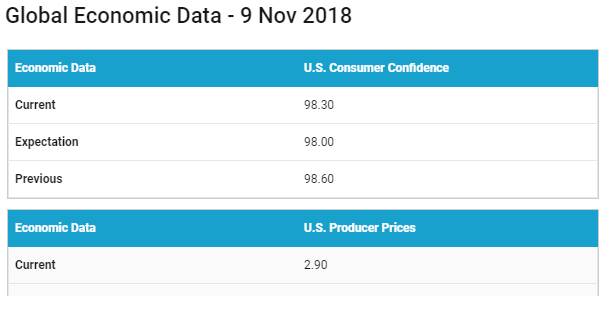

The Fed maintained its confidence that “economic activity has been rising at a strong rate.” GDP growth has averaged 3.3% for the first three quarters in 2018 and markets projected growth for the final three-month to be around 3%. Further, the release of higher-than-expected U.S. inflation data supports Fed’s gradual rate increase policy driving USD higher.

Euro depreciated by 0.59% against the USD last week after the European Commission cut Italy’s growth forecast and said it anticipated a jump in the country’s structural budget deficit.

Weekly Global Bond Market Analysis

U.S. government bond yields rose to a seven-year high after the Federal Reserve held short-term interest rates steady and presented a rosy picture of the U.S. economy. Federal Reserve hinted that rates are likely to rise in December. The U.S. interest rate is currently in a range of 2% to 2.25% and the Fed has signaled it wants to gradually raise rates in the coming months to 3% or higher. The U.S. economy looks very strong on almost every front. Companies are hiring workers at a rapid pace, wages are rising and consumers continue shopping at a healthy rate. The FOMC expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions and inflation near the 2% objective over the medium term.

However, US bond yields fell from highs on concerns over China economic slowdown. The PBoC said the Chinese economy is facing downward pressure, PBoC also said it would encourage financial institutions to increase lending to smaller, privately held businesses. This comes only a day after China Banking and Insurance Regulatory Commission Chairman Guo Shuqing said large banks would now divert a third of new lending to private firms while small banks allocating two-thirds of their lending to the private sector.

Germany 10-year benchmark bond yields fell by 2 bps, as weak Chinese economic data fueled concerns about the global growth outlook. China’s factory-gate inflation slowed for the fourth month in October on cooling domestic demand and manufacturing activity, The producer price index (PPI), a measure of the prices businesses receive for their goods and services, rose 3.3% in October from a year earlier, easing from 3.6% in September.

Italy 10-year benchmark bond yields rose by 8 bps after the European Commission cut Italy growth estimates and forecast a jump in the budget deficit, EU forecasts show Italian growth assumptions are optimistic. In 2019, Italian GDP would rise 1.2%, the Commission said, instead of the 1.5% seen by Italy. Lower growth was expected to push up Italy’s budget deficit, with the EU predicting a jump in the 2019 deficit to 2.9%, rather than the 2.4% seen by Italy, and to 3.1% in 2020, rather than fall to 2.1%.

Greece 10-year benchmark bond yields rose by 8 bps, Spain 10-year benchmark bond yields rose by 1 bps, Portugal 10-year benchmark bond yields rose by 5 bps.

Emerging economies 10-year benchmark bond yields were mixed last week.

Indonesia 10-year benchmark bond yields fell by 31 bps after Foreign funds started buying Indonesian bonds, as faster-than-forecast growth and relatively benign inflation of about 3% bolstered demand. Indonesia annual economic growth in the third quarter rose by 5.17%, close to the market forecast of 5.15%.

Brazil 10-year benchmark bond yields rose by 26 bps. Brazil inflation rate accelerated less than expected in October, bolstering the case for the central bank to wait longer before hiking interest rates. Consumer prices tracked by the benchmark IPCA index rose 4.56% in October.

Australia 10-year benchmark bond yields rose by 4 bps, China 10-year benchmark bond yields fell by 5 bps, South Africa 10-year benchmark bond yields rose by 2 bps.

US high-yield bond yields fell by 14 bps to 6.67% and Eurozone high-yield bond yields fell by 13 bps to 3.79%.