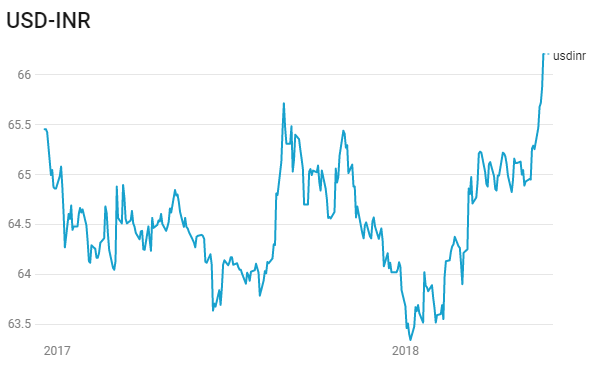

INR has seen sustained strength in calender year 2017 on the back of strong FII flows in debt and equity. The strong INR too allowed importers to go easy on hedges. FIIs in debt were mostly unhedged as forward premia at around 4.5% levels did not encourage “Carry” trades.

The sudden change in sentiments in 2018 has seen all unhedged positions getting caught off guard on the back of INR weakness. The last couple of weeks has seen sustained pressure on the INR leading to the currency hitting a one year low. Short covering has led to weakness in the INR and despite record forex reserves, the INR could come under more pressure until unhedge positions are covered.

INR last week fell to the lowest level in more than a year against the USD. INR depreciated by 1.35% against the USD. The fall in INR is due to broad strength in the USD, firming crude prices, FII Selling, widening trade deficit and hawkish tone of the RBI April policy minutes. FIIs have been selling in Indian equity and debt market. Last week FIIs have sold USD 1.61 billion of equity and debt.

USD started the week on a lower note after U.S.-led missile strikes on Syria on Friday. On Monday, U.S. President Donald Trump accused China and Russia of currency devaluation. However, losses were limited amid expectations that the conflict would not escalate further. The safe haven yen is often sought in times of market turmoil and political tensions. Japanese yen appreciated by 0.21% against USD on Monday but depreciated by 0.29% on weekly basis.

USD gained ground against the yen after U.S. President Trump and Japanese Prime Minister Shinzo Abe met in Florida last week and have agreed to intensify trade consultations. Trump wants a bilateral deal with Japan and said he would be willing to negotiate steel and aluminium tariffs if the two countries can come to an arrangement. Japan, despite being a long-term U.S. ally, currently is not exempt from the tariffs on imported steel and aluminium.

U.S. President Donald Trump accused Russia and China of devaluing their currencies in a Twitter post. The tweet came after the U.S. Treasury Department published its semi-annual report on currencies on Friday and declined to name China as a currency manipulator. China’s foreign ministry said on Tuesday that information coming out of U.S. regarding the Chinese currency is “a bit chaotic”.

USD started its gain on Tuesday and remained supported thereafter throughout the week as geopolitical tensions eased after U.S.-led missile strikes on Syria over the weekend did not lead to an escalation into a broader conflict. USD was also supported by economic data. U.S. housing starts rose by 1.9% in the month of March, to an annual rate of 1.319 million units. A separate report showed that industrial and manufacturing production also rose, supporting a strong economic outlook for the U.S.

Further, a hawkish speech from Fed official John Williamson on Tuesday reassured rate hikes this year.

U.S. Department of Labour on Thursday reported that the number of individuals filing for initial jobless benefits in the week ended 14th April fell by 1,000 to 232,000 from last week’s claim of 233,000 and against the expectation of a fall of 3,000 to 230,000.

Philadelphia Fed’s manufacturing index unexpectedly rose in the month of April, to a reading of 23.2 from 22.3 in March and against the expectation of 20.8.

Euro depreciated by 0.35% against USD last week. Euro came under some selling pressure after a report showed that German economic sentiment deteriorated sharply again in April amid concerns over heightened international trade tensions and euro area inflation accelerated less than initially estimated last month. Inflation in the euro area rose by an annualized 1.3% in March, up from February’s 1.1%, but weaker than expectations for an increase of 1.4%.

Asian currencies were largely lower last week against the USD. Australian Dollar appreciated by 1.18%. New Zealand Dollar depreciated by 2.15%. Japanese Yen depreciated by 0.29% against the USD and appreciated by 0.08% against the Euro. South Korean Won appreciated by 0.24%, Philippines Peso depreciated by 0.23%, Indonesian Rupiah depreciated by 0.99%, Indian Rupee depreciated by 1.35% against the USD and depreciated by 1.27% against the Euro, Chinese Yuan depreciated by 0.34%, Malaysian Ringgit depreciated by 0.46% and Thai Baht depreciated by 0.52%.