Indian Rupee fell to fresh record low levels of Rs 74.22 on Friday, breaching the Rs 74-mark against the USD, after the Reserve Bank of India (RBI) kept key policy rates unchanged. Market was widely expecting RBI to increase the interest rate on Friday. A rate increase would have helped curb inflation fueled by the rupee’s weakness and surging crude prices. Instead, the Reserve Bank of India (RBI) surprised the markets by keeping both the repo and reverse repo rates steady.

Indian Rupee depreciated by 1.73% against USD last week and depreciated by 1.12% against euro.

RBI tried to calm the markets by saying that the rupee’s fall is moderate in comparison to emerging market peers, however the markets seemed unimpressed . The rupee is the worst-performing currency in Asia and has already lost 14% of its value since the start of this year. However, it is still better placed as compared to some of the other currencies in emerging markets such as the Turkish lira (down by over 40% this year), and the Argentine peso (down by over 50%).

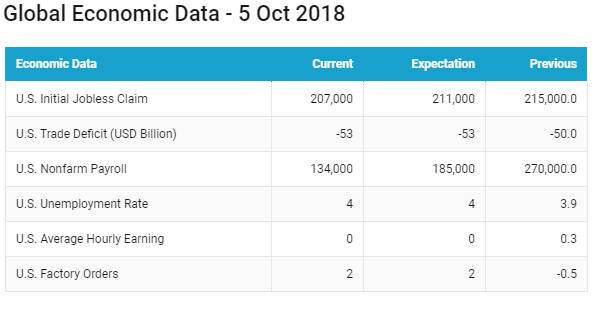

USD after rising for most of the week, lost its momentum on Friday on the back of mixed labour-market data. Friday’s jobs report fell short of expectations with the US economy adding the fewest jobs in 6 months but that was largely due to Hurricane Florence, which put 299,000 people out of work. The unemployment rate was at 48-year low of 3.7% and job growth for August was revised up by 69,000. The bad news in the report was earnings, which maintained a steady 0.3% pace of growth in September.

The main support for the USD was the surge in UST yields that rose to multiyear highs. The primary reason for high UST yields is Amazon that raised minimum wages to USD 15 per hour. This could potentially double minimum wages in the US economy as others follow suit and could lead to wage push inflation.

USD also received additional boost after Fed Chairman Jerome Powell said on Wednesday that the U.S. central bank may raise interest rates above an estimated “neutral” setting as the U.S. economy continues to grow. He also added that “Interest rates are still accommodative, but we’re gradually moving to a place where they’ll be neutral,” neither holding back nor spurring economic growth.

USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.52% on a week on week basis and is at a level of 95.62.

USD started the week on a higher note after the U.S. and Canada secured an agreement late Sunday night to replace the North American Free Trade Agreement (NAFTA) deal and Japanese yen was weighed down by improved market sentiment following the NAFTA announcement.

USD strengthened further on Tuesday amid fresh concerns over Italy’s fiscal issues, which weighed down on the euro. The drop in the euro came after Claudio Borghi, head of the lower house’s budget committee, said Italy would have solved its fiscal problems with its own currency. The comments added to a war of words with the European Union over the populist government’s budget proposal, which seeks to increase spending and cut taxes but would raise Italy’s debt and breach EU budget rule

However, on Wednesday, euro gained marginally after report suggested that the Italy government is aiming to cut its budget deficit to 2% of GDP in 2021. The government forecast a deficit of 2.4% in 2019 and 2.2% in 2020.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 16 bps, as improved economic data continued to deter the demand for the haven asset. 10-year UST yields rose to multiyear highs after improved economic data, private payrolls rose by 230,000 in September, which far surpassed the 168,000 jobs added in August. ISM non-manufacturing index jumped to 61.6 in September, its highest level since 2008, when the index was created. Labor Department said that the number of Americans filing for unemployment benefits fell to a nearly 49-year low last week, with initial claims slipping to a seasonally adjusted 207,000.

Eurozone government bond yields rose sharply after U.S. economic data bolstered the case for interest rate hikes in the U.S and sent yields across the eurozone higher.

Germany 10-year benchmark bond yields rose by 7 bps as Germany industrial orders surged in August, bouncing back from earlier falls and adding to the evidence that the economy is strong despite an uncertain global economic outlook. Factory output rose to 2% in August after a fall of 0.9% in July.

Italy 10-year benchmark bond yields rose by 26 bps after Italian populist government said they had no plans to make further revisions to a budget deficit, which is three times more than the one set by the previous government. Anti-immigrant League leader Matteo Salvini said the government would not back down as next year’s deficit spending was needed to create jobs and spark growth.

Greece 10-year benchmark bond yields rose by 33 bps, Spain 10-year benchmark bond yields rose by 6 bps, Portugal 10-year benchmark bond yields rose by 5 bps.

Japan 10-year benchmark bond yields rose by 3 bps, Japan 10-year bond yields rose to its highest level since the Bank of Japan introduced its negative interest-rate policy in January 2016, tracking the rise in the UST yield.

Emerging economies 10-year benchmark bond yields rose last week.

Indonesia 10-year benchmark bond yields rose by 20 bps, Bank Indonesia Governor said that they must raise interest rates ahead of the U.S. Federal Reserve to avoid drastic capital outflows. Bank Indonesia Governor said “when we know that the Fed Funds rate will increase, we cannot wait. We must act first so that the capital reversals will not be drastic”. Fed is expected to increase U.S. rates for the fourth time this year in December.

South Africa 10-year benchmark bond yields rose by 24 bps, as a rally in U.S. bond yields overshadowed President Cyril Ramaphosa promise to create an additional quarter of a million jobs every year. Ramaphosa announced a package of reforms, in which he said would create 275,000 more jobs a year.

Brazil 10-year benchmark bond yields fell by 48 bps, Australia 10-year benchmark bond yields rose by 7 bps, Russia 10-year benchmark bond yields rose by 17 bps, China 10-year benchmark bond yields were flat.

US high-yield bond yields rose by 15 bps to 6.35% and Eurozone high-yield bond yields rose by 4 bps to 3.42%.