The INR on Friday, posted its biggest single day gain since March 14, 2017, surging 0.66% to close at level of Rs 67.78 against the USD . The INR pared all its weekly loss in one single day of trading. The gain in the INR was due to improving global risk sentiments on factors of reduced fears of trade wars and oil prices peaking out. RBI too was rumored to be selling USD to prevent excessive volatility.

Brent crude oil prices fell by 3% to USD 76.33 a barrel on Friday after reports suggested that the Organization of the Petroleum Exporting Countries (OPEC) and Russia are discussing plans to lift their production for the first time since 2016 by some 1 million barrels per day, with a decision expected on 22nd June at the OPEC meeting in Vienna.

INR throughout the week remained under pressure amid heavy capital outflows and on high demand for USD from importers and corporates. The currency market sentiment improved during the mid of the week amid easing of tensions between the US and China over trade tariff issue after U.S. Treasury Secretary Steven Mnuchin comments.

USD remained highly volatile during the week as the trade tensions between the U.S. and China were put on hold early this week, an unexpected dovish-tone in the latest Federal Reserve meeting minutes and news that the White House had called off a planned summit with North Korea.

The demand for Japanese Yen and to a lesser extent, the Swiss franc, were on the rise during mid of the week amid rising risk aversion, as trade and geopolitical concerns came back into focus and the selloff in high-yielding emerging markets assets intensified. President Donald Trump on Tuesday said he wasn’t happy with how trade talks between the U.S. and China were progressing, and said the much anticipated U.S.-North Korea summit planned for next month in Singapore might not go ahead, which sent ripples through the global financial markets.

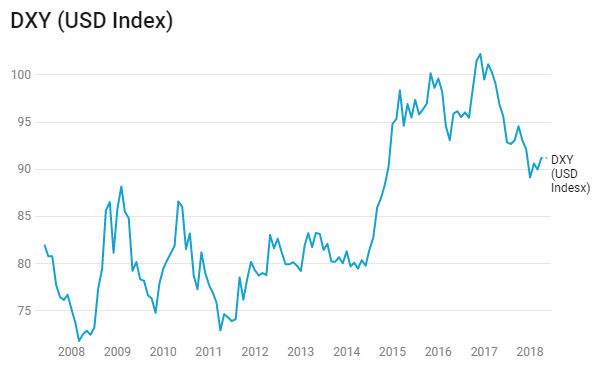

However, on Friday North Korean leader Kim Jong Un said he was still open to talks after the White House said in a statement that it would be “inappropriate” to have a planned summit at this time, which eased risk aversion and led USD to end the week higher. USD Index (DXY), which tracks the movement of the USD against six major currencies, rose by 0.60% on a week on week basis and is at a level of 94.20.

Federal Reserve released minutes of its latest concluded FOMC meet, in which policymakers said they were comfortable with inflation overshooting the central bank’s 2% target, denting investor hopes of more aggressive monetary policy tightening.

Euro continue to remain under pressure amid political uncertainty in Italy and depreciated by 0.93% against the USD last week. The political uncertainty in Italy, slowing growth in Europe, stronger growth in the US, and higher U.S. Treasury yields will continue to keep EUR under pressure in coming weeks.

The Euro Zone Composite Flash Purchasing Managers’ Index (PMI), seen as a good guide to economic activity, sank in May to an 18-month low of 54.1 from 55.1 against the expectation of fall to 55.

British Pound depreciated by 1.15% against USD last week. The sterling was under pressure amid uncertainty over Brexit talks and recent raft of weak economic data.

Bank of England’s Monetary Policy Committee (MPC) member Gertjan Vlieghe said that he could see up to six rate hikes over the next three years. Vlieghe also argued for the BoE to provide a detailed dot plot on the future path of interest rates, following the Federal Reserve’s own projections. However, BoE deputy governor David Ramsden and MPC member Michael Saunders indicated that they didn’t agree.

Asian currencies were largely mixed last week against the USD. Australian Dollar appreciated by 0.44%. New Zealand Dollar appreciated by 0.04%. Japanese Yen appreciated by 1.21% against the USD and appreciated by 2.19% against the Euro. South Korean Won depreciated by 0.03%, Philippines Peso depreciated by 0.53%, Indonesian Rupiah appreciated by 0.22%, Indian Rupee appreciated by 0.35% against the USD and appreciated by 0.99% against the Euro, Chinese Yuan depreciated by 0.18% against USD, Malaysian Ringgit depreciated by 0.23% and Thai Baht appreciated by 0.83%.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 13 bps after minutes from Federal Reserve May 2018 policy suggested that the Federal Reserve is not in a hurry to raise interest rates and is willing to tolerate inflation running above its 2% inflation target rate. The Fed noted that inflation in March finally hit the central bank’s goal of annual increases of 2%. The minutes called this a symmetric target, the phrase officials used to indicate that they would be comfortable letting inflation run above that 2% levels for a time, given the number of years the Fed has failed to achieve its target.

Apart from policy minutes, Trump comment on North Korea and China increased the demand for safe haven assets. President said there is a very substantial chance the historic meeting between the US and North Korea will happen in June as planned unless Pyongyang meets certain conditions. Separately, Trump said that he is not satisfied with the latest round of trade talks with China.

Eurozone

Eurozone economic growth slowed sharper than expected this month’s PMI survey showed, which along with weaker inflation, has intensified concerns that ECB asset purchase programme is unlikely to end this year. PMI fell to 54.1 in May from 55.1 in April. A reading above 50.0 signals an expansion in activity. That was the lowest reading in 18 months.

Italy 10 year bond yields rose by 25bps. Italy prospective prime minister, Giuseppe Conte, is preparing to finalize a coalition government made up of the anti-establishment Five Star party and the far-right League.

Germany 10-year benchmark bond yields fell by 17 bps on weak PMI number and lingering concerns over the composition of the new Italian government.

Spain 10-year benchmark bond yields rose by 3 bps, Portugal 10-year benchmark bond yields rose by 12 bps. Greece 10-year benchmark bond yields fell by 12 bps.

Emerging economies 10-year benchmark bond yields were mixed last week.

Russia 10-year benchmark bond yields fell by 6bps, Retail sales in Russia picked up in April 2018, while real wages growth exceeded expectations as the unemployment rate fell, suggesting an economic recovery is underway, Retail sales, the key gauge for consumer demand, the primary driver of economic growth, were up 2.4% in April 2018 after a 2.0% rise in March 2018.

Australia 10-year benchmark bond yields fell by 15bps, Australian government bonds rallied, as market risk sentiments was weighed down by renewed geopolitical caution towards US negotiations with North Korea and China.

Brazil 10-year benchmark bond yields rose by 56 bps after Brazil central bank kept its interest rate unchanged at 6.5%, Brazil’s Central Bank ended a run of 12 consecutive interest rate cuts,

US high-yield bond yields rose by 1 bps to 6.29% and Eurozone high-yield bond yields rose by 13 bps to 3.20%.