Rally in US equities to record highs and global equities to record highs on receding fears of an esclating trade war between US and China saw the USD come off last week. Markets believe that the latest round of tariffs on US and Chinese goods are not really significant and will not hurt growth in the two countries. Expectations of a Fed rate hike this week too did not help the USD.

Indian Rupee ended the week at Rs 72.20 level against USD after touching its fresh all-time low level of Rs 72.97 on Tuesday. Indian rupee remained under pressure last week despite government announcing series of measures to stem the slide in INR, measures includes removal of withholding tax on Masala bonds, relaxation for foreign portfolio investors and curbs on non-essential imports to contain the widening current account deficit (CAD), which has widened to 2.4% of GDP in April-June. Indian Rupee depreciated by 0.48% against USD last week and by 1.10% against euro.

INR fell to fresh all-time low levels on Tuesday as oil prices spiked based on reports that Saudi Arabia was comfortable with Brent crude trading above USD 80 per barrel. On Thursday, a government source said that the Indian government is planning to ask state oil firms to lock in their crude futures purchase prices, anticipating a spike when US sanctions on Iran snap back again in November.

The market is also raising bets that India’s central bank will need to raise interest rates at least two more times this year to shore up the battered rupee after last week efforts and after continuous central bank intervention failed to defend the currency from sliding.

USD ended last week in negative territory after exhibiting high volatility throughout the week, amid escalating trade tension between U.S. & China and despite better than expected U.S. economic data. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.74% on a week on week basis and is at a level of 94.22.

USD started the week on a lower note on Monday on fears of an escalation in the U.S.-China trade war, while a stronger pound and euro also weighed on sentiment. The U.S. President Donald Trump said in a statement on Monday that U.S. is slapping 10% tariffs on USD 200 billion worth of Chinese goods, and that the tariffs would rise to 25% in January 2019. Trump also added that “if China takes retaliatory action against US farmers or other industries, US will immediately pursue phase three, which is tariffs on approximately USD 267 billion of additional imports.”

However, China announced retaliation tariffs on Tuesday against the US. China said it would impose new tariffs on U.S. goods worth USD 60 billion, effective Sept. 24. The new tariffs are in response to U.S. tariffs on Monday of 10% on USD 200 billion in Chinese goods, which will go up to 25% at the end of the year. The China’s commerce ministry also filed a complaint to the World Trade Organization (WTO) against the U.S.

British Pound ended the week marginally higher against the USD after losing all of the gains that it had built up during the week. British Pound fell sharply on Friday after Prime Minister Theresa May said that the UK and European Union were at an impasse in Brexit negotiations, bringing fresh fears of a no-deal Brexit. May said talks stalled after the EU rejected the UK’s proposals without offering an alternative. She also said that they are far apart on two big issues and the UK expects respect from the EU rather than an outright refusal to accept their proposal.

Stronger than expected retail sales and consumer price growth were completely forgotten as investors focused on renewed Brexit uncertainty. With no major UK economic reports on the calendar in the coming week, pound is expected to remain under pressure .

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 7 bps, UST yields rose to 3.09%, its highest level since May 18, before slipping to 3.07%. UST yields are rising as the market is expecting that the Fed will raise its interest rate in its upcoming policy meet. Market expectations for a rate hike this month are more than 90%, according to the CME Group Fed Watch tool.

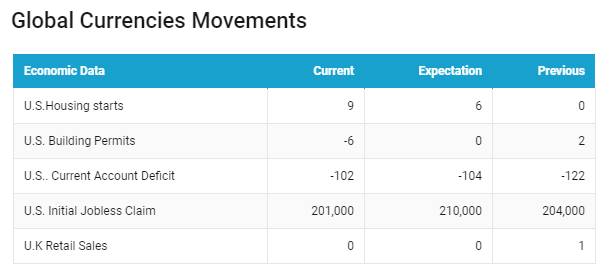

UST yields crossed the 3% mark after the release of strong US economic data. Weekly jobless claims fell to their lowest level in nearly 49 years, totaling 201,000, according to the Labor Department, against market expectations of 210,000. Philadelphia Federal Reserve index (Index measure changes in business growth) rose to 22.9 in September 2018 from 11.9 in August 2018.

Germany 10-year benchmark bond yields rose by 2 bps, as demand for safe haven assets decreased, as hopes of trade talks between the US and China, and interest rate hike in Turkey calmed the markets.

Italy 10-year benchmark bond yields rose by 7 bps after 5-Star Movement party Luigi di Maio threatened to quit the coalition if the party spending demands in the 2019 budget are not met. Italy’s Economy Minister Giovanni Tria has to set the budget for next year by 27th September 2018, Luigi Di Maio has threatened the government by saying “if we do not find the resources we better go home. It is useless to chug along.”

Eurozone peripheral bond yields largely rose last week after European Central Bank confirmed that its monthly asset purchases would be halved from October 2018. Greece 10-year benchmark bond yields were flat, Spain 10-year benchmark bond yields rose by 1 bps, Portugal 10-year benchmark bond yields rose by 2 bps.

U.K 10-year benchmark bond yields rose by 2 bps after U.K inflation beat market expectations, inflation jumped to 2.7% in August 2018 against market expectations of 2.4%, inflation rose to its highest level in 6 months. Apart from inflation, wages is also rising in the U.K, excluding bonuses, wages grew by 2.9% in the three months to July.

Emerging economies 10-year benchmark bond yields were mixed last week.

Indonesia 10-year benchmark bond yields fell by 31 bps after Indonesia government and the central bank took measures to reduce the current account deficit by raising import taxes, delaying billions of dollars of infrastructure projects and widening the use of biodiesel. These steps are expected to bring down the current account deficit, which in the second quarter widened to 3 % of GDP, the most in nearly four years.

Brazil 10-year benchmark bond yields fell by 48 bps, Brazil economy grew 0.57 % in July 2018 from June 2018, the data shows a second consecutive month of Gross Domestic Product (GDP) growth in Brazil. The year-on-year growth of July 2018 was 2.56%.

South Africa 10-year benchmark bond yields fell by 8 bps, after inflation slowed in August from a 10-month high. Consumer price growth decelerated to 4.9 % in August 2018 from 5.1 % in July 2018. South Africa central bank also kept its interest rate steady at 6.5%, citing a deteriorating inflation outlook.

Australia 10-year benchmark bond yields rose by 10 bps, Russia 10-year benchmark bond yields fell by 16 bps, China 10-year benchmark bond yields rose by 4 bps.

US high-yield bond yields fell by 1 bps to 6.21% and Eurozone high-yield bond yields fell by 9 bps to 3.35%.