The Indian Rupee (INR) breached Rs 71 level against the USD for the first time ever on Friday on the back of a selloff in emerging market currencies gathering pace, month-end demand for the USD from oil importers and rise in crude oil prices. The INR remained under pressure despite U.S.-Mexico trade deal easing concerns over a trade war and GDP growth coming in at 8.2% for first quarter of FY19. On weekly basis, Indian Rupee depreciated by 1.53% against the USD and depreciated by 1.91% against the euro.

The INR could emerge stronger if the Indian economy exhibits sustained growth after a robust 1st qtr fy 19 print at 8.2%. Strong economic growth, the fasted among the big world economies, leads to higher levels of capital flows, improved government finances, higher interest rates and better macro economic conditions overall.

Emerging markets sell off started during the later part of the week as Turkish lira fell by more than 6% against the USD last week amid reports that the deputy governor of Turkey’s central bank, Erkan Kilimci, is preparing to resign from his post while Argentina Peso tumbled to a record low, prompting Argentine policy makers to boost rates to 60% and sought the early release of standby funds from the International Monetary Fund.

Emerging market currencies have been hard hit by concerns that higher U.S. interest rates will pressure countries that have borrowed heavily in USD in the recent years.

USD last week remained marginally lower as it pared most of its losses in the later part of the week after data showed that inflation continued to meet the Federal Reserve’s target and consumer spending remained firm, strengthening the central bank’s case to continue with gradual rate hikes. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.01% on a week on week basis and is at a level of 95.14.

USD started the week on a lower note on fading fears over the prospect of a global trade war after the United States and Mexico reached a bilateral deal on NAFTA. President Donald Trump announced on Monday that his administration reached a deal with Mexico on issues that have upended the renegotiation of the North American Free Trade Agreement (NAFTA), the current trade agreement among the U.S., Canada and Mexico, for over a year. President Trump also said that he could still put tariffs on Canadian autos if it refuses to agree to the new deal.

However, market continues to remain concerned over the intensifying China-U.S. trade war. Low-level trade talks between China and the U.S. ended last week with little progress made and both countries slapped fresh reciprocal tariffs on imports. Trump is reportedly meeting his Chinese counterpart Xi Jinping later this year to further discuss trade issues.

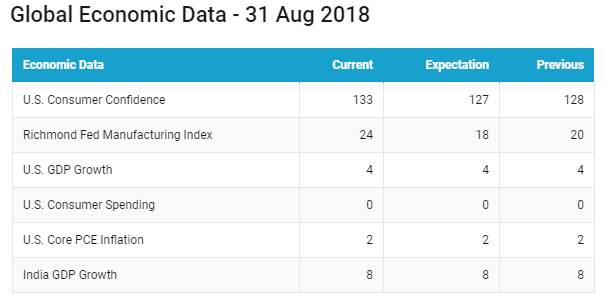

USD gained momentum during the latter part of the week as the demand for safe-haven assets rose amid EM sell off and due to rise in Fed rate hike expectations. U.S GDP data released showed that the economy remained on solid footing. Gross domestic product increased at a 4.2% annual rate in the April-June period, beating economists’ expectation of 4.0% and higher then the preliminary reading of 4.1% seen last month. The strong GDP data was driven by contributions from non-residential fixed investment, exports and federal and state government spending

Market sentiment became nervous as concerns over a global trade war intensified on Friday, after President Donald Trump rejected the proposal from the EU to eliminate tariffs on cars, claiming the offer is “not good enough.” U.S. President Donald Trump also said that he wants to move ahead with a plan to impose tariffs on USD 200 billion worth of Chinese goods when the public comment period ends next week. It’s just the latest of a series of tariffs as the two largest economies in the world go head-to-head over trade disagreements, both countries-imposed tariffs of USD 16 billion worth of goods, after USD 34 billion worth of imports in July.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields rose by 1 bps, UST yields rose to 2.88% after President Donald Trump said his administration had cut a trade deal with Mexico, suggesting the U.S. would overhaul the North American Free Trade Agreement. Treasury prices rose, pushing yields lower, as demand for haven assets increased after recent reports suggested that President Donald Trump would go ahead with tariffs on China and due to problems in emerging markets. Reports suggest that President Donald Trump plans to impose $200 billion worth of tariffs on Chinese imports next week.

Meanwhile, emerging markets came under renewed pressure. The Argentine peso resumed its slide after President Mauricio Macri said he planned to tap into the $50 billion credit line provided by the International Monetary Fund. Argentina central bank hiked rates by 15% points to 60% after the peso continued to slide despite the country already having the highest borrowing rates in the world. The Turkish lira slumped after the deputy governor of the Turkish central bank resigned amid questions over the monetary authority independence to hike rates.

Germany 10-year benchmark bond yields fell by 2 bps after a stronger-than-expected German business sentiment survey suggest ed thatoutlook for the eurozone economy is improving. Ifo business climate index jumped to 103.8 in August from 101.7 in July, suggesting that concerns about a global trade war among company executives in Europe largest economy have eased.

Eurozone peripheral bond yields rose as market risk appetite decreased due to Argentina & Turkey crisis.

Italy 10-year benchmark bond yields rose by 11 bps, Greece 10-year benchmark bond yields rose by 21 bps, Spain 10-year benchmark bond yields rose by 9 bps, Portugal 10-year benchmark bond yields rose by 9 bps.

Japan 10-year benchmark bond yields rose by 1 bps. Recently Japan benchmark bond recorded no trades, this has happened for the 7th time in 2018, and for the 1st time since July 2018, when BoJ said it will allow 10-year JGB to deviate as 0.2% point around 0%.

Emerging economies 10-year benchmark bond yields rose last week.

Most of the emerging countries bond yields rose sharply after Argentina & Turkey crisis. Recently Turkey deputy central bank governor resigned and Argentina hiked rates by 15%, in order to protect its currency.

Indonesia 10-year benchmark bond yields rose by 21 bps. Indonesia benchmark 10-year bond yield hit 8.077 percent on Friday, the highest since December 2016, Indonesia central bank is intervening in the forex & bond market as the rupiah is sliding continuously. Recently, Bank Indonesia (BI) has bought 3 trillion rupiahs ($203.94 million) of government bonds.

China 10-year benchmark bond yields fell by 3 bps after PMI data beat market expectations. PMI reading for August 2018 came in at 51.3 from 51.2 in July, against market expectations of 51.

Australia 10-year benchmark bond yields fell by 4 bps, Russia 10-year benchmark bond yields rose by 10bps, Brazil 10-year benchmark bond yields rose by 7 bps.

US high-yield bond yields were flat at 6.19% and Eurozone high-yield bond yields rose by 6 bps to 3.39%.