The INR traded below Rs 70 mark against the USD for the most part of the week but recovered on Friday to end the week at levels of Rs 69.91 to the USD. The INR came under pressure on Thursday largely due to renewed worries over interest rate hikes in US, global trade war jitters and sudden spike in crude oil prices. On weekly basis, Indian rupee appreciated by 0.35% against the USD and depreciated by 1.58% against the euro.

USD ended lower last week after Fed Chair Jerome Powell’s said at Jackson Hole that further gradual tightening will be needed but investors were not impressed and instead focused on his comment that there’s no sign of inflation accelerating and no elevated risk of overheating. USD was also under pressure during the week amid renewed worries over U.S.-China trade tensions, U.S. President Donald Trump criticizing Fed Chairman Jerome Powell for raising rates, weak U.S. economic data and rising political risks in the U.S.

USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.99% on a week on week basis and is at a level of 95.15.

The pressure on USD eased slightly on Thursday after the Federal Reserve meeting minutes showed that the central bank continued to expect the U.S. economy to expand at an above-trend pace, prompting the need for further rate hikes. The Fed minutes also showed that officials discussed how global trade tensions could affect businesses and households. The Fed has raised rates twice this year and is expected to continue doing so before the year end.

President Trump in an interview on Monday said that he was “not thrilled” with Fed Chairman Jerome Powell for raising rates and added that the Fed should do more to help him to boost the economy. The president also said that he would criticize the Fed if it continues to raise rates. The Fed has been hiking rates and is expected to continue doing so, with another two increases expected this year.

Trump also accused China and Europe of manipulating their respective currencies and said he did not expect much progress from this week’s trade talks with Chinese officials.

Further, the market sentiment was hit by concerns over U.S. President Donald Trump’s standing after his former personal lawyer Michael Cohen admitted he made illegal campaign contributions at the instruction of then-candidate Trump. At the same time, Trump campaign chairman Paul Manafort was convicted on criminal counts in the first trial to come as a result of special counsel Robert Mueller’s Russia probe.

The two-day trade talks between China and the U.S. ended on Thursday with no major breakthroughs. The U.S. moved ahead with imposing 25% tariffs on USD 16 billion of imports from China on Thursday, followed immediately by Beijing imposing retaliatory tariffs on USD 16 billion of U.S. imports to China.

Euro climbed to its strongest level in 3 weeks by appreciating 1.06% against the USD. The gain came after the euro-zone marked the end of Greece’s eight-year bailout program but concerns about Italy’s public finances kept gains in check.

Italy’s new populist government has promised to deliver a big spending plan, but market participants are skeptical as to how the country will be able to finance those plans. These concerns were characterized by a sharp rise in Italian bonds yields, increasing the country’s cost of raising money by issuing sovereign bonds.

Weekly Global Bond Market Analysis

US 10-year benchmark bond yields fell by 4 bps as prospects for a quick resolution of the US-China trade war faded and trade-war took another step forward with US imposing a 25% tariff on $16 billion worth of Chinese goods and China responding to the same. That brings the total amount of goods flowing between the countries subject to tariffs, up to $106 billion. Treasury yields also came under downward pressure after minutes from the Federal Reserve August policy meeting suggested that the central bank could slow the pace of rate increases if global trade war escalate and hit the economy. However, minutes also suggest broad backing among the Committee for a rate increase in September 2018. The fed fund futures suggest 96% probability for a 25 bps rate hike in September 2018.

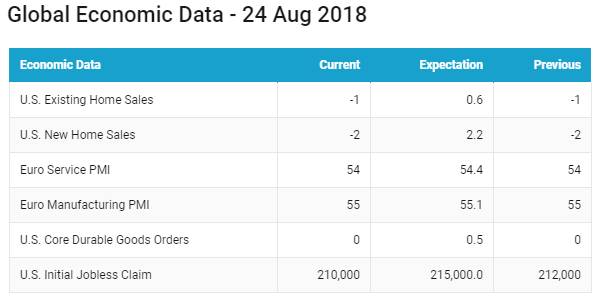

The euro area private sector continued to expand in August 2018, but the rate of expansion remains weak and optimism among companies fell to a 23-month low on rising political concerns and higher prices. The composite output index rose marginally to 54.4 in August 2018 from 54.3 in July 2018, flash data from IHS Markit showed.

Italy 10-year benchmark bond yields rose by 1 bps, recently credit rating agency Moody’s extended the deadline for its review on the country rating, providing some relief to the market as market was expecting a downgrade. Moody’s, which placed Italy Baa2 rating on a review, said it wants to gain greater clarity on Italy fiscal path and reform agenda hence the extension in the deadline.

Greece 10-year benchmark bond yields fell by 15 bps after Greece exited from its bailout program on 20th August. Greece government has managed to end a third bailout rescue by implementing all the measures demanded by creditors. Greece got more than 260 billion euros from its eurozone partners and the International Monetary Fund (IMF) to prevent a crisis, which shrank its economy by over 26%. The European Stability Mechanism said that it will continue to monitor Greece closely using the Early Warning System that ensures the country remains on track.

Spain 10-year benchmark bond yields fell by 8 bps, Portugal 10-year benchmark bond yields fell by 3 bps.

Japan 10-year benchmark bond yields was flat.

Emerging economies 10-year benchmark bond yields were mixed last week.

South Africa 10-year benchmark bond yields fell by 14 bps. South Africa President has a target of 3% GDP growth in 2018, however market is expecting growth to be around 1.4% in 2018. According to a Bloomberg survey, growth in the gross domestic product will average 1.4% this year. This is less than the 1.5% forecast in the July poll and is the fourth consecutive reduction in the outlook.

Australia 10-year benchmark bond yields were flat following the political uncertainty. Australian Treasurer Scott Morrison will replace Malcolm Turnbull to become Australia’s 6th prime minister after emerging victorious in a Liberal party leadership vote on Friday. This comes after Prime Minister Turnbull fell into leadership challenge, despite winning no-confidence motion by seven votes.

Russia 10-year benchmark bond yields fell by 5 bps, China 10-year benchmark bond yields fell by 2 bps.

US high-yield bond yields fell by 10 bps to 6.19% and Eurozone high-yield bond yields fell by 5 bps to 3.33%.