The INR fell to below Rs 70 to the USD for the first time ever on the 14th of August 2018 and touched an all-time low level of Rs 70.40 to the USD, on the back of Turkish Lira collapse and widening trade deficit. According to market reports, Reserve Bank of India (RBI) intervened in the currency market to stabilise the currency. The INR is down over 10% in calendar 2018 to date. On weekly basis Indian Rupee depreciated by 1.89% against USD and by 1.18% against euro. Widening trade deficit and heightened global uncertainty is likely to keep the Indian Rupee under pressure.

India’s trade deficit hit a 5-year high of USD 18.02 billion in the month of July, up by 8.5% month-on-month. This is mainly because of surging oil imports, which grew by over 57% year-on-year to USD 12.35 billion, while total imports jumped 28.81% to USD 43.79 billion, exports only went up by 14.32% to USD 25.77 billion. (Read our August 2018 Economic Data Analysis).

The US sanctions against top Turkish government officials and unorthodox economic policies by Turkey’s President Erdogan is unnerving global financial markets. The Turkish authorities made efforts to boost liquidity in the market on Monday through a host of measures like reducing lira and foreign currency reserve requirements for Turkish banks. The fear over contagion effects mounted after the European Central Bank warned that a number of euro zone banks might be exposed to the sharp decline in the Turkish lira.

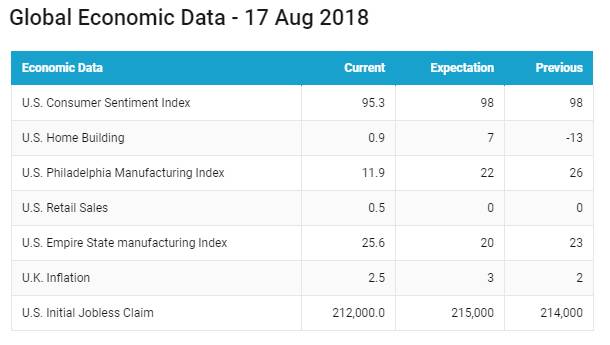

USD was trading near 14-month highs last week against a currency basket amid fears over contagion effects from Turkey’s financial crisis, while the Turkish lira rallied after Ankara hit the U.S. with fresh tariffs. However, demand for USD eased on Friday after the release of weak U.S. economic data and a bounce in the euro and yen. USD Index (DXY), which tracks the movement of the USD against six major currencies, fell by 0.27% on a week on week basis and is at a level of 96.10.

USD started the week on a high note, but gains were capped as the euro eased from a 13-month low and as Turkish lira stabilized after Turkey’s central bank announced a series of measures to offer liquidity and cut reserve requirement for banks, in a bid to save lira from its crisis driven by the U.S. sanctions.

USD came under pressure on Thursday after the release of mixed U.S. economic data and improving risk sentiment after the U.S. confirmed trade talks with China would resume. White House economic advisor Larry Kudlow confirmed on Thursday that the U.S. and China will resume trade talks later this month, ending a two-month stalemate during which both countries have imposed billions of dollars’ worth of tariffs on each other’s goods.

On Thursday the concerns over Turkey eased as lira continued its recovery from a slump earlier in the week after Turkish financial minister Berat Albayrak reportedly said that the government would tighten fiscal policy and ruled out capital controls.

Weekly Global Bond Market Analysis

U.S. Treasury prices fell from recent highs, pushing yields higher, as demand for haven assets abated after reports suggested that China and the U.S. would resume trade talks. According to a statement from China’s Commerce Ministry, China would send a delegation to the U.S. later in August for further trade talks. Vice Commerce Minister Wang Shouwen will meet David Malpass, the U.S. Treasury Department’s undersecretary for international affairs.

On the economic data front, the number of Americans filing for unemployment benefits fell for the second straight week. Initial claims for state unemployment benefits slipped by 2,000 to a seasonally adjusted 212,000 for the week ended 11th August, according to the U.S. Labor Department.

The eurozone economy has shrugged off growing trade tensions to grow faster than estimated in Q2-2018, GDP growth in the eurozone was revised higher from 0.3% to 0.4% in Q2-2018, matching the rate in the first quarter

Germany 10-year yields fell by 1 bps, Germany GDP rose 0.5% (QoQ basis) or 1.8% (annualized) in Q2-2018, against the market expectations of 0.4% rise. Germany GDP rose as spending by German households and the government picked up from the first quarter. Germany economy has outpaced the eurozone 1.4% (annualized) growth in the Q2-2018, but it lags US growth of 4.1%.

Italy 10-year benchmark bond yields rose by 12 bps , Spain 10-year benchmark bond yields rose by 5 bps, Portugal 10-year benchmark bond yields rose by 8 bps. Greece 10-year benchmark bond yields rose by 10 bps.

Japan 10-year benchmark bond yields fell by 1 bps, Japan economy expanded at an annualized pace of 1.9% in Q2 2018, supported by private consumption. The growth came after Japan economy shrank in the first quarter of 2018 for the first time in two years. Japan trade surplus with the US shrank sharply in July, The surplus with the US shrank 22.1% with reduced shipments of motor vehicles and microchip-making equipment dragging down the figure.

Emerging economies 10-year benchmark bond yields were mixed last week.

Indonesia 10-year benchmark bond yields rose by 32 bps Indonesia central bank surprised the market by raising its benchmark interest rate for the fourth time since May 2018, Central bank raised interest rates to defends its currency following a global sell-off in emerging markets due to Turkey crisis. The seven-day reverse repurchase rate was raised to 5.5% from 5.25%.

Brazil 10-year benchmark bond yields rose by 4 bps, Brazil’s economy contracted nearly 1% in the second quarter due to a trucker’s strike that paralyzed the country’s economy for 11 days in May 2018. Brazil economy contracted after 5 straight quarters of expansion.

Australian 10-year benchmark bond yields fell by 4 bps after fall in July employment change disappointed the market, Australia seasonally adjusted number of persons employed decreased by around 4,000 persons in July 2018.

Russia 10-year benchmark bond yields rose by 38 bps, China 10-year benchmark bond yields rose by 8 bps.

US high-yield bond yields rose by 7 bps to 6.29% and Eurozone high-yield bond yields rose by 7 bps to 3.38%.